The Rise of Cryptocurrency ETFs: A New Investment Avenue

Cryptocurrency exchange-traded funds (ETFs) have emerged as a notable financial innovation, allowing investors to gain exposure to digital assets without the complexities tied to direct ownership. As interest in cryptocurrencies grows, ETFs are becoming a popular option for those looking to participate in the market while minimizing some inherent risks. This article will delve into the mechanics of cryptocurrency ETFs, their benefits, and the risks associated with them.

Understanding Cryptocurrency ETFs

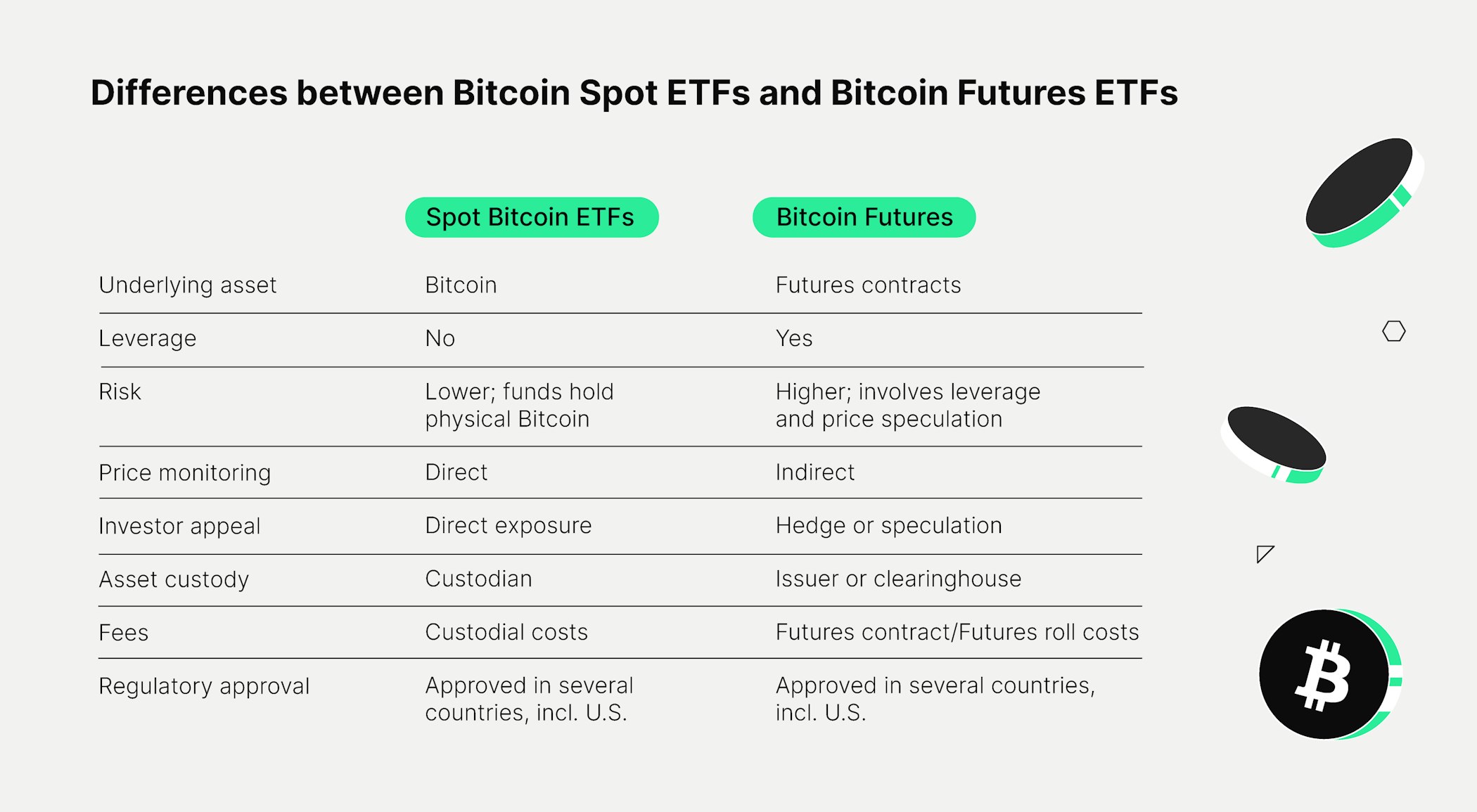

Cryptocurrency ETFs operate by tracking the price performance of cryptocurrencies, investing in a portfolio linked to their value. Unlike traditional ETFs that may invest in stocks or bonds, crypto ETFs primarily invest in cryptocurrency futures contracts rather than the actual digital currencies. This investment structure allows such funds to trade on standard stock exchanges, enabling investors to buy and sell shares through their brokerage accounts.

Key Features of Crypto ETFs

-

Futures vs. Spot ETFs: The majority of crypto ETFs have opted to invest in futures contracts, a decision driven largely by regulatory hurdles surrounding spot ETFs. Spot ETFs, which invest directly in cryptocurrencies, face significant scrutiny from the U.S. Securities and Exchange Commission (SEC). The SEC has expressed concern over investor risks associated with direct cryptocurrency investments, making futures-based ETFs a more viable option for fund managers.

-

Performance Tracking: As futures contracts within an ETF approach their expiration, the fund rolls over its investments—selling the expiring contracts and purchasing new ones. This can lead to discrepancies between the ETF's performance and that of the underlying cryptocurrencies, particularly during volatile market conditions.

-

Security Concerns: One of the primary advantages of investing in crypto ETFs is the mitigation of security risks typically associated with direct cryptocurrency ownership, such as hacks and theft. While the crypto space has seen various incidents of security breaches, ETFs provide an avenue for investors to engage with the cryptocurrency market without needing to manage private keys or secure wallets.

Pros and Cons of Investing in Crypto ETFs

Understanding the advantages and disadvantages of crypto ETFs is crucial for potential investors.

Pros

-

Accessibility: Crypto ETFs allow retail investors to access the cryptocurrency market easily, without the need for specialized knowledge or infrastructure.

-

Diversification: By investing in a fund that tracks multiple cryptocurrencies, investors can achieve greater diversification compared to holding a single asset.

-

Lower Security Risks: As mentioned, ETFs mitigate the risks associated with the security of private keys and wallets, providing a layer of safety for investors.

Cons

-

Performance Discrepancies: The reliance on futures contracts can lead to significant differences between the ETF’s performance and the underlying cryptocurrency prices, particularly in volatile markets.

-

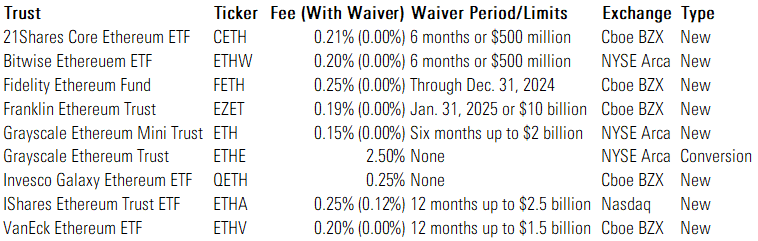

Fees and Expenses: Crypto ETFs often come with management fees that can eat into investment returns. It's essential for investors to understand the fee structures before committing capital.

-

Market Risks: Despite the protective features of ETFs, they are still subject to the high volatility characteristic of the cryptocurrency market, and investors can still incur losses.

:max_bytes(150000):strip_icc()/Pros-and-cons-of-crypto-etfs-8362499-e85d2852ed624cdba4dc55e2538f66a0.jpg)

Recent Developments in the ETF Market

As of April 2025, the cryptocurrency market has seen significant developments surrounding ETFs. One such notable advancement was the SEC’s approval of the first 11 spot cryptocurrency ETFs in January 2024. This pivotal decision reflects a growing acceptance of cryptocurrency investment vehicles within the regulatory framework and signals a potentially more favorable environment for future crypto-related financial products.

The ProShares Bitcoin ETF, which began trading in October 2021, is one of the largest and most recognized cryptocurrency futures ETFs in the U.S. Its success has paved the way for similar investment products, enhancing the legitimacy and accessibility of cryptocurrencies to mainstream investors.

Strategic Insights for Investors

For those considering an investment in cryptocurrency ETFs, it is vital to conduct thorough research and stay informed about market dynamics. Here are several strategic insights:

-

Diversification: While ETFs themselves provide some level of diversification, investors may also consider holding a mix of different ETFs that track various cryptocurrencies.

-

Performance Monitoring: Investors should regularly monitor the performance of their chosen ETFs relative to the underlying cryptocurrencies to ensure that they are meeting their investment objectives.

-

Understanding Fees: Be aware of the management fees associated with different ETFs and how they impact overall returns.

-

Market Awareness: Stay updated on regulatory changes and market conditions, as these factors can significantly influence cryptocurrency prices and ETF performance.

Conclusion

The rise of cryptocurrency ETFs marks a significant development in how investors can access the volatile and often complex world of digital assets. As the market evolves, ETFs provide a relatively secure and straightforward avenue for participation, although they are not without risks. Investors must weigh these factors carefully and consider their financial goals before diving into this burgeoning asset class.

For more detailed insights into cryptocurrency ETFs and their implications in the market, resources like Investopedia can provide additional guidance.