The Impact of U.S.-China Trade Talks on Bitcoin and Cryptocurrency Markets

As Bitcoin prices surge amidst optimism surrounding U.S.-China trade negotiations, investors are observing a market dynamic that could reshape the cryptocurrency landscape. Recently, the price of Bitcoin climbed to approximately $82,000, reflecting a broad sentiment that easing trade tensions could stabilize the global economy and benefit risk assets—including cryptocurrencies. This article delves into the implications of these trade talks for cryptocurrency investors and assesses the market's response.

Market Dynamics

The resilience of Bitcoin’s price is closely tied to macroeconomic indicators and geopolitical developments. Analysts have identified a critical support level around $80,000 and a significant resistance level at $88,800. Should Bitcoin surpass this resistance, potential gains could see prices reaching between $92,000 and $94,000. Historical data reveals that Bitcoin has typically performed well when investor sentiment is buoyed by positive macroeconomic signals, highlighting the interplay between traditional market dynamics and cryptocurrency performance.

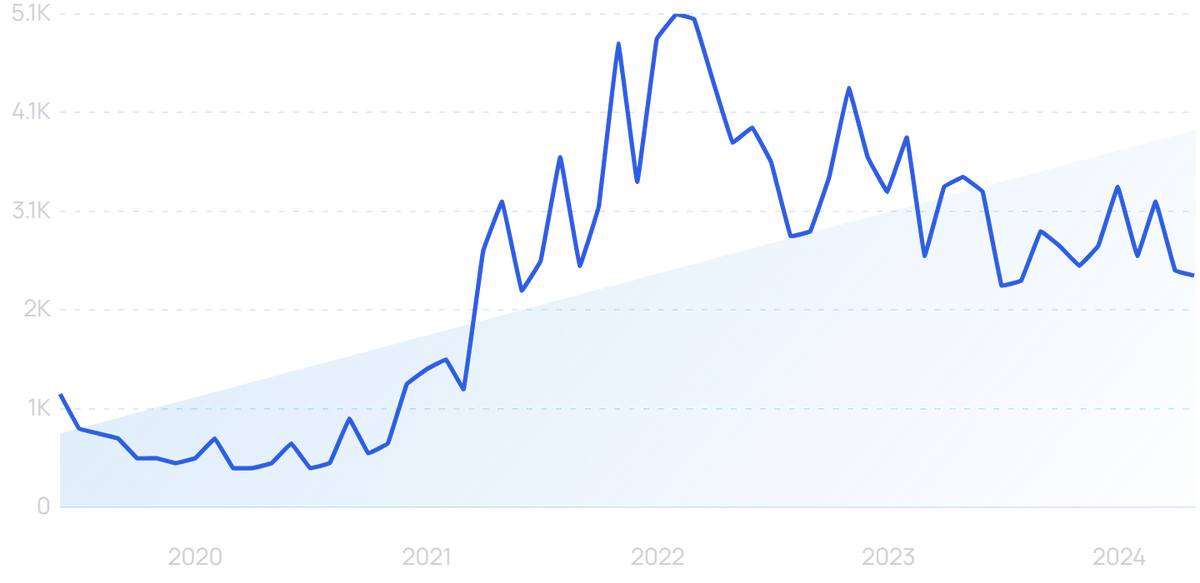

For context, Bitcoin has witnessed a 150% increase in value over the past year, reflecting both speculative trading and institutional interest. As the U.S. and China engage in crucial discussions over tariffs and trade policies, market analysts are keenly focused on how these negotiations could influence investor behavior toward cryptocurrencies.

Investor Sentiment

Investor sentiment appears cautiously optimistic in light of the trade talks. Many market participants view these negotiations as a potential catalyst for renewed interest in cryptocurrencies. The recent liquidation of $758 million in crypto positions underscores the volatility in the market; however, this has not deterred demand for Bitcoin. The underlying strength of Bitcoin, combined with favorable trade prospects, has reignited investor confidence.

A survey conducted by CoinDesk indicated that approximately 70% of cryptocurrency investors are optimistic about the potential for regulatory clarity emerging from the trade discussions. This optimism is further fueled by developments in the U.S. administration, where both policymakers and industry participants are expressing a willingness to engage constructively on cryptocurrency regulation.

The Interconnectedness of Trade and Crypto

The relationship between U.S.-China trade negotiations and cryptocurrency markets highlights a broader theme of interconnectedness in today’s global economy. According to a report by SCMP, the impact of geopolitical tensions on financial markets is profound, and the cryptocurrency sector is no exception. Analysts assert that cryptocurrencies often serve as a hedge against traditional financial systems, particularly during periods of uncertainty.

The ongoing trade talks are anticipated to have ripple effects across various sectors, with cryptocurrencies potentially benefiting from improved investor sentiment. If the U.S. and China can reach an agreement, it could stabilize not only stock markets but also encourage investment in riskier assets like Bitcoin and other cryptocurrencies, as investors seek higher returns.

Conclusion

As the U.S. and China navigate critical trade discussions, the cryptocurrency market stands at a pivotal moment. The potential for significant movements in Bitcoin and other cryptocurrencies is heightened by the evolving geopolitical landscape. Investors are urged to remain vigilant, acknowledging that while opportunities abound, inherent risks persist.

As the trade talks progress, staying informed about market dynamics and utilizing risk management strategies will be crucial for participants in the cryptocurrency space. With Bitcoin positioned at a crucial juncture, its trajectory will be closely monitored by both crypto enthusiasts and traditional investors alike.

Keywords

Bitcoin, cryptocurrency, U.S.-China trade, market dynamics, investor sentiment