Emerging Market Debt: A $331 Billion Surge Amid Rising Yields

Emerging market debt (EMD) is experiencing a significant resurgence in 2025, with approximately $331 billion in hard currency bonds issued so far this year. This remarkable growth is largely driven by the allure of attractive yields and the pressing capital needs of emerging economies. Amidst global economic uncertainties, investors are increasingly turning their attention to these markets, seeking higher returns than those available in developed economies.

Overview of Emerging Market Debt

The EMD market has not only recovered from previous volatility but is also flourishing, reflecting renewed investor confidence. A recent Bloomberg gauge indicates that total returns on emerging market debt have risen by 3.5%, showcasing the attractiveness of these investments. This surge in issuance represents a strategic move by governments and corporations in emerging economies to tap into international capital markets to fund critical infrastructure and development projects.

Key Drivers of Growth

-

Attractive Yields

Emerging markets are currently offering yields that surpass those in developed economies. For investors chasing higher returns, these opportunities have become increasingly appealing, especially as interest rates remain low in many developed countries. -

Capital Needs

Many emerging economies are grappling with substantial capital needs, prompting an uptick in bond issuance. Infrastructure projects, which are essential for long-term economic growth, require significant funding. Governments and corporations are leveraging the bond markets to secure the necessary capital. -

Market Recovery

Following a period of uncertainty, the EMD market is showing signs of recovery. The recent performance metrics suggest that investor sentiment is shifting back toward riskier assets, driven in part by diminishing fears of harsh economic levies and geopolitical tensions.

Investment Considerations

While the prospects of higher yields are enticing, potential investors should remain cautious. Here are some essential considerations:

-

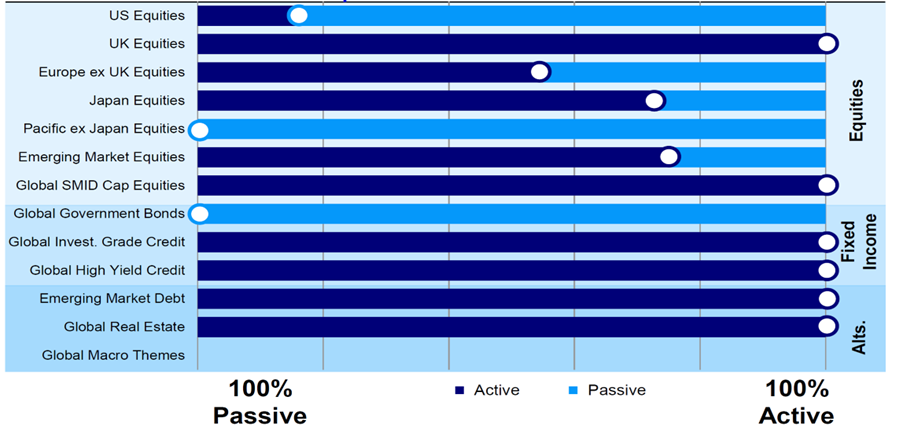

Diversification

Incorporating EMD into a portfolio can provide diversification benefits. These assets often exhibit different behaviors compared to traditional equities, allowing investors to mitigate risks associated with market downturns. -

Risk Assessment

Investors must carefully assess and understand the risks inherent in emerging market investments. Factors such as political instability, currency fluctuations, and economic volatility can significantly impact returns. A thorough risk assessment is vital for navigating these challenges.

Expert Insights

“Investors are increasingly seeking diversification through emerging market debt, particularly as yields in developed markets stay low,” said James Thompson, a senior analyst at Global Investment Insights. “However, it’s critical to maintain a balanced perspective on the risks involved, especially in a politically volatile environment.”

Moreover, institutions such as the International Monetary Fund (IMF) have highlighted the importance of responsible lending practices in emerging markets to ensure that infrastructure projects funded through bonds are sustainable and supportive of long-term economic growth.

Conclusion

The current landscape for emerging market debt presents both opportunities and challenges. With a remarkable $331 billion in bonds issued this year, investors are reminded to conduct thorough due diligence. While the pursuit of higher yields can be rewarding, considering risk tolerance and market conditions is essential when exploring these investment avenues.

Investors interested in capitalizing on this trend should stay well-informed and be prepared to adapt their strategies as the market continues to evolve. As global economic dynamics shift, emerging market debt may offer a compelling avenue for those willing to navigate its complexities.

For further reading on the trends and dynamics influencing the emerging market debt landscape, you can explore a comprehensive analysis on Yahoo Finance.

As we move further into 2025, the momentum in emerging market debt will likely continue, making it a sector to watch closely for investors targeting growth amidst fluctuating global economic conditions.