:max_bytes(150000):strip_icc()/5KeyInvestmentStrategiestoLearnBeforeTrading_final-9d7b3680b134437996eb36592186314f.png)

Navigating Market Volatility: Strategies for Investors in 2025

In 2025, the stock market has encountered significant volatility, prompting investors to reassess their strategies. With mixed performance across various sectors and ongoing economic uncertainties, understanding how to navigate this landscape is crucial for maintaining and growing investments.

Current Market Overview

As of early June 2025, the U.S. equity markets have shown signs of instability. The Dow Jones Industrial Average and the S&P 500 have reflected mixed results, with investors facing a complex array of challenges. Geopolitical tensions, inflation concerns, and shifting monetary policies have all contributed to the current volatility.

Recent developments, such as the substantial fluctuations in stock prices and mixed signals from economic data, have left investors on edge. For instance, the ongoing discussions surrounding U.S. tariffs and trade negotiations with countries like China have added layers of uncertainty, impacting market sentiment significantly. According to a CNBC report, stock futures were near flat as traders awaited new data, highlighting the cautious nature of the current market environment.

Key Strategies for Investors

To successfully navigate these turbulent waters, investors should consider several actionable strategies to manage risk and optimize portfolio performance.

1. Diversification

Investors are encouraged to diversify their portfolios across different asset classes, including equities, bonds, and alternative investments. This approach can help mitigate risks associated with market downturns. As noted by BlackRock, diversification is vital in periods of market volatility to cushion the impact when certain assets decline in value.

2. Focus on Quality Stocks

In times of uncertainty, investing in high-quality stocks with strong fundamentals can provide a buffer against volatility. Companies with solid balance sheets and consistent earnings are more likely to weather economic storms. According to market analysts, sectors such as technology and consumer staples are currently viewed as safer bets amidst the unpredictable landscape.

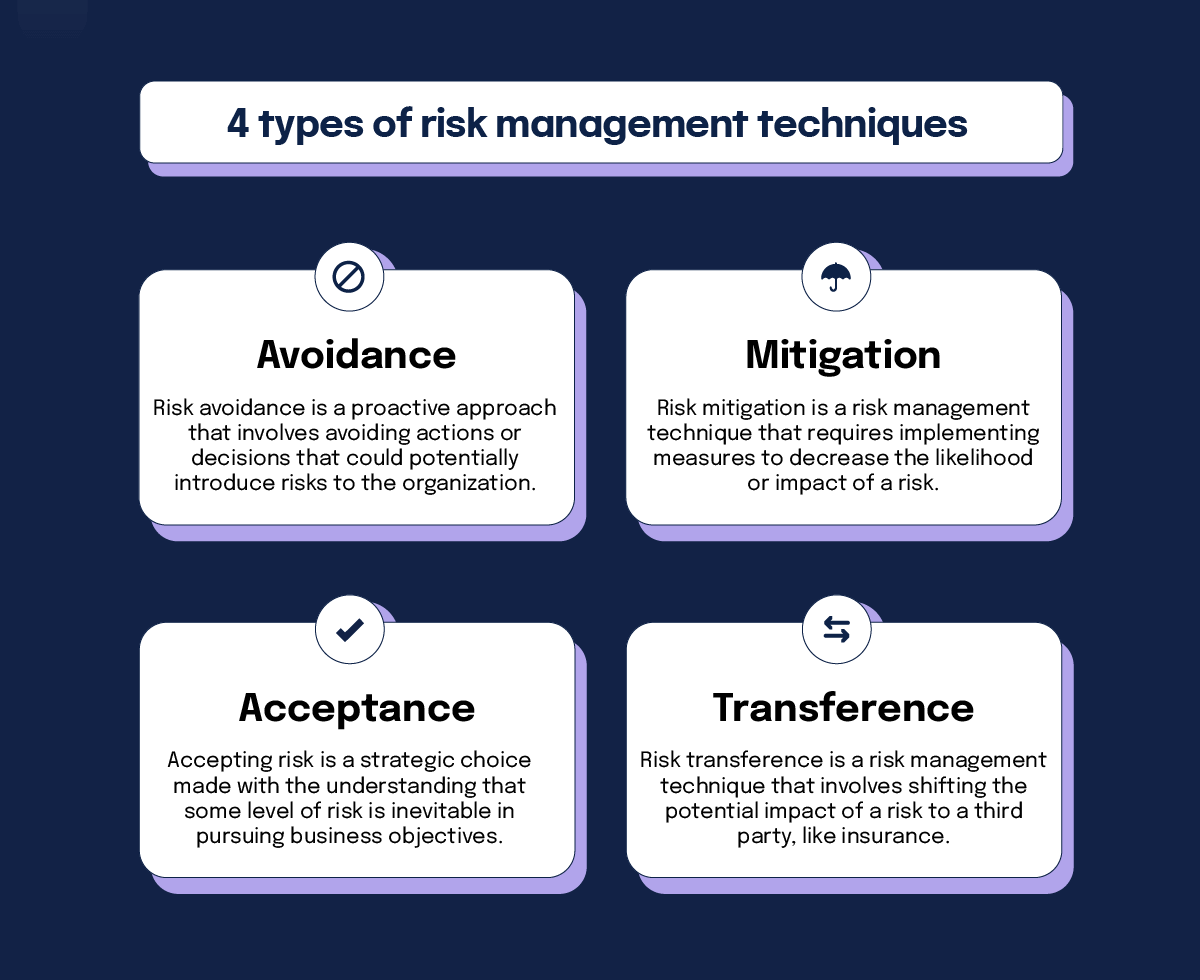

3. Utilize Risk Management Tools

Implementing risk management strategies, such as stop-loss orders and options trading, can help protect investments from significant losses during market downturns. Tools that allow for hedging against market fluctuations can be invaluable for investors looking to preserve capital.

4. Stay Informed

Keeping abreast of market trends, economic indicators, and geopolitical developments is essential for making informed investment decisions. Regularly reviewing financial news and analysis can provide valuable insights. For instance, the Wall Street Journal recently highlighted how external factors like political instability can lead to rapid market changes, underscoring the importance of vigilance.

5. Long-Term Perspective

While short-term volatility can be unsettling, maintaining a long-term investment perspective remains vital. Historically, markets have rebounded from downturns, and staying invested can lead to significant gains over time. An analysis of historical market data shows that after major downturns, stocks often recover within several months, making patience a valuable asset for investors.

Conclusion

The current market environment in 2025 presents both challenges and opportunities for investors. By employing diversified strategies, focusing on quality investments, and utilizing risk management tools, investors can navigate the complexities of the market effectively. Staying informed and maintaining a long-term perspective will be key to achieving investment success in these turbulent times.

As investors consider their next steps, they should remain adaptable and proactive, leveraging insights from financial experts and staying attuned to the evolving market dynamics. By doing so, they can position themselves for potential growth, even amidst significant volatility.

For more insights on market trends and strategies, visit BlackRock or check live updates on CNBC.