Market Resilience Amid Geopolitical Tensions: A Focus on India and Pakistan Stock Markets

In the wake of the recent Pahalgam terror attack, which has escalated geopolitical tensions between India and Pakistan, the financial markets of these neighboring nations have reacted starkly differently. The Indian stock market has shown remarkable resilience, with the Nifty 50 and BSE Sensex indices experiencing significant gains. Conversely, Pakistan's KSE 100 index has suffered a sharp decline, exposing the economic vulnerabilities that the country faces. This article aims to analyze the divergent performances of the Indian and Pakistani stock markets in detail and provide insights for global investors navigating these tumultuous waters.

Indian Market Performance

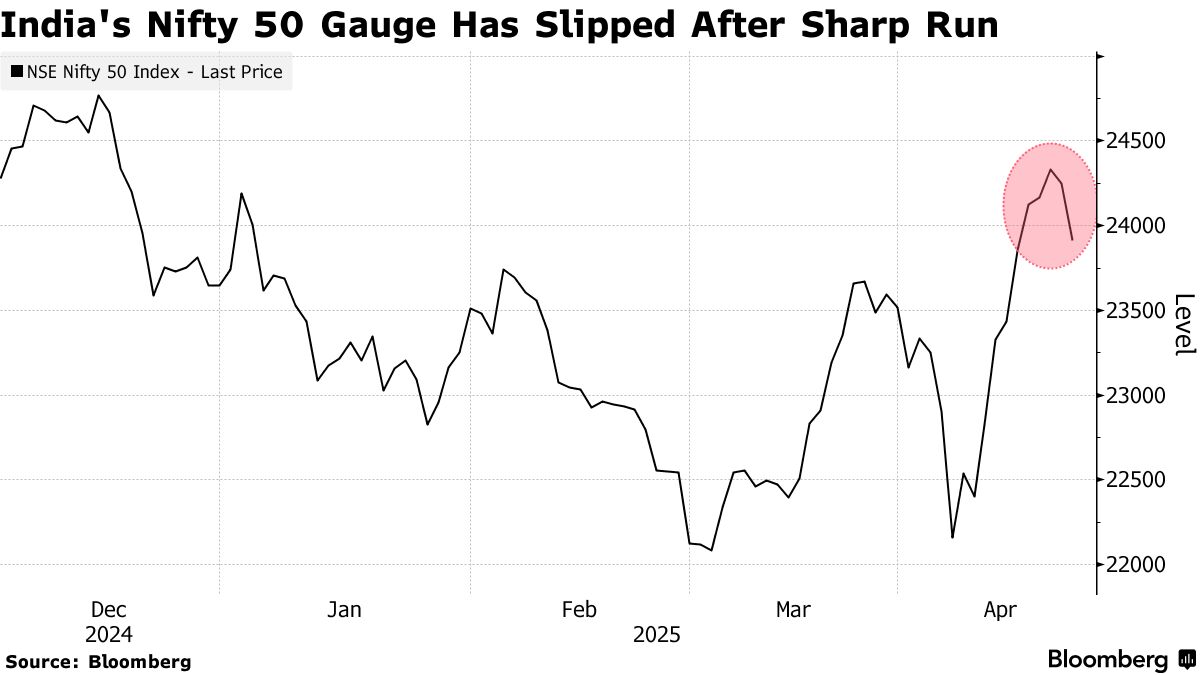

Despite the geopolitical turbulence, the Indian stock market has emerged relatively unscathed. The Nifty 50 index surged by approximately 5% following the attack, reflecting strong investor confidence in India's economic fundamentals. Analysts attribute this resilience to several key factors:

-

Robust Economic Growth: India’s economy continues to expand at a healthy rate, bolstered by strong consumer demand and comprehensive government reforms aimed at enhancing productivity and investment inflows. According to the Reserve Bank of India, GDP growth for the fiscal year is projected to be around 6.1%.

-

Investor Sentiment: Positive sentiment among investors has been amplified by favorable macroeconomic indicators such as declining inflation rates, which are now reported at 4.2%, and strong corporate earnings reports from key sectors.

-

Sectoral Gains: Notably, sectors like technology and pharmaceuticals have outperformed expectations, contributing significantly to the overall market uplift. Companies such as Tata Consultancy Services (TCS) and Sun Pharma have reported higher than anticipated quarterly earnings, further solidifying investor confidence.

Pakistani Market Decline

In stark contrast, the KSE 100 index in Pakistan has faced significant challenges, plummeting by nearly 7% in the same timeframe. Several factors contribute to this downturn:

-

Economic Vulnerabilities: Pakistan's economy is currently grappling with high inflation rates, hovering around 17.5%, coupled with persistent fiscal deficits. These issues have led to diminished investor confidence and a flight to perceived safe-haven assets.

-

Political Instability: The ongoing political turmoil in the country exacerbates market uncertainties, discouraging both domestic and foreign investments. Analysts note that the lack of political stability can lead to adverse economic policies that further impede growth.

-

Investor Flight: The heightened risk environment has resulted in capital outflows, with foreign investors withdrawing approximately $300 million in the last month alone. This trend contributes to the bearish sentiment enveloping the KSE 100, as market participants seek safer investment avenues.

Comparative Analysis

The stark contrast between the performances of the Indian and Pakistani markets highlights the broader implications of geopolitical events on investor behavior. While India capitalizes on its economic strengths, Pakistan’s market struggles under the weight of political and economic instability.

The divergence presents unique opportunities and risks for global investors. For instance, the Indian stock market's resilience indicates a robust environment for investment, provided investors conduct thorough due diligence. In contrast, the challenges faced by Pakistan underscore the necessity for caution when considering investments in riskier markets.

Global Investor Insights

For global investors, the current situation in South Asia necessitates a careful analysis of geopolitical dynamics and economic fundamentals. Here are some actionable insights:

-

Diversification Strategy: Investors should consider diversifying their portfolios to mitigate risks associated with country-specific exposure. Allocating assets across different sectors and geographical regions can cushion against potential downturns.

-

Monitoring Economic Indicators: Keeping a close watch on key economic indicators such as GDP growth, inflation rates, and political stability can provide critical insights into market trends. The International Monetary Fund (IMF) and other financial institutions regularly publish reports that can help investors gauge economic health.

-

Sector Allocation: Given the strength of certain sectors in India, such as IT and pharmaceuticals, investors may want to prioritize these industries in their portfolios. Conversely, caution is warranted in sectors heavily reliant on political stability in Pakistan.

Conclusion

As geopolitical tensions in South Asia continue to evolve, investors must remain vigilant and informed about the dynamics shaping the region's markets. The resilience of the Indian stock market amid adversity serves as a reminder of the importance of sound economic fundamentals guiding investment decisions. Conversely, the challenges faced by Pakistan highlight the need for caution in volatile environments.

In light of these insights, investors should evaluate their strategies and consider how geopolitical events, economic performance, and market sentiment can influence their investment decisions in this critical region.

Key Takeaways

- The Indian stock market is thriving despite geopolitical tensions, driven by robust economic fundamentals.

- Pakistan's market is under pressure due to economic vulnerabilities and political instability.

- Investors should consider these factors when evaluating opportunities in the region.

For further information on the impact of geopolitical factors on stock markets, refer to Times of India.