The Resilience of Forex Markets Amidst Global Economic Shifts

In the face of escalating geopolitical tensions and fluctuating economic indicators, the foreign exchange (forex) markets have exhibited a surprising degree of stability. As traders navigate these turbulent waters, understanding current trends and adopting effective strategies become crucial for optimizing trading outcomes.

Current Market Overview

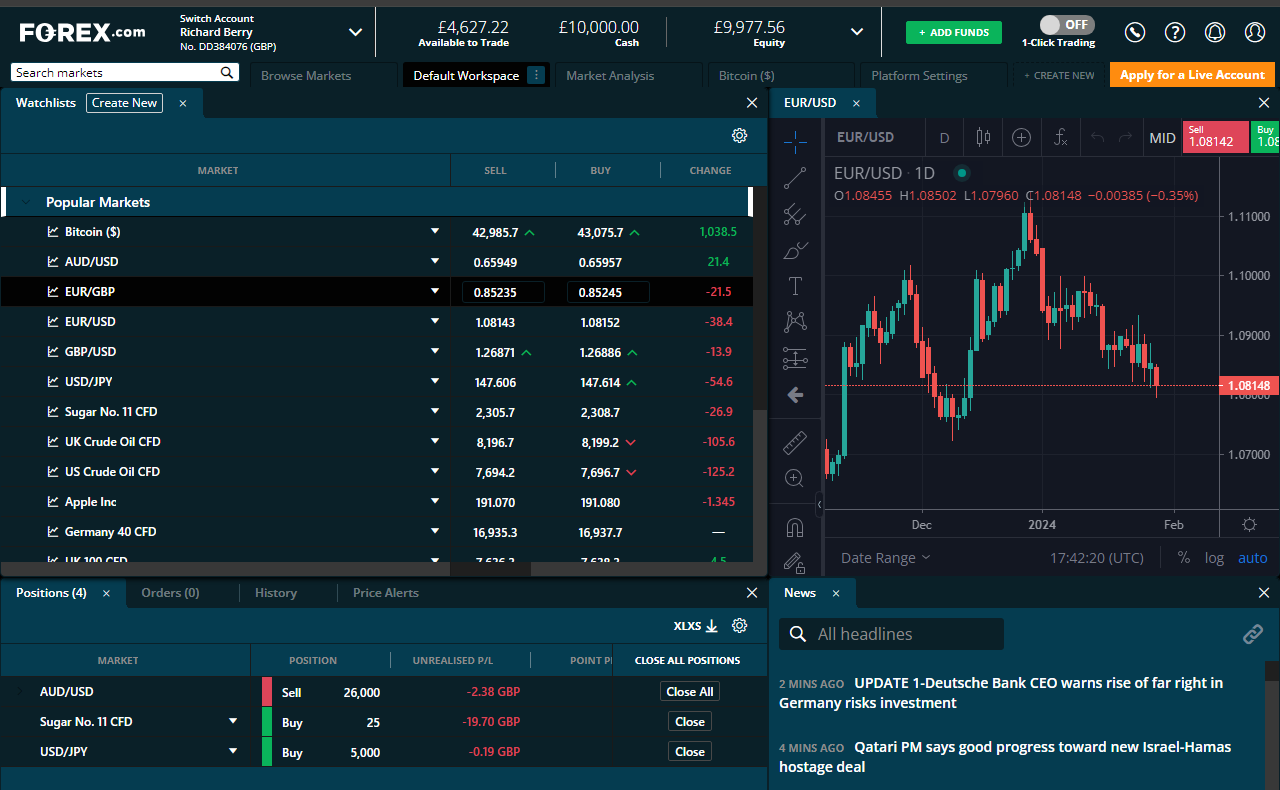

As of May 11, 2025, forex markets have remained relatively stable, with major currency pairs and crosses largely confined to the previous day's trading ranges. This phenomenon is attributed to the typical month-end lull, characterized by decreased trading volumes as investors reassess their positions and strategies. According to data from Action Forex, this period often leads to a pause in significant price movements, allowing traders to recalibrate their analyses.

Key Currency Movements

Recent fluctuations in currency values reveal significant movements in several major pairs. The GBP/CAD has appreciated by 0.54%, signaling a positive sentiment towards the British Pound against the Canadian Dollar. Similarly, the GBP/USD has seen a 0.44% increase, while the JPY/CAD and JPY/USD pairs have also demonstrated gains of 0.52% and 0.47%, respectively. These developments indicate an increasing interest in currencies perceived as stable amidst global uncertainties, as reflected in the latest market data from Barchart.

Strategic Insights for Traders

Navigating the forex landscape requires a proactive and informed approach. Here are several strategies that traders can adopt to enhance their success:

-

Diversification: Given the current market conditions, traders are advised to diversify their portfolios by incorporating a mix of stable and volatile currencies. This strategy can mitigate risks related to sudden market shifts, providing a buffer against adverse movements.

-

Technical Analysis: Utilizing technical indicators is essential for identifying potential entry and exit points. Traders should pay close attention to support and resistance levels, particularly in pairs like AUD/USD, which has recently shown significant price action. Implementing tools such as moving averages and Fibonacci retracements can also enhance trade timing and execution.

-

Stay Informed: Keeping abreast of global economic news and geopolitical developments is critical. Events impacting major economies can lead to rapid changes in currency valuations. For instance, fluctuations in commodity prices, central bank announcements, or political instability can drastically alter market dynamics. Accessing resources like economic calendars and market analyses will equip traders with timely information necessary for successful trading.

Conclusion

The forex market's current stability presents both challenges and opportunities for traders. By adopting a strategic approach that incorporates diversification, technical analysis, and ongoing market awareness, investors can effectively navigate this complex landscape. As we progress through 2025, agility and vigilance will be paramount in capitalizing on emerging trends within the forex markets.

In summary, while the forex market remains resilient amidst global economic shifts, traders must remain adaptable and informed to seize opportunities and manage risks effectively in a continually evolving marketplace.

For those looking to deepen their understanding of forex trading, platforms such as Myfxbook offer valuable tools and educational resources that can significantly enhance trading outcomes.

As the market landscape continues to evolve, staying connected with current economic trends and employing effective trading strategies will be essential for achieving success in the forex arena.