Bitcoin's Resilience Amid Tariff Turmoil: A Market Analysis

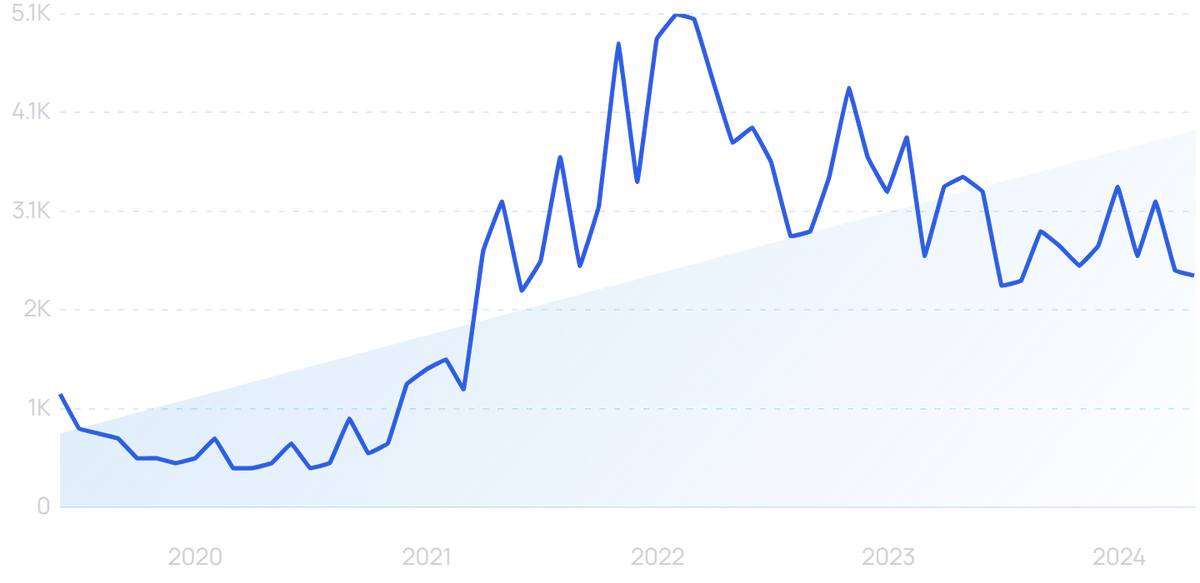

Bitcoin has recently demonstrated remarkable resilience, hovering around $82,000 despite the backdrop of escalating U.S. tariffs that have sent ripples through global markets. Analysts suggest that the cryptocurrency's ability to maintain these levels indicates strong underlying demand, particularly as it approaches critical resistance levels. As geopolitical tensions escalate, market participants are keenly observing Bitcoin's response to tariff-induced volatility.

Current Market Dynamics

As of May 11, 2025, Bitcoin's price fluctuated near $82,000, with analysts emphasizing that the $80,000 mark is a crucial support level. A failure to hold this level could trigger further sell-offs, especially as the market grapples with the implications of U.S. tariffs on trade and economic stability. Recent data from Coinglass reports that approximately $758 million worth of cryptocurrency positions were liquidated in a recent sell-off—the highest liquidation seen in nearly six weeks. This wave of liquidations underscores the fragile state of investor sentiment amid the ongoing geopolitical landscape.

The imposition of tariffs, namely the 25% tariffs against Canada and Mexico initiated by the Trump administration, has weighed heavily on risk assets, including cryptocurrencies like Bitcoin. The uncertainty surrounding these tariffs has created a turbulent environment, leading many investors to adopt a cautious approach. According to BTC Markets analyst Charlie Sherry, the market is experiencing heightened uncertainty, which could lead to further declines if the geopolitical landscape does not stabilize.

Investor Sentiment and Future Outlook

The current sentiment among cryptocurrency investors appears cautious, with many adopting a 'sell mode' in response to broader market volatility. Sherry notes, “The dynamics in the market have made investors wary. A decisive drop below the $80,000 support could push many to liquidate their positions.”

However, some analysts maintain optimism. If Bitcoin can decisively break through the $88,800 resistance, it may pave the way for a rally towards the $92,000–$94,000 range. This potential upside is bolstered by Bitcoin's historical performance during economic turbulence, where it has often been viewed as a hedge against inflation and currency devaluation.

The Global Influence of Tariffs on Cryptocurrency

Tariff-related tensions have a ripple effect across various markets, impacting not only traditional assets but also the cryptocurrency space. The U.S. dollar's relative strength and geopolitical maneuvers are crucial factors influencing investor behavior. As economic pressures mount, many investors are looking to alternatives such as Bitcoin to safeguard their assets, yet the ongoing tariff disputes create layers of complexity.

The situation remains fluid, as new developments emerge in the geopolitical sphere. For example, recent reports suggest that U.S.-China trade talks could shift investor sentiment positively if an agreement is reached. Conversely, continued tariff escalations could lead to increased selling pressure, particularly from retail investors who are more sensitive to macroeconomic shifts.

Conclusion

In conclusion, while Bitcoin faces significant challenges due to external economic pressures, its current price stability suggests robust demand that could support future growth. Bitcoin's resilience amid tariff turmoil highlights its dual role as both a speculative asset and a potential safe haven. Investors should remain vigilant and consider the potential for volatility as the market reacts to ongoing geopolitical developments. The interplay between tariffs, global economic conditions, and cryptocurrency dynamics will be crucial in shaping Bitcoin's trajectory in the near future.

Keywords

- Bitcoin

- Tariffs

- Cryptocurrency

- Market Analysis

- Investor Sentiment