Market Resilience Amid Tech Sell-Off: A Deep Dive into Recent Trends

The past week has been tumultuous for the stock market, marked by a significant sell-off in the technology sector. As investors grappled with uncertainty, the Dow Jones Industrial Average plummeted nearly 700 points, while the Nasdaq Composite fell by 3%. This article delves into the factors contributing to this volatility and offers recovery strategies for investors looking to navigate the turbulent waters of the market.

Market Overview

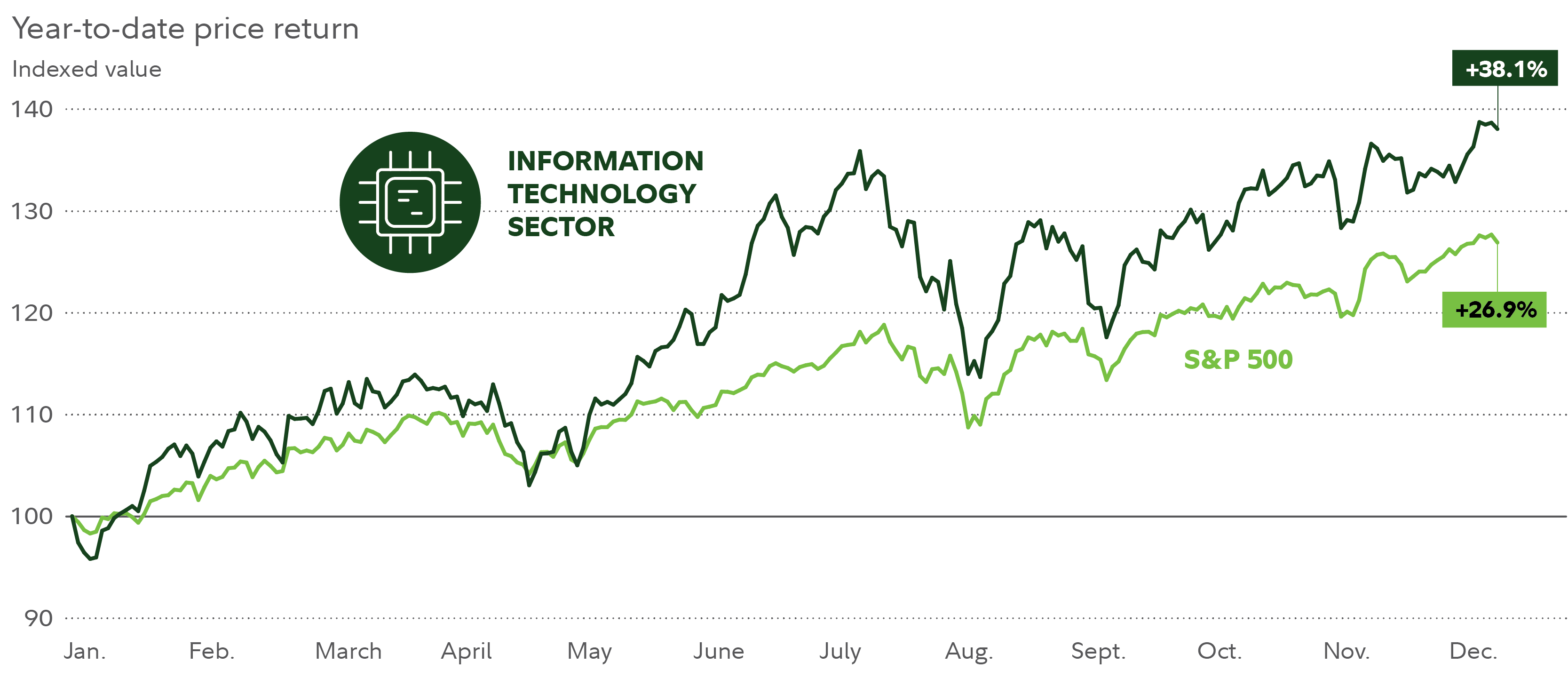

The stock market has been a rollercoaster, with the technology sector taking the brunt of recent disruptions. The alarming drop in the Dow and Nasdaq has sparked concerns about whether the market's previous gains can be sustained. Since the beginning of 2025, concerns about rising interest rates and geopolitical tensions have exacerbated these fears, prompting investors to reevaluate their positions in the tech-heavy landscape.

Factors Influencing the Sell-Off

Several interconnected factors have influenced the recent market downturn:

-

Nvidia's Export Restrictions: Nvidia (NVDA) has implemented new restrictions on chip exports to China, leading to a staggering 14% decline in its stock price. This decision has broader implications for the semiconductor industry, impacting major players like AMD and Qualcomm. The ramifications of these export curbs extend beyond immediate stock price drops, possibly hindering technological advancements in critical sectors globally.

-

Investor Sentiment: With the backdrop of rising geopolitical tensions and ongoing tariff uncertainties, investor sentiment has soured. A notable trend has emerged, with many investors opting to increase cash holdings as a defensive strategy against market volatility. This shift illustrates a cautious approach as market participants weigh the risks of potential economic downturns against the allure of recovery.

-

Earnings Outlook: Despite the pessimism surrounding tech stocks, analysts from Morgan Stanley report that the earnings outlook for major tech players, including the Magnificent Seven (a term popularized to describe leading tech companies such as Apple and Amazon), appears to be stabilizing. Analysts suggest that this stabilization may signal a potential bottoming out of stock prices, creating a possible entry point for investors looking to capitalize on future rebounds.

Recovery Strategies for Investors

In light of the current market dynamics, here are several strategies that investors may consider to mitigate risks and position themselves for potential recovery:

-

Long-Term Focus: Experts emphasize the importance of maintaining a long-term investment perspective. Historical trends indicate that equities have consistently outperformed cash savings over time. For instance, the average annual return of the stock market has been approximately 7% over the last century, which suggests that patient investors may ultimately reap the benefits despite short-term fluctuations.

-

Diversification: A diversified portfolio can serve as a buffer against sector-specific downturns. Investors might consider reallocating funds into more stable sectors such as consumer staples, healthcare, or international markets that may not be as heavily impacted by domestic tech volatility.

-

Monitoring Economic Indicators: Keeping an eye on key economic indicators such as inflation rates, employment data, and consumer spending will be crucial for navigating these choppy waters. The Federal Reserve's policies, particularly regarding interest rate adjustments, will also play a pivotal role in shaping market trends going forward.

Conclusion

While the recent sell-off in the tech sector has raised alarms, the potential for recovery remains. Investors are encouraged to adopt a strategic approach, focusing on long-term gains while navigating the current volatility. Continuous monitoring of market trends and economic indicators will be essential for making informed investment choices.

As the market adjusts to these shocks, the resilience of tech stocks and the broader economy will be tested. Even amidst uncertainty, strategic investment in the tech sector could provide opportunities for growth, especially as earnings outlooks stabilize. Keeping abreast of developments and implementing thoughtful investment strategies will be key for navigating the future market landscape.

For further insights, consider resources from trusted financial news outlets and market analysts such as MarketWatch and CNBC.