Analyzing the Impact of U.S. Dollar Weakness on Forex Trading Strategies

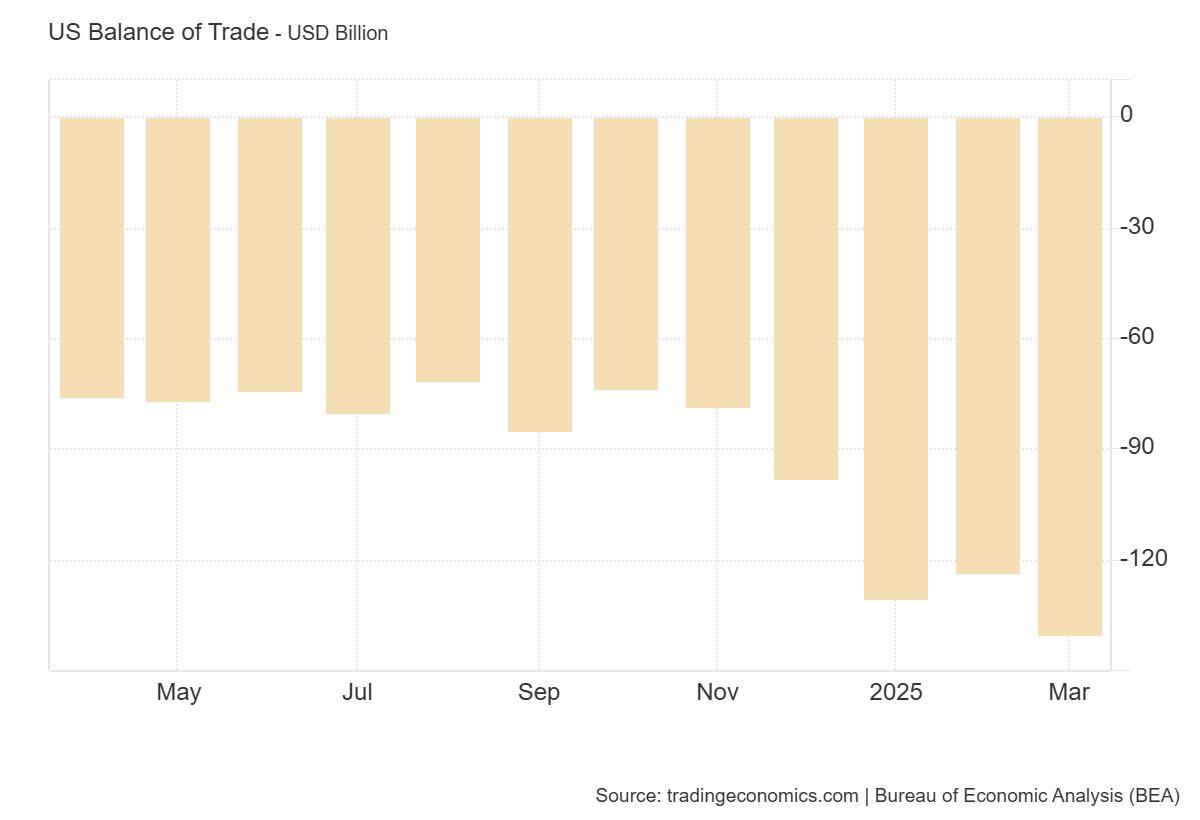

The forex market is currently experiencing significant shifts, prompted primarily by the depreciation of the U.S. dollar, which has declined approximately 10% since January 2025. This weakening has brought forth notable implications for traders worldwide, necessitating a reevaluation of strategies as they navigate this volatile environment. With geopolitical tensions and economic contractions at play, the landscape of currency trading has transformed, presenting both challenges and opportunities.

Current Market Dynamics

As of May 11, 2025, the Dollar Index has dipped below 100, marking a level not seen in several years. This decline has shifted trader focus toward more stable currencies, particularly the euro (EUR) and the Japanese yen (JPY). Major currency pairs such as EUR/USD and GBP/USD have demonstrated notable volatility, indicating increased trading activity as investors adjust their positions.

The EUR/USD pair showcases strong sell momentum, highlighting bearish trends that traders need to monitor closely. Recent trading data indicates that EUR/USD has seen fluctuations driven by both macroeconomic factors and market sentiment. According to sources from ForexLive, movements in this pair reflect a broader trend of traders seeking to hedge against the dollar's depreciation.

Strategic Adjustments for Traders

In light of the dollar's weakness, forex traders must adapt their strategies to capitalize on emerging trends. Here are several key adjustments to consider:

-

Diversification: With the dollar losing ground, diversification into stronger currencies becomes paramount. Focusing on stable currencies, particularly the euro and yen, can help traders mitigate risks associated with dollar volatility. For instance, the euro has shown resilience, supported by favorable economic data from the Eurozone, which could enhance its attractiveness against the dollar.

-

Technical Analysis: Employing technical analysis tools is essential for identifying potential entry and exit points. Traders should pay close attention to key support and resistance levels in major currency pairs. For example, in the EUR/USD pair, technical indicators may reveal critical levels that signal potential price reversals or continuations. As observed on TradingView, monitoring price action can provide traders with actionable insights.

-

Economic Indicators: Staying abreast of economic indicators is crucial for understanding market dynamics. The recent contraction of U.S. GDP by 1.2% has already impacted trader sentiment, and upcoming economic reports will likely further influence currency valuations. Data from Action Forex highlights the importance of economic calendars in anticipating market-moving events.

Conclusion

The current forex landscape, characterized by the U.S. dollar's weakness, presents both challenges and opportunities for traders. By adapting strategies to focus on more stable currencies, utilizing robust analytical tools, and continuously monitoring economic indicators, traders can position themselves to capitalize on the evolving market dynamics. The interplay between economic developments and geopolitical factors will remain critical in shaping forex trading strategies moving forward.

As the market continues to evolve, traders must embrace adaptability and informed decision-making to navigate the complexities of the forex environment successfully. In this landscape, those who remain vigilant and proactive stand to benefit the most from the opportunities that arise from the dollar's ongoing fluctuations.

Keywords

Forex, U.S. Dollar, EUR/USD, GBP/USD, Trading Strategies, Technical Analysis, Economic Indicators