Market Volatility: Analyzing the Impact of U.S.-China Trade Tensions on Forex

In recent weeks, the forex market has experienced significant volatility, largely attributed to the resurgence of trade tensions between the United States and China. These geopolitical developments have sent ripples across global financial markets, influencing currency valuations and shaping investor sentiment. As we delve deeper into this situation, we will focus particularly on the USD/CNY and USD/JPY currency pairs, examining how these tensions have impacted their performances.

U.S.-China Trade Relations

The trade relationship between the U.S. and China has long been a focal point for global markets. Recent statements from key officials have soured sentiment, leading to increased uncertainty among investors. As of late May 2025, the U.S. dollar showed signs of stabilization, despite weak economic data, buoyed by hopes of easing trade tensions. The U.S. dollar index (DXY) was observed hovering around 104.50, indicating slight strength against a basket of currencies, while market participants kept a keen eye on potential announcements regarding tariffs and changing trade policies.

According to Economic Times, the dollar experienced a volatile week, initially buoyed by the U.S.-China trade truce but later tempered by uncertainties surrounding trade deals. Analysts point out that the anticipation surrounding President Biden’s upcoming tariff announcements could sway the dollar's trajectory, which is now closely linked to broader geopolitical narratives.

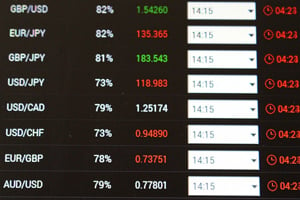

Currency Pair Analysis

-

USD/CNY: The Chinese yuan has been under pressure as the U.S. dollar strengthens amidst trade uncertainties. The USD/CNY pair saw fluctuations, with the yuan trading at approximately 7.15 against the dollar. Experts argue that the yuan's depreciation could lead to further interventions by the People's Bank of China (PBOC) to stabilize its currency. This intervention might manifest through direct market actions or adjustments in interest rates.

Recent statements from the PBOC suggest a readiness to act if the yuan’s depreciation continues. As noted in Action Forex, “Trade chaos is likely to linger, and June is expected to bring more uncertainty,” which indicates that traders might have to brace for further volatility in the USD/CNY pair.

-

USD/JPY: The Japanese yen has also reacted to these tensions, with fluctuations influenced by the Bank of Japan's (BoJ) monetary policy decisions. The yen was trading at about 135.20 against the dollar, reflecting its sensitivity to global risk sentiment. Investors are closely monitoring upcoming economic indicators that may affect the yen's performance, notably the BoJ's interest rate decisions and Japan's GDP growth figures.

As noted by analysts, “The BoJ’s current stance is to keep monetary policy loose, which could further weaken the yen if U.S. economic data shows signs of recovery.” The relationship between the dollar and yen underscores the impact of domestic economic policies on forex dynamics.

Investor Sentiment and Market Outlook

Investor sentiment remains cautious amid these geopolitical events, with many looking for clarity on trade agreements. The upcoming U.S. jobs data and the Bank of Japan's meeting are critical events that could influence market dynamics. A solid jobs report could bolster the dollar, while any hints of hawkishness from the BoJ could strengthen the yen.

The consensus among market experts is that traders should prepare for continued volatility as developments unfold. According to analysts from Capital Street FX, “The forex market is a massive $7.5 trillion beast that reacts sharply to news. Given the current state of U.S.-China relations, we are in for a bumpy ride.”

Conclusion

The forex market's reaction to geopolitical events underscores the interconnectedness of global economies. As the U.S.-China trade narrative evolves, investors must remain vigilant and adaptable to navigate the complexities of currency trading in this uncertain environment. The dynamics between the USD/CNY and USD/JPY pairs encapsulate the broader implications of trade tensions on currency valuations.

As market participants seek to make informed decisions, staying updated on trade developments and economic indicators will be crucial in managing risks and seizing opportunities in the forex landscape.

In summary, as tensions between the U.S. and China continue to influence the forex market, traders must balance their strategies with geopolitical awareness. The upcoming weeks will likely be critical in determining the direction of currencies, reinforcing the need for a proactive approach in today’s fast-paced market environment.

For more insights on forex trends, investors and traders can monitor resources from Action Forex and Economic Times to stay updated on the latest market developments.

Understanding these complex interrelations will equip investors with the knowledge needed for informed trading decisions amidst market volatility.