The Unprecedented Bond Market Sell-Off: Implications for Investors

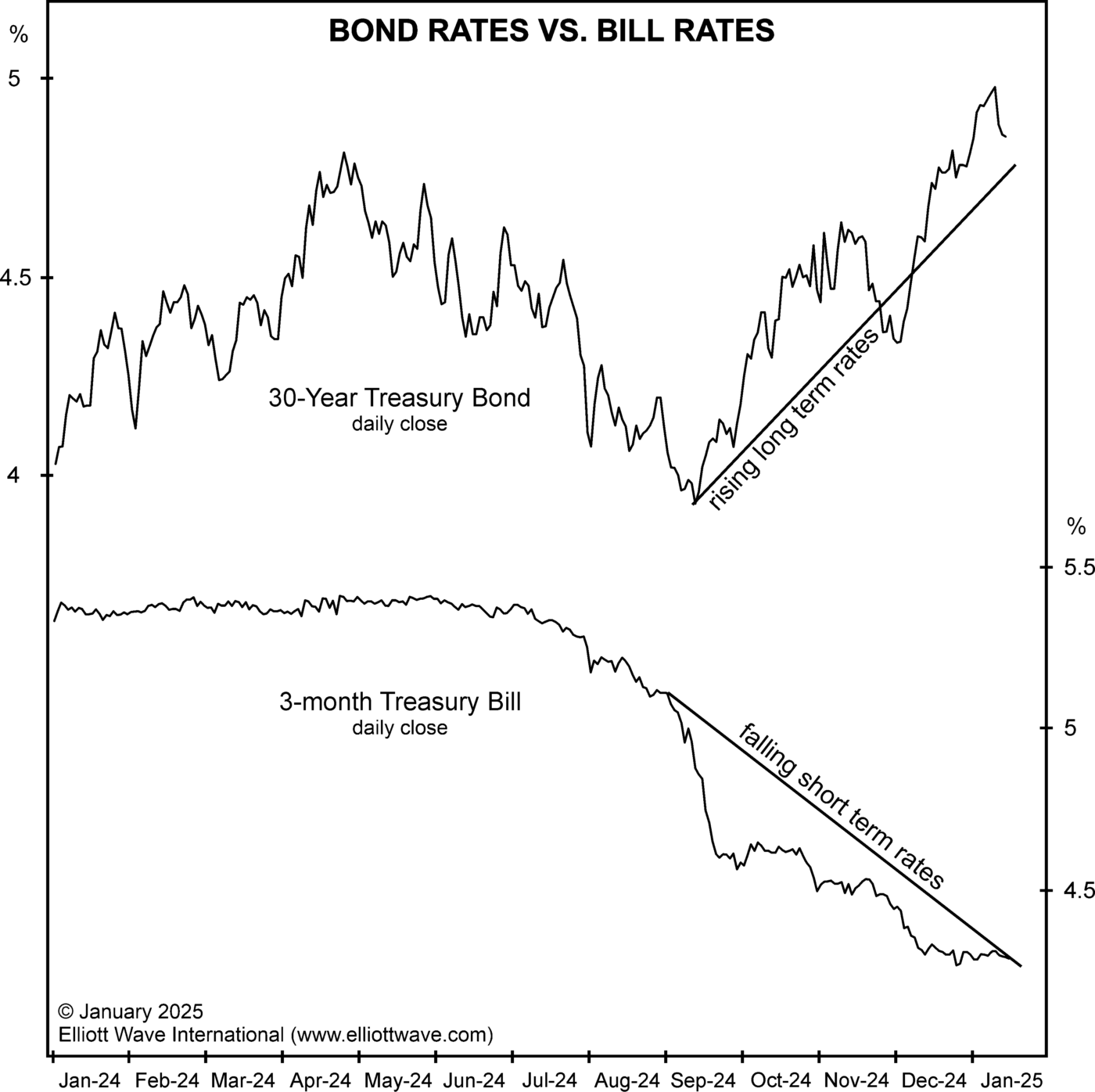

In a surprising turn of events, the U.S. bond market has experienced significant turmoil, leading to a sell-off that has left many investors questioning the stability of government bonds—long considered a safe haven. The 10-year Treasury note's yield has soared past 4.5%, marking one of the largest single-day movements in decades. This unusual behavior signals not just a reaction to market conditions, but a potential shift in the financial landscape that could have profound implications for investors, consumers, and the broader economy.

Overview of the Current Bond Market Situation

In recent days, U.S. government bonds have faced unprecedented selling pressure, resulting in a sharp rise in yields. The rapid increase in the 10-year Treasury yield, combined with concurrent declines in equities, is a departure from the typical inverse relationship between these asset classes. When stocks falter, investors usually flock to the perceived safety of bonds. However, this time, both markets are moving in tandem, raising alarms about underlying issues within the financial system.

Factors Driving the Sell-Off

Several key factors are contributing to the current turmoil in the bond market:

-

Tariff Policies: Recent tariff announcements by President Trump have sparked uncertainty regarding U.S. Treasuries. Analysts suggest that foreign holders of these bonds, particularly from countries like China and Japan, may be reducing their holdings in response to heightened tensions. The ongoing trade war has intensified speculation about the long-term viability of U.S. debt instruments.

-

Loss of Confidence: There is a growing sentiment that U.S. Treasuries may no longer be viewed as the "safe haven" they once were. As Andrew Ackerman from The Washington Post noted, "If Treasurys are not a safe-haven asset, that has major implications for balance sheets across the board—businesses, nonprofits, pensions, households." This shift could destabilize a global financial system that heavily relies on the predictability of U.S. bonds.

-

Economic Indicators: Rising inflation expectations and geopolitical uncertainties are exacerbating the situation. With inflation creeping higher, investors are concerned about the implications for interest rates and borrowing costs. This sentiment was echoed by Vance Barse, founder of Your Dedicated Fiduciary, who stated, "When the bond market speaks, the stock market reacts."

Implications for Investors

The rise in Treasury yields has significant consequences for borrowing costs across the economy. As yields increase, the rates on mortgages, credit cards, and business loans are likely to follow suit. This increase in borrowing costs could dampen consumer spending and ultimately slow economic growth.

According to Ernie Tedeschi, former top economist in the Biden administration, "So much of world finance is predicated on U.S. Treasuries being safe." The ongoing volatility in this market could lead to uncertainty for both consumers and businesses alike, as they navigate higher costs and potential credit tightening.

Strategies for Navigating the Turbulence

In light of the current market dynamics, investors are advised to adopt a cautious approach. Here are several strategies they might consider:

-

Diversification: Investors should look to diversify their portfolios by including high-quality corporate bonds and inflation-protected securities. This could provide a buffer against the impacts of rising yields.

-

Focus on Quality: Maintaining a focus on quality investments will be crucial in this turbulent environment. Investors should prioritize assets with strong fundamentals and solid cash flows, as these are more likely to withstand market volatility.

-

Consulting Advisors: Given the complexity of the current situation, it may be prudent for investors to consult with financial advisors. Professional guidance can help navigate the shifting landscape and avoid making hasty decisions driven by fear.

Conclusion

The current dynamics in the bond market reflect a significant shift in investor sentiment and confidence in U.S. financial stability. As yields rise and investor anxiety grows, stakeholders must remain vigilant and adaptable, employing strategies that emphasize diversification and quality to mitigate risks.

The implications of this unprecedented bond market sell-off extend far beyond individual investors. A loss of confidence in U.S. Treasuries could reverberate through the global financial system, impacting borrowing costs and economic growth for everyone. As the landscape continues to evolve, staying informed and strategically positioned will be essential for all market participants.

For further insights, refer to sources such as USA Today and NPR.