Navigating the Impact of U.S. Tariff Policies on Forex Markets

The forex market is experiencing notable fluctuations, largely driven by recent U.S. tariff policies that have stirred uncertainty and triggered strategic reassessments among traders. As the dollar weakens and major currency pairs respond, stakeholders must navigate these changes with a keen understanding of the evolving landscape.

U.S. Tariff Policies and Currency Fluctuations

In the latest developments, the dollar index (DXY) has dipped below 100 for the first time since July 2023, reflecting a significant depreciation of the U.S. dollar. This shift has resulted in a 2.26% decline against the euro (EUR/USD) and a 2.06% drop against the Japanese yen (USD/JPY). The renewed uncertainty surrounding tariff implementations has prompted traders to reassess their positions, particularly concerning emerging market currencies that are notably sensitive to U.S. economic strategies.

According to market analysts, the impact of tariffs is multifaceted. Higher tariffs typically lead to increased costs for imported goods, which can fuel inflation. This inflationary pressure may prompt the Federal Reserve to adjust monetary policy, further influencing forex valuations. "Traders must remain vigilant and adaptable as the interplay between tariff policies and economic indicators evolves," says Forex analyst Sarah Williams.

Major Currency Pairs Affected

The recent fluctuations have particularly affected several major currency pairs:

-

EUR/USD: The euro has gained strength against the dollar, trading above 1.1350 amid renewed dollar weakness. Analysts anticipate that a stronger-than-expected retail sales report from the U.S. could bolster the euro’s position, further complicating the dollar's recovery efforts. As noted by FXStreet, "The pair is strongly bid above 1.1350 in European trading."

-

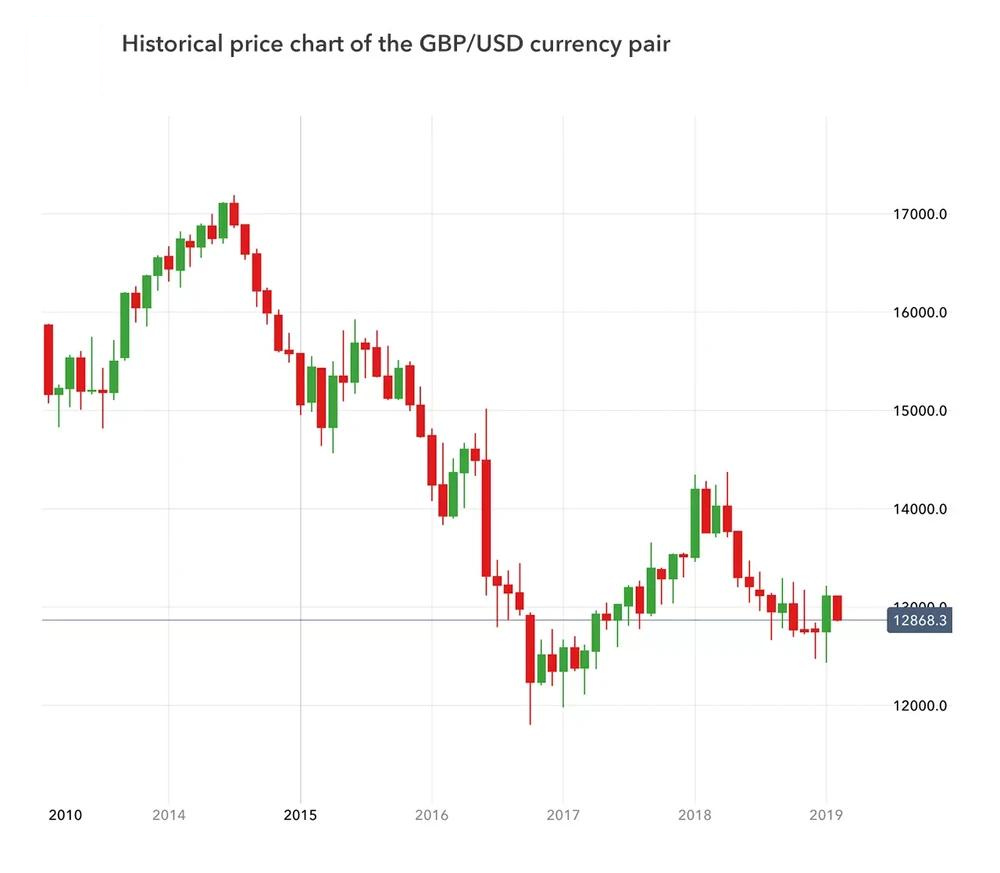

GBP/USD: The British pound has also benefitted from the dollar's decline. Traders speculate on bullish targets, particularly if the U.K. Consumer Price Index (CPI) exceeds expectations. A report from BabyPips highlights this potential, stating that "if U.K. CPI comes in hot, it could lead to increased speculation about the Bank of England's monetary policy adjustments."

-

USD/JPY: The Japanese yen is viewed as a safe haven in times of U.S. economic uncertainty. Increased demand for the yen has been observed as traders seek to hedge their positions. The yen’s low interest rate environment continues to attract carry trades, impacting its valuation against the dollar. As stated in AvaTrade, “The USD/JPY pair remains a staple for traders looking to balance risk amid geopolitical tensions.”

Strategic Recommendations for Traders

In light of the current market dynamics, traders are advised to adopt proactive strategies:

-

Diversify Portfolios: To mitigate risks associated with currency volatility, traders should consider diversifying their exposure across various currency pairs.

-

Employ Technical Analysis: Identifying key support and resistance levels is crucial, particularly in major pairs like EUR/USD and GBP/USD. Traders should leverage charts to pinpoint entry and exit points effectively.

-

Monitor Economic Indicators: Upcoming economic data releases will significantly influence market sentiment. For instance, the U.S. retail sales report and U.K. CPI figures could act as catalysts for further volatility.

Conclusion

The interplay between U.S. tariff policies and forex market dynamics underscores the importance of informed decision-making. As traders navigate these complexities, staying abreast of both macroeconomic indicators and currency movements will be essential. The current environment presents both challenges and opportunities, making it imperative for market participants to adapt their strategies accordingly.

As the situation evolves, traders must remain vigilant and ready to adjust their strategies to effectively navigate the complexities of the forex landscape. The ongoing fluctuations and regulatory implications highlight the critical need for thorough analysis and strategic foresight in this high-stakes market.

References

By keeping a pulse on tariff policies and economic indicators, traders can position themselves to capitalize on opportunities while managing risks effectively.