Bitcoin's Resurgence: Analyzing the Recent Price Movements and Market Sentiment

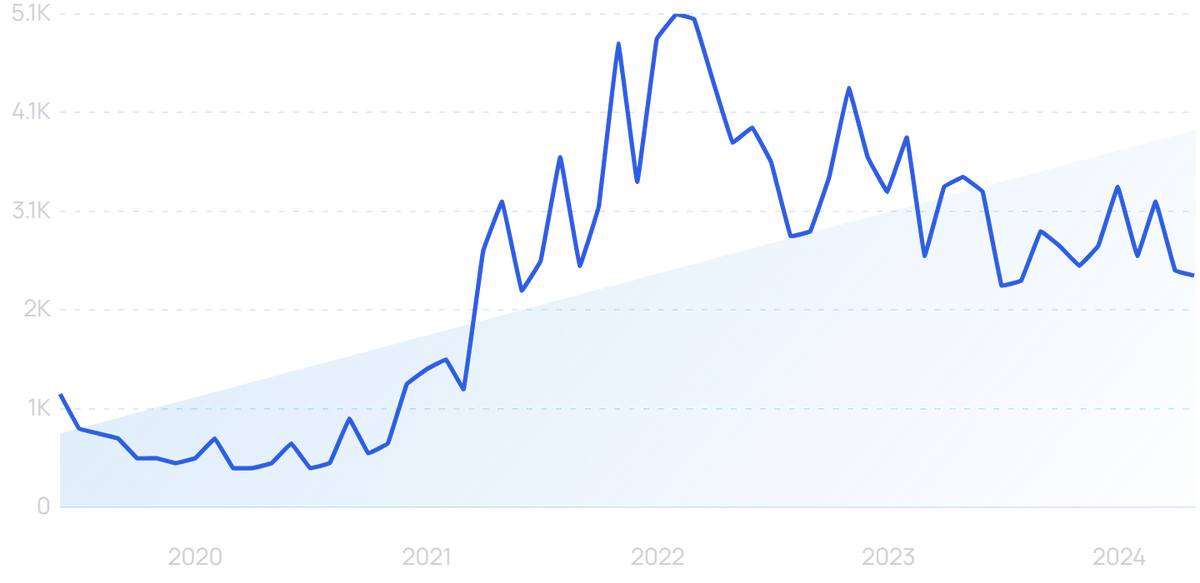

Bitcoin, the leading cryptocurrency, has made headlines recently by breaking through the $110,000 mark after languishing below $74,000 for nearly three years. This significant price movement can be attributed to a classic technical pattern known as the cup and handle, which typically indicates bullish momentum. However, the market's current volatility raises questions about the sustainability of this rapid ascent.

Price Movements

After reaching a peak of $110,000, Bitcoin faced a pullback, trading at approximately $106,000 as of early June 2025. This retracement has sparked uncertainty among investors, prompting many to reassess their strategies in light of recent market dynamics. The cryptocurrency's bounce back from strong support at $74,000 indicates persistent bullish sentiment among traders. This level has become a psychological barrier, suggesting that many investors view it as a buying opportunity, even in the face of price fluctuations.

Data from recent trading sessions shows that Bitcoin's market cap remains robust, accounting for about 63% of the total cryptocurrency market. Such dominance emphasizes Bitcoin's position as a bellwether within the digital asset ecosystem. However, analysts caution that while the price movements may signal a renewed interest in the asset, the potential for further corrections looms large as the market digests these changes.

Market Sentiment

The current market sentiment is characterized by cautious optimism. With the recent price surge, many investors express renewed hope for Bitcoin's long-term potential. According to Andrew Smith, a market analyst at CoinDesk, "The cup and handle breakout pattern typically signifies that the asset is poised for significant upward movement. However, the volatility inherent in cryptocurrency markets necessitates a careful approach."

This view is supported by various analysts who suggest that while the recent surge is promising, it is essential for investors to monitor key support levels and consider potential exit strategies to mitigate risks associated with sudden price corrections. The interplay between bullish sentiment and market volatility creates a landscape where both opportunities and risks coexist.

Technical Analysis

From a technical standpoint, the cup and handle pattern has historically predicted bullish price movements. This pattern is characterized by a rounded bottom followed by a consolidation phase (the handle) before breaking out to a new high. The breakout above $104,000 was a critical point for Bitcoin, suggesting that the asset could see further gains if positive sentiment persists.

Despite the bullish indicators, the market is not immune to external factors. Geopolitical tensions and regulatory concerns continue to cast shadows over the cryptocurrency market. For example, recent discussions around potential regulations in various jurisdictions could impact investor sentiment and market dynamics significantly.

Conclusion

As Bitcoin continues to navigate through this volatile landscape, understanding market dynamics and technical indicators will be crucial for investors looking to capitalize on potential opportunities. The classic cup and handle breakout serves as a reminder of the unpredictable nature of the cryptocurrency market, where both significant gains and losses can occur rapidly.

Investors are advised to remain vigilant, keeping an eye on key support levels and market news. The interplay between market sentiment, investor behavior, and external factors will ultimately shape Bitcoin's trajectory in the coming months. For those looking to invest, adopting a diversified approach and maintaining a risk management strategy may prove beneficial as the landscape evolves.

For further insights into Bitcoin's price movements and market dynamics, visit TradingView.