The Rise of Cryptocurrency ETFs: Navigating the New Investment Landscape

As cryptocurrency continues to gain traction among retail and institutional investors alike, the emergence of cryptocurrency exchange-traded funds (ETFs) presents a novel and strategic investment avenue. These funds offer exposure to digital assets without the complexities and risks associated with direct ownership, thereby attracting a diverse range of investors seeking to capitalize on the burgeoning digital currency market.

Understanding Cryptocurrency ETFs

Cryptocurrency ETFs are designed to track the price performance of various cryptocurrencies by investing in a portfolio linked to their instruments. Unlike traditional ETFs that may invest in stocks or bonds, cryptocurrency ETFs provide a way for investors to gain exposure to cryptocurrencies while avoiding the need to buy and store the digital assets directly. This feature significantly mitigates risks such as theft, fraud, or mismanagement, which are often associated with individual cryptocurrency investments.

The first significant player in this market was the ProShares Bitcoin ETF, which began trading in October 2021. This ETF focuses on Bitcoin futures, allowing investors to speculate on Bitcoin's price movements without directly owning the cryptocurrency itself. Since then, the landscape has evolved, with numerous options now available for investors.

The Regulatory Landscape

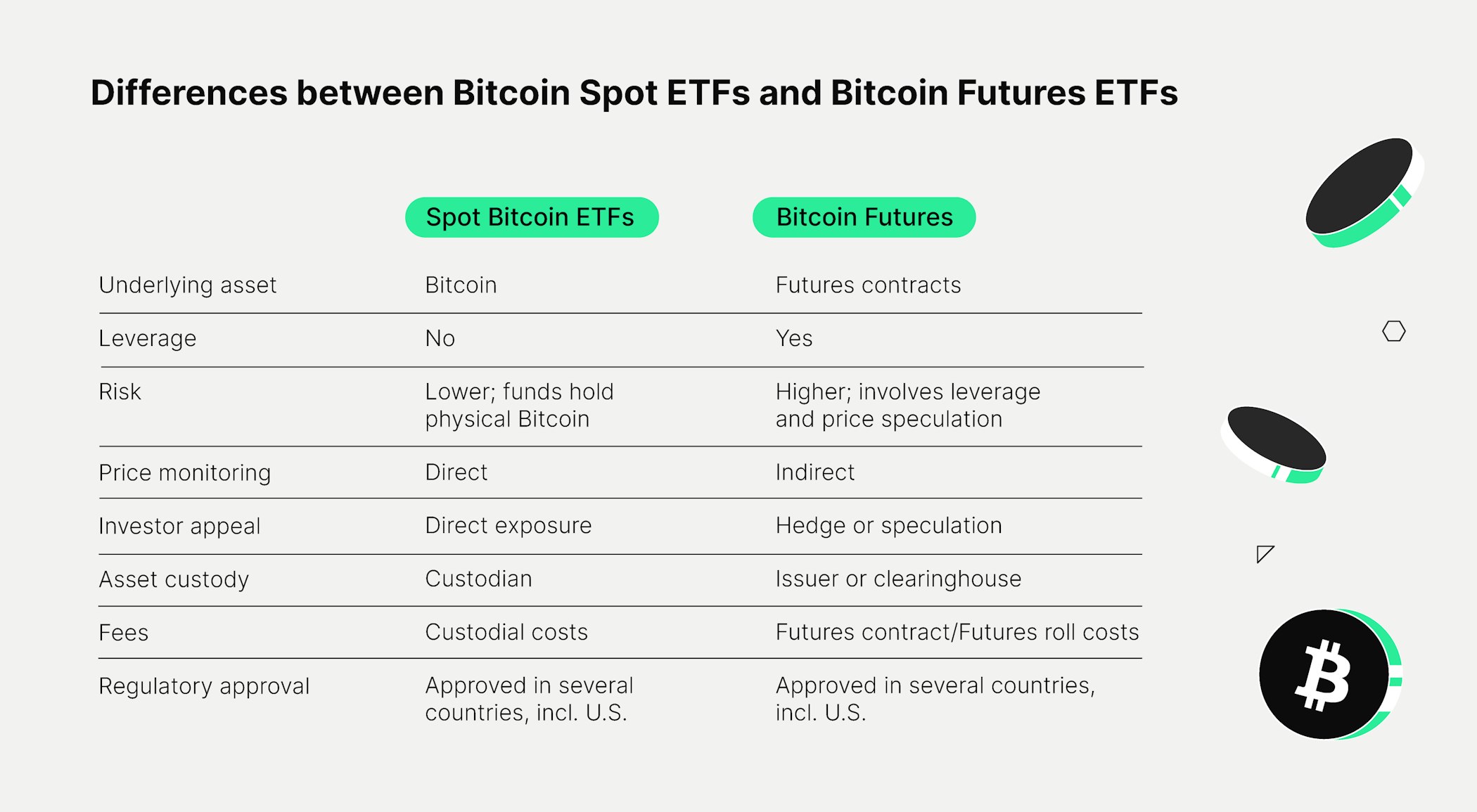

The regulatory environment surrounding cryptocurrency ETFs has gradually evolved to accommodate the growing interest in digital assets. In January 2024, the U.S. Securities and Exchange Commission (SEC) approved the first 11 spot cryptocurrency ETFs for the U.S. market, marking a significant milestone for the industry. Spot ETFs invest directly in cryptocurrencies, unlike futures ETFs, which trade contracts based on the future price of the underlying assets. However, spot ETFs face greater regulatory hurdles due to concerns about investor risks, market volatility, and security issues associated with cryptocurrencies.

The SEC's cautious approach reflects ongoing apprehensions about the potential for significant price fluctuations and the lack of a robust legal framework for cryptocurrency trading. As such, while the approval of spot ETFs signals a shift towards broader acceptance of digital currencies, it also emphasizes the need for regulatory clarity in this rapidly evolving sector.

Performance and Risks

While cryptocurrency ETFs offer a convenient way to invest, investors should be aware of the inherent risks and potential discrepancies in performance compared to the underlying digital assets. Tracking error, which refers to the difference between the ETF's performance and the actual price movement of the underlying cryptocurrency, can be especially pronounced in ETFs relying on futures contracts. These contracts must be rolled over as they expire, leading to costs that can impact the overall performance of the ETFs.

Investors need to conduct thorough research and consider the inherent risks associated with cryptocurrency ETFs. The potential for tracking errors, higher expenses compared to traditional ETFs, and regulatory uncertainties can significantly influence investment outcomes.

:max_bytes(150000):strip_icc()/GettyImages-1440170035-e33a1fc136d940f6b5d1ee30de579722.jpg)

Moreover, while cryptocurrency ETFs provide a more accessible entry point into the digital asset market, they do not completely eliminate risk. The volatility of cryptocurrencies means that investors could experience significant price swings, underscoring the importance of a well-informed approach to investing.

Conclusion

As the cryptocurrency market matures, ETFs are poised to play a crucial role in shaping how investors engage with digital assets. By offering a more accessible and regulated means of exposure to cryptocurrencies, these funds cater to both retail and institutional investors alike. However, potential investors should remain vigilant, conducting thorough research and considering the inherent risks involved before entering this volatile market.

The growth of cryptocurrency ETFs signals a shift in investment strategies, reflecting an increasing demand for innovative financial products that cater to the evolving landscape of digital assets. For those looking to navigate this new investment terrain, understanding the dynamics of cryptocurrency ETFs is essential.

For more information on cryptocurrency ETFs, Investopedia offers in-depth resources and guidelines for prospective investors, while specific ETF insights can be found through dedicated platforms such as ProShares.