The Impact of Climate Change on Agricultural Commodity Prices

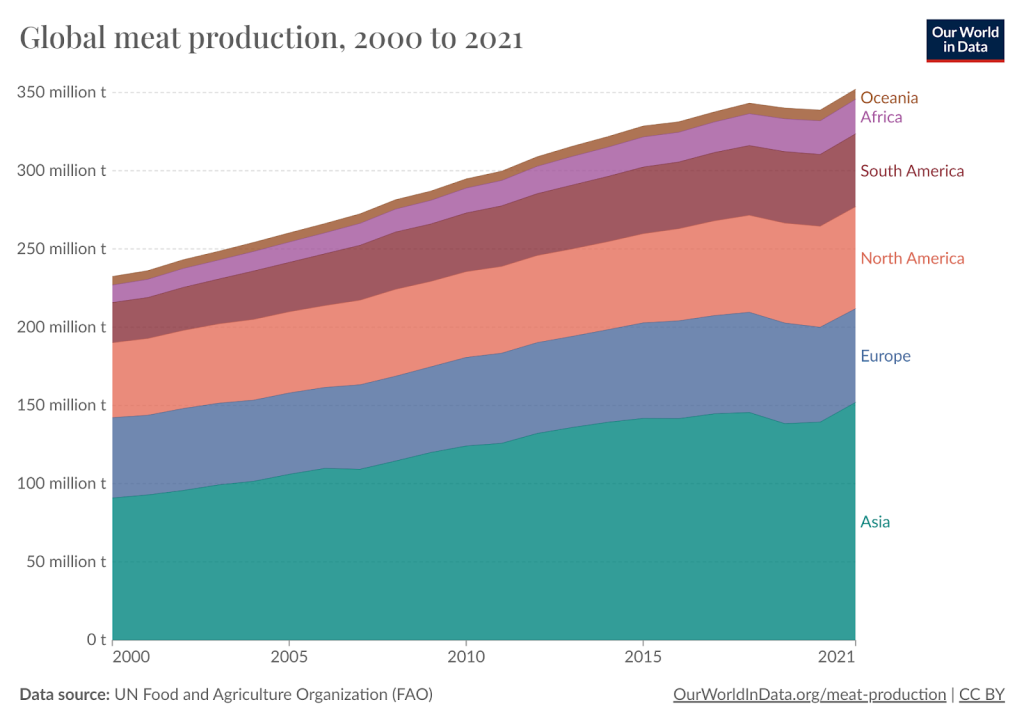

As of May 2025, the agricultural commodity landscape has undergone a significant transformation, with prices for staple crops like wheat and corn experiencing a notable increase. Wheat prices have surged approximately 10%, reaching around $5.80 per bushel. This rise is primarily driven by climate-induced disruptions, including severe weather events that are increasingly affecting crop yields. The U.S. Department of Agriculture (USDA) projects a 10-15% decline in yields for the upcoming season, a forecast that has prompted investors to reassess their strategies in the agricultural sector.

Market Trends

The fluctuations in agricultural commodity prices reflect heightened concerns over food security and supply chain disruptions. The impact of climate change has been palpable, with adverse weather conditions causing significant crop loss and threatening future supply. According to experts, the volatility in prices could lead to increased food inflation, further straining consumers and producers alike.

Investors are increasingly turning to futures contracts as a hedging mechanism against potential losses due to fluctuating prices. This trend underscores the importance of sustainable farming practices and the need for resilience in agricultural production. The evolving climate scenario necessitates a proactive approach from stakeholders looking to safeguard their investments and ensure stable food supply chains.

“Climate change is not just an environmental issue; it is a pressing economic concern that affects agricultural productivity and food prices globally,” said Dr. Sarah Thompson, an agricultural economist at the University of California. “Investors must adapt to these realities and consider the implications of climate variability on their portfolios.”

Investment Strategies

In light of the recent price surges, investors are advised to diversify their portfolios by incorporating agricultural commodities. This strategy can serve as a buffer against traditional market fluctuations and inflationary pressures. Utilizing futures contracts can also help manage risks associated with price volatility, allowing investors to lock in prices and mitigate losses when market conditions worsen.

Sustainable agricultural practices are increasingly recognized as not just beneficial for the environment but also as a pathway to enhanced long-term profitability. These approaches can improve crop resilience against climate impacts, thereby ensuring consistent yields and stable prices over time.

Diversification will be key for investors as they navigate this tumultuous market. By spreading investments across various agricultural commodities, investors can reduce their exposure to any single crop's price volatility. For instance, while corn prices may fluctuate due to weather events, other crops such as soybeans could potentially provide a more stable return.

Conclusion

The current landscape of agricultural commodities is heavily influenced by climate change, necessitating strategic adaptations from investors. As prices rise and the potential for supply chain disruptions looms, staying informed and proactive will be crucial for stakeholders in the agricultural sector.

By implementing diversified investment strategies and embracing sustainable practices, investors can navigate the complexities of this evolving market effectively. “The need for resilience in agriculture has never been more critical,” says Dr. Thompson. “Investors who recognize this reality stand to benefit in the long run.”

For ongoing updates and insights into the agricultural markets, stakeholders can refer to resources such as AgWeb and MarketWatch.