Navigating Forex Volatility: Insights from Recent U.S. Economic Data

The Forex market is currently in a state of flux, influenced heavily by recent economic indicators released from the United States. On June 4, 2025, traders observed a noticeable decline in the U.S. dollar's value following disappointing ADP employment figures and a surprising contraction in the ISM manufacturing index. These unsettling developments have prompted Forex participants to reevaluate their trading positions, leading to mixed performance outcomes for the dollar against major currencies.

Key Economic Indicators Impacting Forex

The recent employment and manufacturing data has created a ripple effect throughout the Forex market.

-

ADP Employment Change: The latest report revealed a mere increase of 150,000 jobs in May, significantly below expectations which had predicted a rise of 250,000 jobs. This shortfall not only suggests a slowdown in hiring but also raises concerns about the overall health of the labor market.

-

ISM Manufacturing Index: The index dropped to 48.5, indicating a contraction in the manufacturing sector. Historically, this index serves as a key bellwether for economic performance, and its decline further underscores apprehension regarding economic growth.

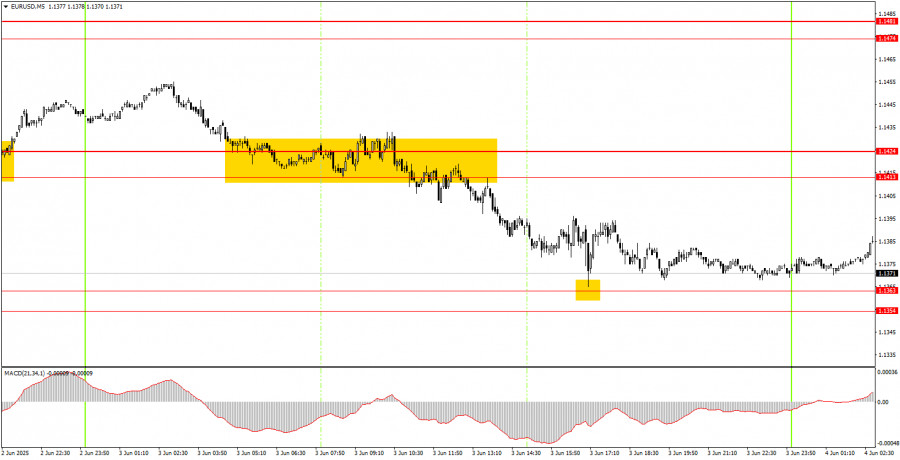

As a result of these disappointing figures, the dollar weakened against the euro and yen. The EUR/USD pair surged, briefly touching 1.1400 before settling around 1.1380, illustrating a critical swing in market dynamics. Conversely, the USD/JPY saw a short dip to 143.80 before rebounding to 144.20. This volatility highlights the importance for traders to closely monitor economic indicators and adjust their strategies accordingly.

Strategic Considerations for Traders

As volatility persists in the Forex market, traders are advised to adopt a vigilant stance. Key strategies include:

-

Diversification of Currency Holdings: Given the potential for further declines in the dollar, a diversified portfolio can help mitigate risks. This approach allows traders to cushion their investments against currency-specific downturns.

-

Monitoring Economic Reports: Staying informed about upcoming economic reports and central bank announcements is crucial. For instance, any signaling from the Federal Reserve regarding interest rate hikes or adjustments can significantly impact the dollar's trajectory.

-

Technical Analysis: Employing technical analysis can provide insights into potential entry and exit points. Traders should be aware of resistance and support levels that could influence currency movements.

-

Risk Management: Implementing robust risk management strategies is essential to protect capital in a volatile market. Setting stop-loss orders and maintaining a disciplined approach can help traders navigate unexpected market shifts.

Conclusion

The current economic climate necessitates a proactive approach to Forex trading, with an emphasis on data-driven decision-making and risk management strategies. As the market continues to react to economic indicators, traders must remain adaptable, leveraging insights gleaned from the latest data to capitalize on market movements.

For further insights on the current Forex landscape, please refer to these sources:

- ForexLive Americas FX news wrap: US dollar falls after soft ADP and ISM data

- ForexLive European FX news wrap: Light changes as markets wait on trade developments

In this turbulent environment, maintaining flexibility and informed strategies will be key to successfully navigating the complexities of the Forex market as we move further into 2025.