Navigating Agricultural Commodity Price Surges Amid Climate Challenges

As of May 9, 2025, agricultural commodity prices have surged dramatically, reflecting the complex interplay between climate change, supply chain disruptions, and global demand. Wheat prices have jumped by 10%, with corn trading at $5.80 per bushel and soybeans reaching $14.50 per bushel. These escalating prices underscore the urgent need for investors and stakeholders to develop adaptive strategies to navigate this volatile landscape.

Climate Change and Its Impact on Agricultural Production

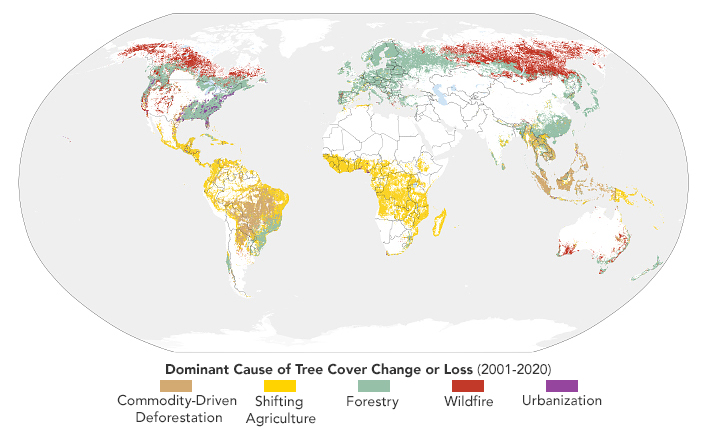

Climate change continues to pose substantial risks to agricultural production, resulting in unpredictable weather patterns that directly affect crop yields. According to a report by the U.S. Department of Agriculture, adverse weather conditions, including droughts and unseasonable temperatures, have severely hampered agricultural output across various regions, leading to concerns over food security and rising prices.

For instance, the National Oceanic and Atmospheric Administration (NOAA) highlights that more frequent extreme weather events have increased the volatility of crop production, challenging traditional agricultural practices and necessitating a reevaluation of risk management strategies. As a result, investors are being urged to adopt a more nuanced approach that considers these environmental dynamics.

Key Insights into Price Increases

- Wheat Prices Surge by 10%: This significant increase is primarily driven by supply chain issues and decreased yields due to climate factors.

- Corn at $5.80 per Bushel: The corn market has felt the pressure from both domestic and international demand, particularly in livestock feed and biofuel production.

- Soybeans Reach $14.50 per Bushel: Soybeans have seen increased demand from both the food industry and as a biodiesel feedstock, further inflating prices.

The agricultural commodity market's response to these challenges is multifaceted. As prices rise, challenges related to supply chain logistics, transportation costs, and geopolitical tensions over crop exports come into sharper focus.

Investment Strategies in a Volatile Market

Investors looking to capitalize on the current volatility in agricultural commodities should consider adopting various strategies that include diversification and hedging through futures contracts. Such methods can help mitigate risks associated with sudden price swings and adverse market conditions.

Diversification and Hedging

Diversification: By spreading investments across different commodity markets, investors can reduce their exposure to any single crop's unforeseen issues. For example, maintaining a balanced portfolio that includes a mix of grains, legumes, and cash crops can buffer against localized supply disruptions.

Hedging: Utilizing futures contracts allows investors to lock in prices and protect themselves from future market fluctuations. As the market evolves, the ability to hedge against price changes becomes increasingly crucial for managing risk effectively.

Monitoring Market Trends

Investors and stakeholders must remain vigilant in monitoring agricultural reports and weather patterns, as these elements play a significant role in market stability. The United States Department of Agriculture (USDA) and other relevant agencies provide essential insights into crop forecasts and potential impacts of climate events.

An analysis suggests that with increasing investment in sustainable agricultural practices and technology, there may be opportunities for innovation within the sector. Techniques such as precision agriculture and drought-resistant crops could offer solutions that enhance yield resilience against climate variability.

The Future of Agricultural Commodities

The current landscape of agricultural commodities is marked by significant price volatility driven by climate challenges and shifting global consumption patterns. Stakeholders must be proactive and adaptable, seeking out opportunities while effectively managing risks.

As we move forward, the focus on sustainable farming practices and technological advancements will likely shape the market dynamics. The integration of climate-smart practices is not merely beneficial for the environment but also essential for ensuring the long-term viability of agricultural investments.

Conclusion

In conclusion, navigating the complexities of agricultural commodity price surges amid climate challenges requires a strategic and informed approach. Investors are encouraged to remain vigilant, adapt their strategies in line with market trends, and leverage innovative practices to capitalize on emerging opportunities. The evolving agricultural landscape demands resilience and insight to thrive in an unpredictable future.

For continuous updates and market insights, stakeholders can refer to resources like AgWeb and industry reports from the USDA.

By understanding the intersections of climate change, market demand, and investment strategies, participants in the agricultural sector can better prepare to meet future challenges head-on.