The Resurgence of Tech Stocks: Analyzing the Bull Market Dynamics

In recent weeks, the technology sector has witnessed a remarkable resurgence, with stocks like Nvidia (NVDA) and Tesla (TSLA) leading the charge in a renewed bull market. As of mid-May 2025, the Nasdaq has recorded a six-day winning streak, buoyed by substantial contributions from these tech giants, whose performances underscore a broader rally across the market. This article delves into the factors driving this upswing and the implications for investors navigating this dynamic environment.

Key Drivers of the Rally

1. Easing Trade Tensions

The recent U.S.-China trade agreement has alleviated some of the significant pressures that tech companies faced due to tariffs imposed in prior years. This thawing of relations has boosted investor confidence, particularly in sectors heavily reliant on international trade. According to analysts, reduced trade barriers allow companies like Nvidia and Tesla to operate more efficiently in their supply chains and expand market access, thereby enhancing their growth prospects.

2. Strong Earnings Reports

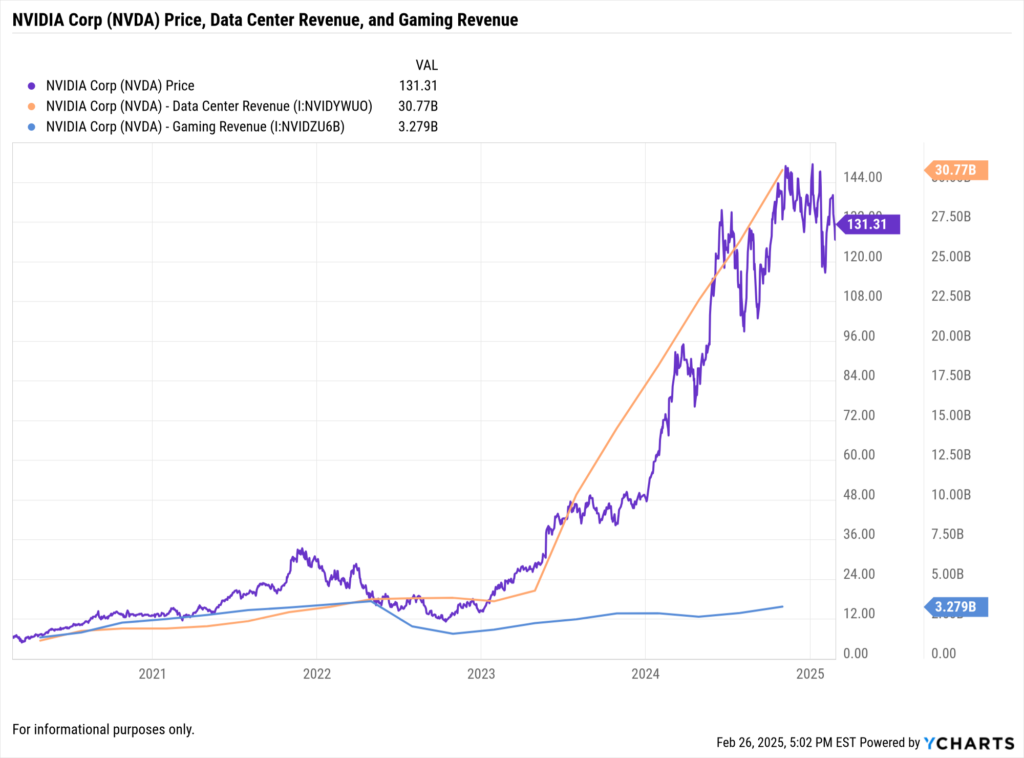

Nvidia's recent earnings report, which exceeded expectations, is a prime example of the company's robust performance. The firm reported a 40% increase in revenue year-over-year, driven by surging demand for its graphics processing units (GPUs) particularly in artificial intelligence (AI) and gaming sectors. With the gaming industry expected to grow significantly, Nvidia's strong position within this space has made it an attractive investment for many. Similarly, Tesla’s continuous innovation in electric vehicles (EVs) and their commitment to battery technology have contributed to a bullish outlook, further lifting investor sentiment.

3. Market Sentiment

The general shift in market sentiment towards optimism about economic recovery has also played a crucial role. Recent data indicate that consumer spending has been resilient, despite concerns over inflation, with retail sales rising by 1.2% in April 2025. Analysts emphasize that when consumer spending is strong, it typically translates into increased revenues for tech firms, which are often viewed as bellwethers for economic health.

Implications for Investors

As the tech sector continues to climb, investors are advised to consider several strategies to navigate this bullish landscape effectively:

-

Diversification: While tech stocks have shown strong performance, diversifying into other sectors can mitigate risks associated with market volatility. For instance, sectors like healthcare and renewable energy are also witnessing growth and could provide balance to a tech-heavy portfolio.

-

Monitoring Economic Indicators: Keeping a close eye on economic indicators such as inflation rates, unemployment figures, and consumer confidence will be crucial in assessing the sustainability of this rally. A sudden uptick in inflation or a downturn in consumer sentiment could influence market dynamics drastically.

-

Long-term Perspective: Given the cyclical nature of markets, maintaining a long-term investment horizon is advisable. Historical data suggests that tech stocks often experience short-term volatility but can provide significant returns over extended periods. Investors are encouraged to focus on fundamentals rather than react to short-term market fluctuations.

Challenges Ahead

Despite the positive momentum, challenges loom on the horizon. The recent rally may face headwinds if inflation continues to rise, leading to tighter monetary policies from the Federal Reserve. Rising interest rates could dampen investment in growth stocks like Nvidia and Tesla, which are typically valued based on future earnings potential. Furthermore, geopolitical tensions, particularly regarding the U.S.-China relationship, remain a concern. Continued negotiations could introduce volatility back into the markets, impacting investor confidence.

Additionally, segment-specific challenges must be considered. For example, Tesla faces increasing competition from traditional automakers entering the EV market, as well as potential regulatory hurdles that could affect production costs and market access.

Conclusion

The current dynamics in the tech sector present both opportunities and challenges for investors. By understanding the underlying factors driving this bull market, including easing trade tensions, robust corporate earnings, and positive market sentiment, investors can make informed decisions to capitalize on ongoing trends. However, maintaining a watchful eye on economic indicators and potential market disruptions will be critical to sustaining performance.

Investors who embrace diversification and adopt a long-term perspective are likely to navigate this volatile but promising landscape successfully. As always, the key to capitalizing on market dynamics lies in careful analysis and proactive strategy adjustments.

For further insights and ongoing updates on the stock market, you can view detailed reports on platforms like Business Insider and Yahoo Finance.