Market Volatility: Understanding the VIX and Its Implications for Investors

In the wake of recent market fluctuations, the Cboe Volatility Index, widely known as the VIX, has captured the attention of investors grappling with uncertainty. Often dubbed the "fear gauge," the VIX measures market expectations of future volatility based on S&P 500 index options prices. As market dynamics shift, understanding the implications of the VIX is more crucial than ever for making informed investment decisions.

The Misinterpretation of the VIX

One prevalent misconception is that an increase in the VIX directly correlates with declining stock prices. This belief is misleading and can lead to misguided investment strategies. According to a recent analysis from Bloomberg, "Elevated market volatility means stocks are going down, right? Wrong." This statement underscores the complexity of interpreting VIX movements.

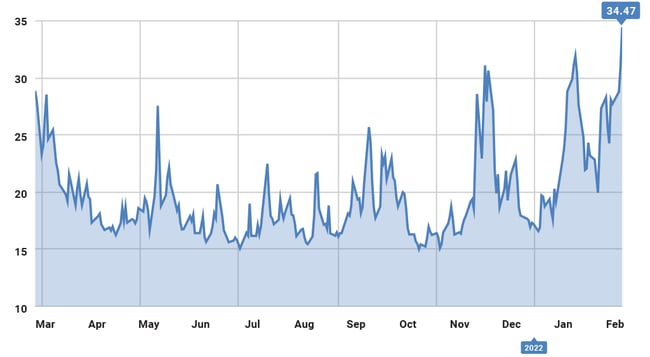

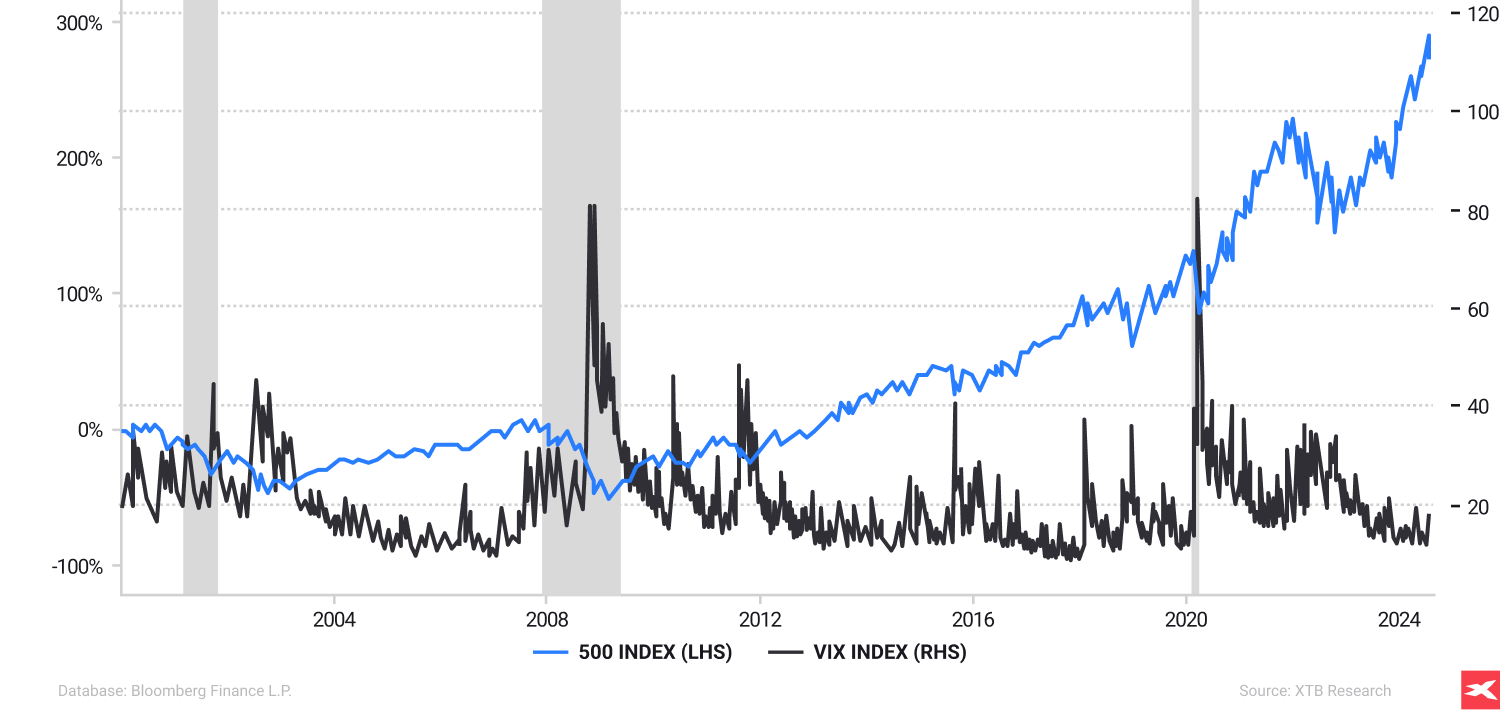

Historically, the VIX tends to spike during periods of market stress, such as during the COVID-19 pandemic sell-off when it reached unprecedented levels. However, it has also surged during market recoveries. This dual role of the VIX as both a fear indicator and a signal of potential buying opportunities complicates investors' understanding.

Historical Context

To grasp the true significance of the VIX, one must consider its historical behavior alongside market trends. The VIX is not merely a reflection of fear; it can also serve as a harbinger of market rebounds. For instance, during the tumultuous market conditions of March 2020, the VIX spiked above 80, a level indicative of extreme fear. Yet, as the market stabilized, stocks rebounded sharply, illustrating that a high VIX does not always predict doom.

Investors should contextualize VIX spikes within the broader landscape of market conditions, taking into account economic indicators, corporate earnings, and geopolitical factors. For example, the recent VIX increase amid tariff announcements and economic uncertainty does not solely point to impending market declines but suggests heightened investor anxiety.

Strategic Implications for Investors

Understanding the VIX can provide strategic advantages for investors. A high VIX often signals heightened fear and uncertainty, which may lead to market corrections and, consequently, attract buying opportunities.

Buying Opportunities in Undervalued Stocks

When the VIX spikes, fundamentally strong stocks may become temporarily undervalued due to market panic. Savvy investors can leverage this by identifying quality stocks that have been unfairly punished by market sentiment. As historical patterns suggest, buying during periods of elevated volatility can yield significant returns in the long run.

Conversely, a low VIX might indicate market complacency. Investors should be cautious in entering new positions during such periods, as complacency often precedes corrections. In this context, monitoring the VIX can help investors gauge market sentiment and position themselves accordingly.

Conclusion

In conclusion, the VIX serves as a vital tool for navigating market volatility. By recognizing its limitations and understanding its historical context, investors can make more informed decisions. As market conditions continue to fluctuate, keeping a close watch on the VIX can provide valuable insights into investor sentiment and potential market movements.

Investor strategies should reflect a nuanced understanding of the VIX, using it not as a definitive predictor of market direction but as a supplementary measure to inform decision-making. By interpreting the VIX alongside other market indicators, investors can better anticipate market shifts and capitalize on opportunities that arise from volatility.

For further insights on navigating market volatility, consider exploring resources on financial strategy and analysis. Understanding the VIX's role can empower investors to make astute decisions in an ever-changing market landscape.