The Resurgence of Catastrophe Bonds: A Strategic Opportunity for Fixed Income Investors

In the wake of rising climate-related risks, catastrophe bonds (cat bonds) have gained significant traction among fixed income investors. As of May 2025, yields on these bonds have surged to 10.86%, reflecting heightened demand driven by both seasonal influences and widening credit spreads. The shift towards these innovative financial instruments underscores an ongoing evolution in investment strategies, particularly as climate change exacerbates the frequency and intensity of natural disasters.

Understanding Catastrophe Bonds

Catastrophe bonds are securities that transfer the risk of natural disasters from insurers to investors. These specialized bonds are structured to provide a return on investment that is contingent upon the occurrence of a pre-defined catastrophic event, such as hurricanes or earthquakes. If such an event does not occur during the bond's term, investors receive periodic interest payments, often at attractive rates. However, in the event of a catastrophe, investors may lose some or all of their principal.

The unique risk-reward profile of cat bonds makes them an appealing option for diversifying fixed income portfolios. According to experts, they offer a compelling yield premium, typically higher than that of traditional bonds, while also providing a hedge against market volatility and economic downturns.

Market Dynamics and Growth

The global catastrophe bond market reached approximately $10.5 billion in 2024, indicating robust growth as more issuers seek to manage risk in an increasingly volatile climate. Florida's Citizens Property Insurance Corporation, for instance, plans to issue up to $1.525 billion in cat bonds to cover 70% of its reinsurance needs. This strategic move demonstrates the practical application of these instruments in risk management, particularly in regions prone to severe weather events.

In a recent report, Brian Therien, a Senior Fixed Income Analyst, noted that "the rising interest in cat bonds illustrates a growing recognition of climate risk among investors. These bonds not only provide high yields but also offer diversification away from traditional asset classes." The issuance of cat bonds has become a crucial tool for insurers and governments alike to mitigate the financial impact of natural disasters.

Investment Appeal

Investors are increasingly drawn to catastrophe bonds for several reasons:

-

High Yields: The current yield on cat bonds, reported at 10.86%, is significantly higher than traditional fixed-income securities, making them an attractive option for yield-seeking investors.

-

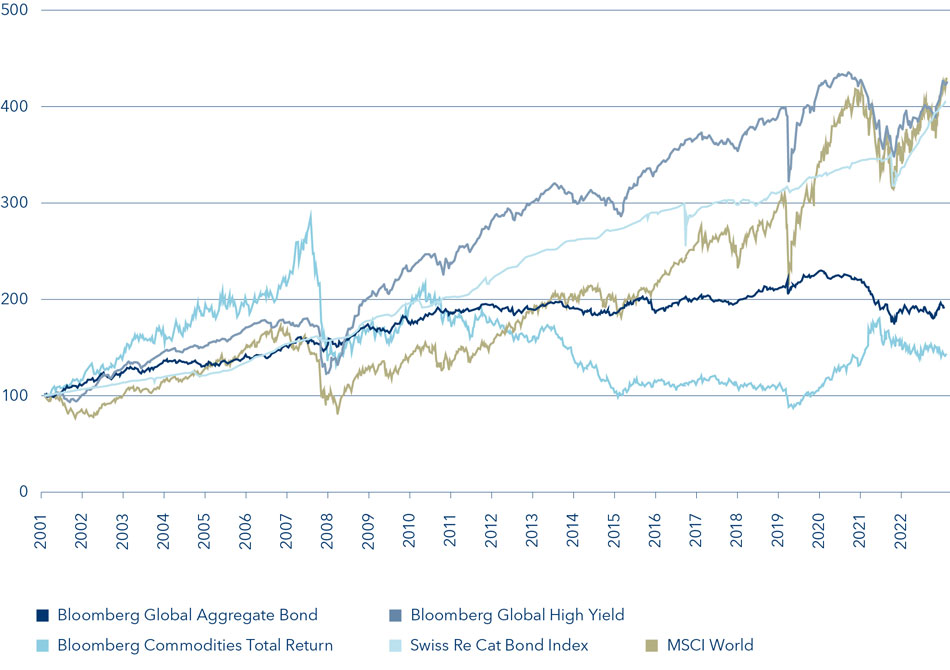

Low Correlation with Traditional Assets: Cat bonds typically demonstrate low correlation with other asset classes, allowing investors to diversify their portfolios effectively. This characteristic is particularly advantageous during periods of economic uncertainty, where traditional asset values may fluctuate due to macroeconomic factors.

-

Inflation Hedge: In an environment characterized by rising interest rates and inflationary pressures, cat bonds can provide a hedge against economic downturns while offering substantial return potential.

Strategic Considerations

While the allure of high yields is significant, investors should also consider the inherent risks associated with catastrophe bonds. These include:

-

Potential for Loss of Principal: Investors face the risk of losing their entire investment if a natural disaster occurs that triggers the bond.

-

Complex Risk Assessments: Evaluating the underlying risks associated with specific cat bonds requires a deep understanding of climate science and actuarial assessments, which can be complex and nuanced.

-

Market Volatility: The market for cat bonds can experience volatility, especially in the immediate aftermath of a natural disaster when investor sentiment may shift.

Therefore, thorough due diligence and a clear understanding of the bond's terms are essential. Investors should carefully analyze the triggers, payout structures, and overall risk landscape before committing capital.

Conclusion

As climate change continues to pose significant risks, catastrophe bonds represent a strategic opportunity for fixed income investors looking to enhance yield while diversifying their portfolios. By understanding the dynamics of this market, investors can position themselves to capitalize on the growing demand for innovative risk transfer solutions.

For further insights and market updates, resources such as Artemis and Bloomberg provide comprehensive coverage of catastrophe bonds and related investment opportunities. This evolving landscape offers a promising avenue for investors willing to navigate its complexities and embrace the potential for substantial rewards amidst the challenges posed by climate-related risks.