Catastrophe Bonds: Analyzing the Surge in Yields Amid Seasonal Trends

The catastrophe bond market has reached a significant milestone, with overall yields climbing to 10.86% as of May 2, 2025. This latest surge is primarily attributed to seasonal influences and widening spreads, leading investors to view catastrophe bonds as an increasingly attractive option within the fixed income space. With the convergence of heightened risk from natural disasters and low correlation to traditional asset classes, these bonds are emerging as a key investment strategy.

Current Market Dynamics

According to data from Plenum Investments, the recent yield increase is composed of a 6.54% insurance risk spread and a 4.32% collateral yield. This combination reflects a historically appealing yield level for investors, especially in an environment where traditional fixed income investments may offer less favorable returns. Earlier in the year, yields were reported at 10.34%, showcasing a robust demand for catastrophe bonds as risk perceptions evolve.

Investment in catastrophe bonds, which are designed to provide insurance against specified catastrophic events, is becoming particularly relevant as investors seek higher yields amidst a backdrop of increasing competition in the fixed income sector. As noted by Plenum Investments, "The total yield in the CAT bond market is still at a very attractive level," which underscores the attractiveness of these instruments given current economic conditions.

Seasonal Influences

Seasonality plays a pivotal role in the behavior of catastrophe bonds, particularly as it relates to natural disasters like hurricanes. The heightened anticipation of events during the Atlantic hurricane season tends to drive investor interest, leading to an uptick in yields. The recent yield increase can be viewed as a preemptive response to the anticipated risks associated with this seasonal cycle.

The catastrophe bond market’s resilience in absorbing these risks while providing competitive yields indicates its capacity for adaptation. According to analysis from Artemis.bm, "Having competed with demand for a couple of months, seasonality seemingly took over in the catastrophe bond market in April 2025."

Investment Implications

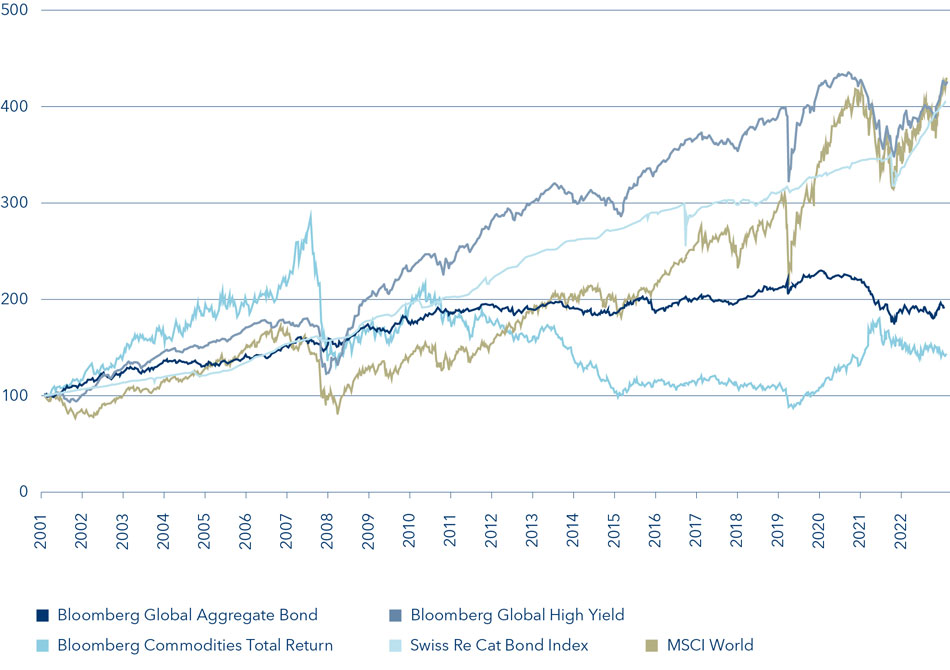

For investors, the current yield levels present a compelling case for including catastrophe bonds in diversified portfolios. The unique characteristics of these bonds include a low correlation with traditional asset classes, which provides a strategic advantage in risk management. This low correlation is critical in an investment landscape increasingly influenced by macroeconomic factors such as inflation and interest rate volatility.

However, investors must remain vigilant about potential yield fluctuations as market conditions evolve. While the current yield of 10.86% is enticing, it is essential to consider the underlying risks associated with the insurance spread and collateral yield dynamics. The insurance risk spread, which has decreased approximately 11% year-on-year, suggests that while yields are compelling, they are also sensitive to market pressures, including demand dynamics and investor sentiment.

The Broader Context of Catastrophe Bonds

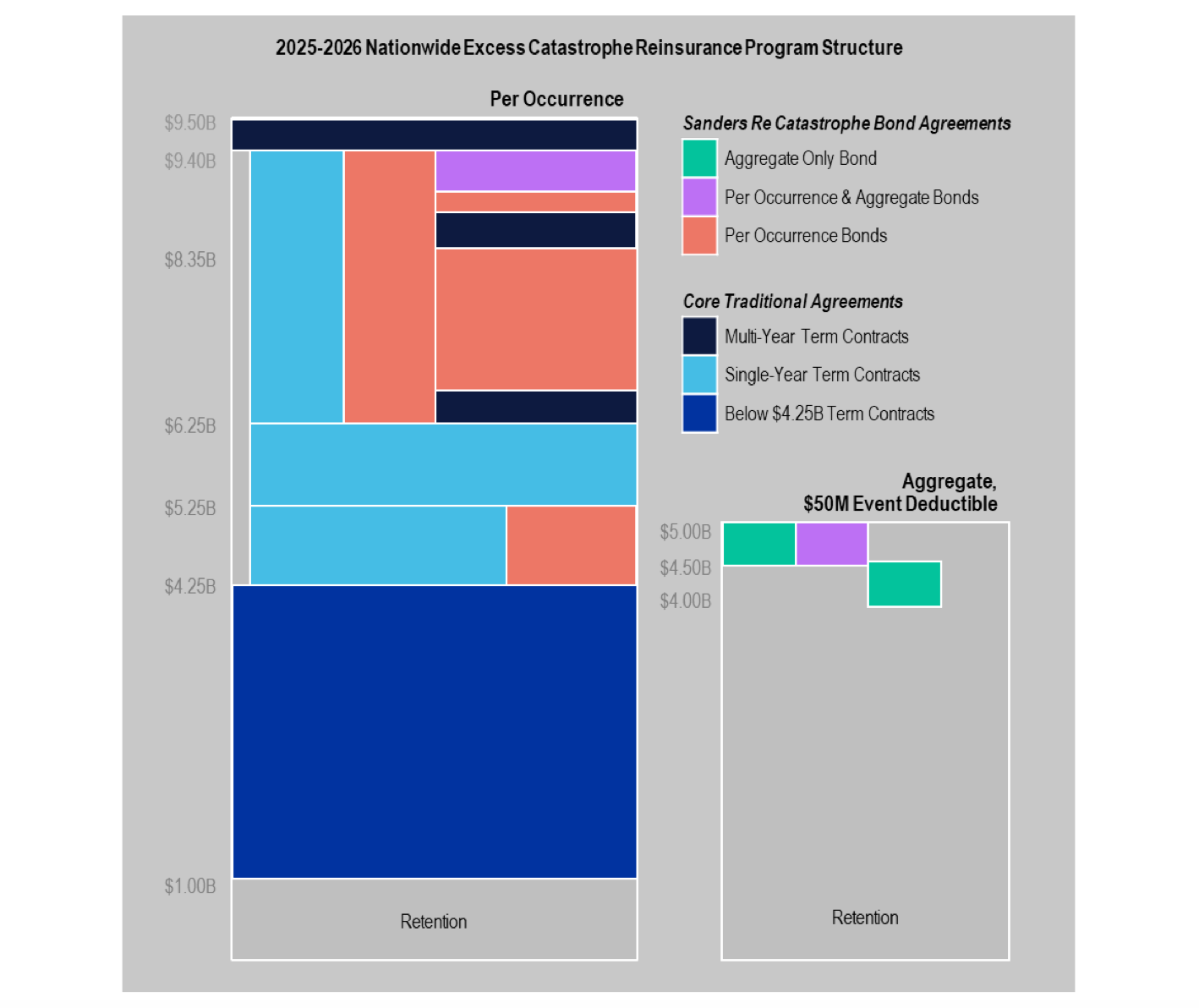

Catastrophe bonds have gained popularity not only as a tool for risk transfer but also as a viable investment alternative, particularly in the face of increasing climate-related risks. The rising prominence of these bonds in the insurance landscape is evidenced by significant commitments from major insurers. For instance, Florida's Citizens Property Insurance Corporation has indicated plans for catastrophe bonds to make up 70% of its reinsurance needs in 2025, reflecting the growing reliance on these instruments as a risk management strategy.

Conclusion

The recent surge in yields within the catastrophe bond market highlights its significance as a fixed-income investment vehicle. With market yields now at 10.86%, investors are encouraged to consider the implications of seasonal trends and dynamics when evaluating their investment strategies. As the catastrophe bond market continues to adapt to shifting risk landscapes, it offers valuable opportunities for yield enhancement and portfolio diversification.

Investors looking to capitalize on these developments should remain informed about the evolving factors influencing yield dynamics and be prepared to adjust their strategies accordingly. By doing so, they can leverage the unique benefits of catastrophe bonds while navigating the complexities of the current financial environment.

For further insights, refer to the original source from Artemis.