The Helformer Model: Revolutionizing Cryptocurrency Price Forecasting

As the cryptocurrency market continues to evolve, investors are confronted with the daunting challenge of predicting price movements in an asset class known for its volatility. Traditional forecasting models, often inadequate for capturing the intricate dynamics of cryptocurrencies, have left traders seeking more reliable tools. Enter the Helformer model, a groundbreaking approach that integrates deep learning and traditional time series analysis to enhance predictive accuracy in the crypto space.

Understanding the Helformer Model

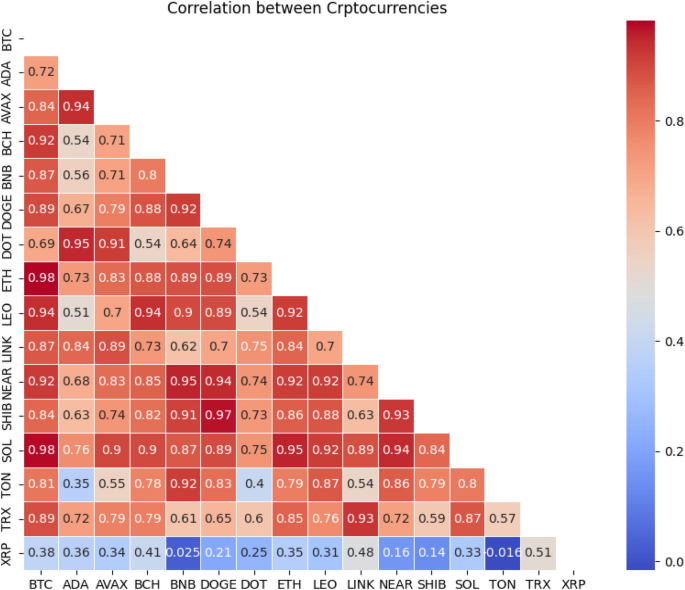

Cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) have gained considerable traction, becoming significant financial instruments in global markets. However, their non-linear and non-stationary price behavior poses unique challenges for traditional forecasting methods. The Helformer model, developed by a team of researchers, seeks to address these limitations by employing a hybrid methodology that combines Holt-Winters exponential smoothing with a Transformer-based architecture.

Key Features of the Helformer Model

-

Robust Decomposition: The Helformer model excels in breaking down time series data into its fundamental components—level, trend, and seasonality. This decomposition allows it to capture complex price patterns typical of cryptocurrency markets, enhancing its predictive power.

-

Bayesian Hyperparameter Tuning: By utilizing Bayesian hyperparameter tuning through Optuna, the Helformer model efficiently identifies optimal parameters. This method not only boosts performance but also reduces training time through early termination of suboptimal runs, ensuring that the model remains agile.

-

Empirical Validation: In rigorous testing against other advanced deep learning models across a variety of cryptocurrencies, the Helformer model demonstrated superior predictive accuracy. It achieved lower prediction errors and exhibited remarkable generalization capabilities across different asset types.

Practical Applications

The real-world applicability of the Helformer model extends beyond academic interest. The researchers validated its effectiveness through backtesting in trading strategies, where it significantly outperformed traditional approaches. This performance suggests that the Helformer model can provide actionable insights for traders and financial analysts alike.

For instance, traders leveraging the Helformer model could potentially enhance their risk management strategies by making more informed decisions based on accurate price predictions. The model's insights are invaluable not only for individual investors but also for institutional players looking to navigate the complexities of cryptocurrency markets.

A Game Changer for Investment Strategies

As volatility continues to characterize cryptocurrency trading, the Helformer model offers a more sophisticated tool for forecasting price movements. By enabling investors to anticipate market trends, it helps mitigate risks and optimize investment strategies.

Conclusion

In a landscape where traditional forecasting models struggle to keep pace with the rapid changes in cryptocurrency prices, the Helformer model emerges as a promising solution. By integrating advanced deep learning techniques with proven time series analysis, it not only enhances predictive accuracy but also provides a robust framework for decision-making in the volatile crypto space.

As the demand for reliable forecasting tools grows, the Helformer model stands out as a beacon of innovation. Investors, policymakers, and researchers alike can leverage this model to make informed decisions, navigate market complexities, and ultimately harness the potential of cryptocurrencies more effectively.

For more in-depth insights into the Helformer model and its implications for cryptocurrency trading, you can explore the original study published here.

In conclusion, as cryptocurrency markets continue to attract attention and investment, the Helformer model represents a critical advancement in the tools available for accurate price forecasting. By embracing these innovations, stakeholders can better position themselves to adapt to the ever-changing landscape of digital assets.