Analyzing the Surge in Treasury Yields: Implications for Fixed Income Investors

In recent weeks, the bond market has experienced significant volatility, particularly with U.S. Treasury yields reaching new highs. As of late April 2025, the yield on the 10-year Treasury note has surged, reflecting changing investor sentiment and macroeconomic conditions. This shift poses crucial questions for fixed income investors globally, particularly regarding their investment strategies moving forward.

Current Market Dynamics

The yield on the 10-year Treasury note (^TNX) has increased markedly, currently hovering around 4.25%, a level not seen since early 2024. This rise can be attributed to a confluence of factors:

-

Inflation Concerns: Persistent inflationary pressures have led the Federal Reserve to maintain a hawkish stance, with interest rate hikes anticipated in the coming months. According to the latest data from the Consumer Price Index (CPI), inflation remains above the Fed's target of 2%, prompting speculation about further tightening measures.

-

Economic Growth: Strong economic indicators, including robust GDP growth and low unemployment rates, have bolstered investor confidence. For instance, the U.S. GDP grew at an annualized rate of 3.2% in the first quarter of 2025, as reported by the Bureau of Economic Analysis (BEA). This growth has prompted a shift from bonds to equities, as investors seek higher returns.

-

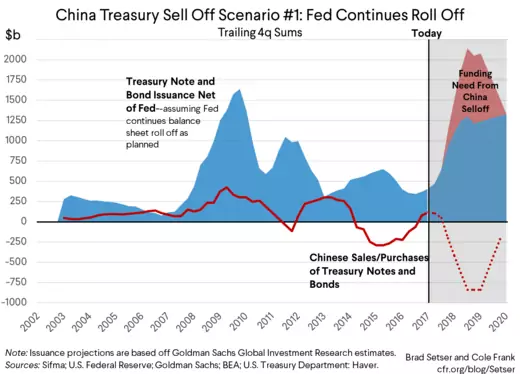

Supply and Demand: An increase in government borrowing to fund infrastructure projects has added to the supply of Treasuries, putting upward pressure on yields. The Treasury Department has announced plans to issue an additional $100 billion in bonds this quarter alone, aimed primarily at financing infrastructure improvements.

Implications for Fixed Income Investors

For fixed income investors, the rising yields present both challenges and opportunities:

-

Portfolio Reallocation: Investors may need to reassess their bond holdings, considering the potential for capital losses in a rising rate environment. Duration management becomes critical; as interest rates rise, bond prices typically fall. A recent report from Fidelity suggests that investors should reduce exposure to long-duration bonds which are more sensitive to interest rate changes.

-

Opportunities in High-Yield Bonds: As Treasury yields rise, the spread between corporate bonds and Treasuries has widened, making high-yield bonds more attractive for those seeking better returns. The current average yield on high-yield corporate bonds sits at approximately 7.5%, providing a compelling alternative for investors willing to accept additional risk.

-

Inflation-Protected Securities: Investors might consider Treasury Inflation-Protected Securities (TIPS) as a hedge against inflation, which could further erode fixed income returns. TIPS have seen increased demand amidst rising inflation expectations, with their yields reflecting a premium over traditional Treasuries.

Expert Insights and Market Trends

According to recent commentary from Barron’s, the bond market has seen a significant shift this year, with yields on Treasury and municipal bonds surging. "The dynamics of the bond market are changing, and investors need to recalibrate their strategies in light of these developments," states a senior analyst at Vanguard.

Market analysts emphasize that maintaining a diversified portfolio will be essential for navigating the current landscape. This sentiment echoes findings from the CME Group, which indicates that market volatility in the bond sector could lead to unexpected price movements.

Conclusion

The current landscape of rising Treasury yields necessitates a strategic approach for fixed income investors. By staying informed about macroeconomic trends and adjusting portfolios accordingly, investors can navigate this challenging environment effectively. The surge in yields reflects broader economic conditions that may impact investment strategies for the foreseeable future.

Investors are advised to focus on quality and yield but remain cautious about interest rate risks. Engaging with a financial advisor to reassess investment objectives may provide clarity in these turbulent times.

Keywords

Treasury, yields, inflation, fixed income, investment strategy

For ongoing updates and data on bond markets, interested parties can refer to sources such as Yahoo Finance and Barron’s.