Maximizing Returns in the Secondary Bond Market: Strategies for Investors

The secondary bond market has increasingly become a focal point for investors seeking to enhance liquidity and yield in a volatile economic landscape. As interest rates appear to stabilize, the trading of existing bonds presents a myriad of opportunities for savvy investors eager to capitalize on market dynamics. This article delves into the current state of the secondary bond market and unveils strategic insights for maximizing returns.

Current Market Overview

As of June 2025, the U.S. 30-year Treasury bond is yielding approximately 4.9%, while the 10-year note hovers around 4.4%. This stability stands in stark contrast to previous years, when erratic Federal Reserve interest rate policies have led to significant volatility in bond prices. Investors now confront a dual challenge: navigating the ongoing inflation concerns and adjusting to fiscal policy changes that directly impact bond performance.

Key Economic Indicators

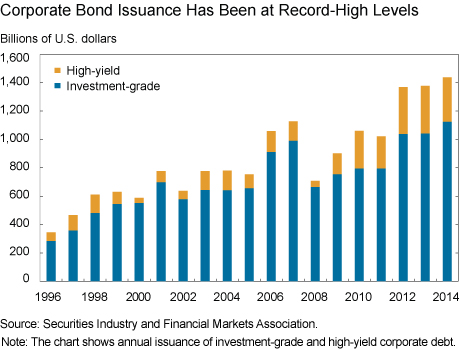

According to the latest data, while inflation remains a critical issue, there are signs of easing within various sectors. The Federal Reserve's latest decisions have created a less aggressive tightening stance, which could potentially boost bond market confidence. Nevertheless, the risk of new bond issuances with higher yields remains a persistent concern for existing bondholders, as these can lead to capital depreciation in older bonds.

Secondary Bond Market Dynamics

The secondary bond market facilitates the buying and selling of previously issued bonds, thus providing liquidity and price discovery. This market is vital for investors who may need to liquidate positions before bond maturity. It allows for strategic rebalancing of portfolios based on changing market conditions.

Key Strategies for Investors

As investors look to navigate this complex landscape, several strategies can be employed to enhance return potential:

1. Focus on High-Quality Bonds

Investing in high-quality bonds, such as those issued by the U.S. government or corporate entities with strong credit ratings, can provide relative stability. These bonds typically perform better during economic downturns, as they are perceived to carry less risk compared to equities. According to a report from Grip Invest, high-quality bonds are less likely to experience significant price drops and offer predictable returns.

2. Utilize Bond Trading Platforms

Platforms like Grip Invest enable real-time trading of bonds, allowing investors to monitor and compare current prices. This immediate access to market data enhances liquidity and empowers investors to make prompt decisions. With tools that simplify yield calculations and provide comprehensive bond comparisons, these platforms are invaluable for informed investing.

3. Diversification Across Bond Types

To mitigate risks associated with interest rate fluctuations, investors should consider a diversified bond portfolio. By combining bonds with varying maturities and credit ratings, investors can stabilize their returns. For example, while long-term bonds may offer higher yields, short-term bonds can reduce interest rate risk during periods of volatility.

4. Monitor Yield Trends

Awareness of yield trends is crucial. As newer bonds emerge with potentially higher yields, existing bonds may lose market value. Investors should proactively adjust their portfolios to maintain competitive yields. Monitoring changes in the bond yield curve can help predict shifts in interest rates and resultant price changes.

Conclusion

The secondary bond market offers a dynamic environment rife with opportunities for investors eager to enhance their portfolios. By prioritizing high-quality bonds, leveraging trading platforms, diversifying investments, and vigilant monitoring of yield trends, investors can effectively navigate the complexities of the bond market.

As economic conditions evolve and the Federal Reserve continues to adjust its policies, staying informed and adaptable will be key to maximizing returns. The strategies outlined here will empower investors to take advantage of existing market conditions, ensuring they can respond swiftly to changing circumstances.

Keywords

- Secondary Market

- Bond Trading

- Yield

- Investment Strategies

- Liquidity