Navigating the Crude Oil Market: Impacts of OPEC+ Supply Decisions

As the crude oil market braces for the upcoming OPEC+ meeting, investors are keenly observing the potential implications of supply adjustments on global oil prices. On June 2, 2025, crude oil futures were trading at ₹5,363 on the Multi Commodity Exchange (MCX), reflecting the market's heightened sensitivity to supply dynamics amidst geopolitical tensions and fluctuating economic indicators. This article delves into the current market conditions, price movements, and strategic considerations for investors as they navigate this complex landscape.

Overview of Current Market Conditions

The crude oil market is currently experiencing volatility fueled by speculation surrounding OPEC+'s decisions regarding production levels. The anticipation of a significant output increase by 411,000 barrels per day has led to a cautious market sentiment. Analysts from ING Think indicate that this move is intended to defend market share in light of increasing global demand. With broader production quotas ratified through the end of 2026, OPEC+ appears committed to maintaining market stability despite external pressures.

OPEC+ Meeting Insights

The next OPEC+ meeting is pivotal. Analysts predict that the organization will agree to raise output to address rising consumer demand while simultaneously seeking to protect its market share from non-OPEC producers. This anticipated output increase is viewed as a proactive response to the recovering global economy, especially in the post-pandemic landscape.

Price Movements and Influencing Factors

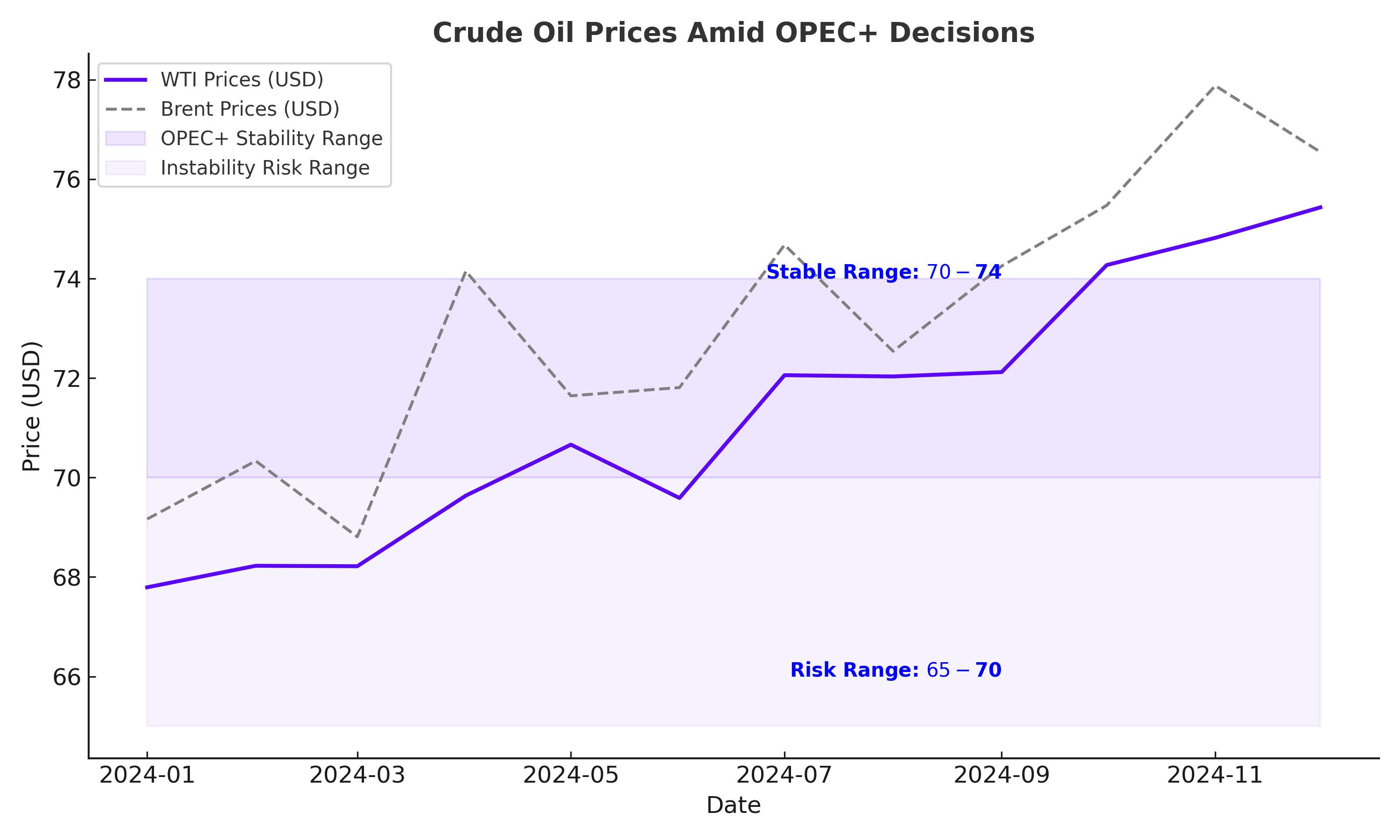

As of the latest trading session, Brent crude futures are quoted at $63.04, down by 0.49%, while West Texas Intermediate (WTI) futures are trading at $60.65, reflecting a decline of 0.48%. These dips in price can be attributed to multiple factors, including geopolitical uncertainties stemming from the ongoing conflict in Ukraine. The potential for additional sanctions against Russia poses further risks, impacting energy flows and adding layers of complexity to price stabilization efforts.

Market sentiment is further challenged by fluctuations in U.S. trade policies. Recent court rulings concerning tariffs imposed by the previous administration have created an environment of uncertainty, contributing to the downward pressure on crude oil prices.

Strategic Considerations for Investors

In light of the current market dynamics, investors are advised to consider the following strategic approaches:

-

Monitor OPEC+ Announcements: Close attention to the outcomes of OPEC+ discussions is critical, as supply decisions can lead to significant price adjustments. Investors should prepare for potential volatility around these announcements.

-

Geopolitical Awareness: Understanding the geopolitical landscape, particularly related to sanctions and conflicts that may disrupt oil supplies, is essential. Investors should stay informed about developments in regions that are major oil producers.

-

Diversification: Given the inherent volatility in the crude oil market, diversifying investments across various commodities can serve as a risk mitigation strategy. This approach allows investors to balance their exposure and potentially capitalize on movements in different sectors.

-

Technical Analysis: Employing technical analysis tools can help investors identify price trends and potential entry points for trading. Analyzing historical price movements can enhance decision-making in such a fluctuating market.

Conclusion

The crude oil market stands at a critical juncture, with OPEC+ decisions poised to exert significant influence over global prices. As the organization prepares to meet and potentially adjust supply levels, investors are advised to remain agile and informed. The interplay of geopolitical events, economic indicators, and strategic supply management will shape the outlook for crude oil prices in the coming months. By adopting a proactive and well-researched investment strategy, market participants can navigate the complexities of this dynamic environment effectively.

For those seeking further insights, relevant articles include Crude oil futures fall as market anticipates OPEC+ supply increase and Crude oil futures decline amid uncertainty over US trade tariff rulings.

By maintaining awareness of these key market factors, investors can better position themselves to capitalize on opportunities while mitigating risks in the crude oil sector.