Bitcoin Approaches Record High: Market Analysis

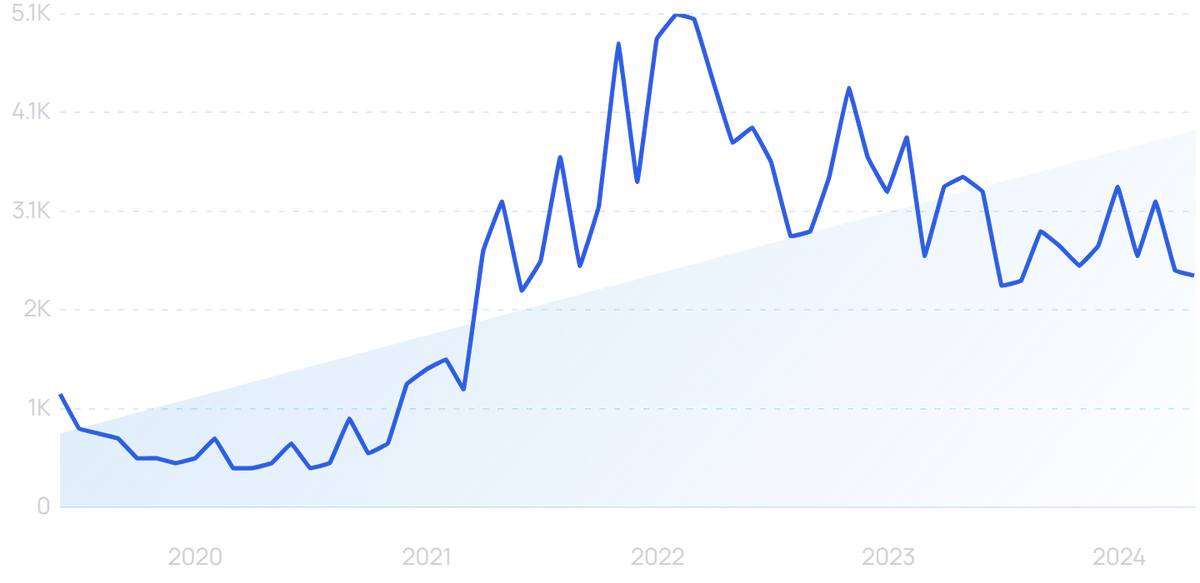

Bitcoin, the leading cryptocurrency by market capitalization, is on the cusp of a significant milestone as it recently surged past previous resistance levels. This upward movement positions the digital asset for a potential retest of its all-time high of $109,000, a record established in late 2021. The current trajectory indicates a compelling market momentum that is capturing the attention of both retail and institutional investors alike.

Market Dynamics

The recent price action reflects a strong bullish sentiment among Bitcoin traders. Analysts are closely watching key support and resistance levels to assess the sustainability of this upward trend. The resurgence in interest in Bitcoin can be attributed to several factors, including favorable market conditions, increased institutional participation, and broader acceptance of cryptocurrency as a viable investment.

As Bitcoin approaches its previous heights, the BTC/USD trading pair has demonstrated resilience, contributing to a renewed wave of buying activity. According to reports from Yahoo Finance, the breakout signals potential for further gains, with analysts suggesting that a robust support level around $100,000 could act as a launching pad for further advancements.

Institutional Interest

Institutional investors have increasingly viewed Bitcoin as a hedge against inflation and market volatility. This shift in perception has led to heightened participation from large financial entities, with many integrating Bitcoin into their portfolios. The growing acceptance of Bitcoin by major financial institutions has been viewed as a critical driver behind the current bullish market sentiment.

According to recent data, Bitcoin's market capitalization has surged, surpassing $2 trillion, indicating a robust demand for the cryptocurrency. Furthermore, the rise of Bitcoin exchange-traded funds (ETFs) has facilitated easier access for traditional investors, further boosting overall market confidence.

Technological Developments

The technological advancements within the Bitcoin ecosystem have also contributed to its positive outlook. The Bitcoin network has seen upgrades aimed at improving transaction efficiency and scalability. The implementation of the Lightning Network, which allows for faster and cheaper transactions, has been a significant development, enhancing the usability of Bitcoin for everyday transactions.

Moreover, the ongoing development of decentralized finance (DeFi) projects and non-fungible tokens (NFTs) within the broader cryptocurrency landscape has sparked additional interest in Bitcoin. The interconnectivity of these innovations with Bitcoin enhances its position as a foundational asset in the cryptocurrency market.

Investor Sentiment

The current investor sentiment surrounding Bitcoin is largely optimistic, with many anticipating that the cryptocurrency will continue to gain value as it approaches its all-time high. However, market participants are advised to remain cautious. Potential volatility could arise from both external economic factors and internal market dynamics.

According to a survey conducted by the cryptocurrency platform TradingView, approximately 60% of investors expressed confidence that Bitcoin will surpass its previous all-time high within the next six months. This sentiment underscores the prevailing bullish outlook, although it is tempered by the understanding that the cryptocurrency market can be unpredictable.

Conclusion

As Bitcoin approaches its record high, market participants should remain vigilant and consider the implications of this price movement on their investment strategies. The evolving landscape of cryptocurrency trading presents opportunities, but understanding market dynamics will be crucial for navigating potential volatility. Investors are encouraged to stay informed and adapt their strategies as conditions fluctuate.

For detailed analysis, refer to the original article here.

As always, investors should conduct thorough research and consider seeking professional financial advice before making significant investment decisions in the cryptocurrency space.