Current Trends in the Forex Market: A Focus on Major Currency Movements

As of June 4, 2025, the Forex market is witnessing notable fluctuations influenced by a mix of geopolitical tensions and recent economic data releases. The U.S. dollar has shown a mixed performance against major currencies, reflecting the market's cautious sentiment amidst ongoing trade negotiations and economic indicators.

Key Currency Movements

EUR/USD

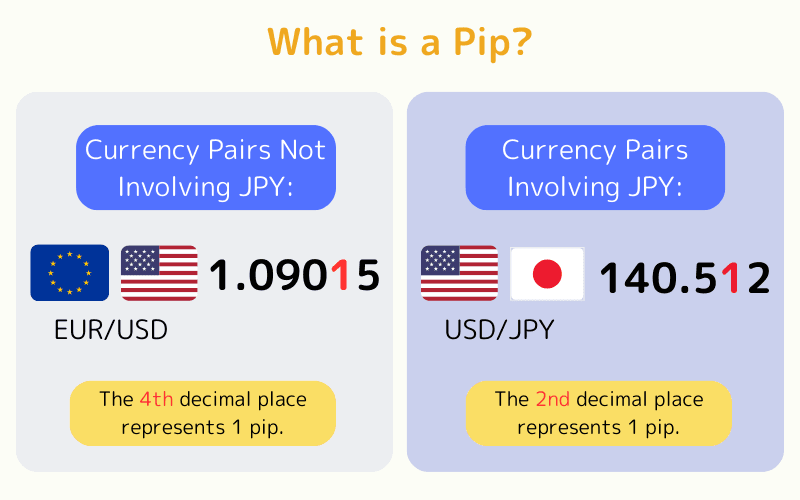

The euro has slightly strengthened against the dollar, moving up to touch 1.1400 before retracting to around 1.1380, indicating a modest gain of 0.1% on the day. This movement reflects traders' anticipation of upcoming economic data from the U.S. that could influence Federal Reserve policy. The economic backdrop for the Eurozone is showing resilience, with recent indicators suggesting a gradual recovery, which has bolstered demand for the euro.

USD/JPY

In the USD/JPY pair, after a brief dip to 143.80, the dollar rebounded to 144.20, showcasing a push-and-pull dynamic as traders weigh the implications of Japan's economic policies and U.S. interest rate expectations. The Bank of Japan's recent monetary policy stance continues to play a crucial role in influencing the yen, especially as the market anticipates any signals of policy adjustments in light of Japan's inflation trends.

Economic Data Impact

Recent data releases, particularly concerning U.S. inflation and consumer spending, have created a backdrop of uncertainty. The Personal Consumption Expenditures (PCE) index, a key inflation measure, has shown signs of easing, prompting speculation about a potential dovish shift in Federal Reserve policy. This has led to fluctuations in the dollar's value as traders reassess their positions in light of changing inflation expectations. According to the latest figures, the PCE index recorded a year-over-year increase of 3.2%, down from previous readings, indicating that inflationary pressures may be stabilizing.

Geopolitical Tensions

Ongoing U.S.-China trade tensions continue to loom over the Forex market, affecting currency valuations and trader sentiment. The dollar's performance is closely linked to developments in these negotiations, as any signs of resolution could bolster the dollar against its peers. Market analysts are particularly focused on upcoming discussions between U.S. and Chinese officials, which could either ease tensions or exacerbate them, impacting global trade dynamics.

The latest commentary from investment banks indicates that traders are adopting a cautious approach, with some urging clients to hedge their positions against potential volatility stemming from geopolitical developments. According to a ForexLive report, the current environment is characterized by low trading volumes and a wait-and-see attitude as participants assess the impact of these broader economic and political factors.

Conclusion

As the Forex market navigates these complexities, traders are advised to remain vigilant and adaptable. Monitoring economic indicators—especially inflation data—and geopolitical developments will be crucial for making informed trading decisions in this dynamic environment. The interplay between currency movements, economic data, and geopolitical events underscores the intricate nature of Forex trading, necessitating astute analysis and strategic positioning.

Investors are encouraged to stay abreast of these developments to effectively navigate the fluctuations of major currency pairs, particularly the USD, EUR, and JPY.

For further insights and updates, you can refer to the detailed reports on ForexLive and Investing.com.