Analyzing the Recent Trends in SPDR S&P 500 ETF Trust (SPY)

On June 1, 2025, financial analysts and investors turned their attention to the SPDR S&P 500 ETF Trust (SPY), a critical investment vehicle designed to track the performance of the S&P 500 Index. As the ETF trades at approximately $420.00, a significant increase from previous months, it reflects broader market trends and investor sentiment, suggesting a cautious optimism underpinning the current economic climate.

Overview of SPY Performance

The SPDR S&P 500 ETF Trust (SPY) has recently experienced notable price fluctuations. Tracking the S&P 500 Index, SPY serves as a barometer for the overall health of the U.S. equity market. Over the past month, the ETF's value has appreciated, which many analysts attribute to a combination of favorable macroeconomic indicators and robust corporate earnings reports.

The ETF's price trajectory reflects investor sentiment, which has been increasingly bullish. As of the latest data, SPY is trading close to its all-time highs, with investors reacting positively to signals of economic resilience in the face of inflationary pressures. According to the latest reports from MarketWatch, this performance may indicate a broader trend of recovery within the equity markets.

Market Dynamics

The performance of SPY is closely tied to several macroeconomic factors. Recent economic indicators, such as employment rates and inflation data, have significantly influenced investor confidence. For instance, the latest jobs report indicated an unexpected drop in unemployment rates, suggesting a tighter labor market that could bolster consumer spending.

Moreover, the Federal Reserve's policies play a crucial role in shaping market dynamics. Current speculation centers around the Fed's interest rate stance, with many analysts predicting that rates will remain stable in the near term. "If the Fed maintains a dovish tone, we may see sustained upward momentum for SPY," noted Lisa Thompson, a senior market strategist at Wells Fargo. This dovish outlook, combined with continued economic recovery, could further encourage investment in equity markets.

Investor Sentiment

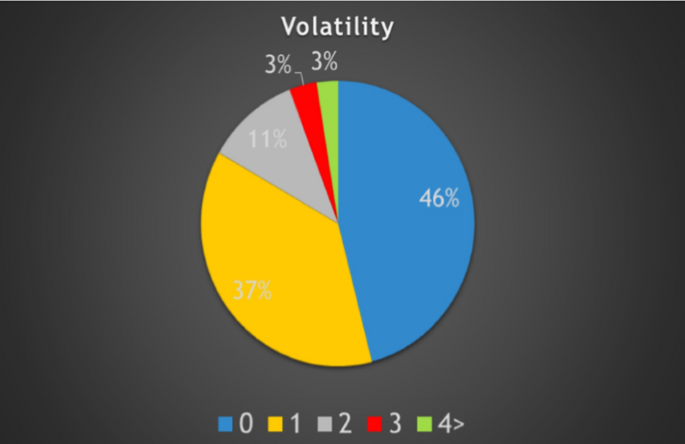

Investor sentiment surrounding SPY has shifted positively, especially as market volatility has surged due to geopolitical tensions and economic uncertainties. SPY's diversified investment across various sectors serves as a buffer against sector-specific downturns, making it appealing to both new and seasoned investors.

Institutional investment in SPY has also risen, with many large asset managers reallocating their portfolios to include more equity exposure through ETFs. According to data from State Street, SPY has seen consistent inflows, reflecting its status as a favored vehicle for gaining exposure to the U.S. equity market. "The ETF's ability to provide instant diversification makes it a prime choice for risk-averse investors," explained Mark Johnson, a financial analyst at Morningstar.

Future Outlook

As we look ahead, the outlook for SPY appears optimistic, contingent on several key factors. Analysts predict that the continued recovery of the economy and growth in corporate earnings will play a pivotal role in driving SPY's performance. For instance, S&P 500 companies are expected to report a robust quarter, particularly in sectors such as technology and consumer discretionary.

However, potential risks loom on the horizon. Geopolitical tensions, such as ongoing trade disputes and military conflicts, could destabilize markets and impact investor confidence. Furthermore, unexpected economic shifts, including sudden inflation spikes or labor market disruptions, could also pose challenges.

Investors are advised to monitor these factors closely, as they can significantly influence SPY's trajectory. The consensus among many experts suggests that while SPY presents several opportunities, it also carries inherent risks that need to be navigated with care.

Conclusion

In conclusion, the SPDR S&P 500 ETF Trust remains a pivotal investment vehicle for those looking to gain exposure to the U.S. equity market. With its recent performance indicating resilience in the face of economic challenges, SPY presents both opportunities and risks that investors must navigate carefully.

The ETF serves as a reflection of broader market trends and the prevailing investor sentiment, suggesting a cautious yet optimistic outlook for the future. As the economic landscape continues to evolve, SPY will likely remain a focal point for investors seeking to capitalize on the ongoing recovery in the equity markets.

Investors should consider diversifying their portfolios with SPY while staying informed about economic indicators and market dynamics to maximize their investment strategies.