Navigating the Current Stock Market: Insights on the Dow Jones and Global Indices

As the Dow Jones Industrial Average (DJIA) approaches significant milestones, investors are keenly observing the market dynamics influenced by geopolitical tensions and economic indicators. The DJIA, often seen as a bellwether for U.S. financial health, has demonstrated resilience in recent weeks, buoyed by strong corporate earnings and favorable employment reports. This article delves into the recent performance of the DJIA and other global indices, providing actionable insights for investors amid a complex landscape.

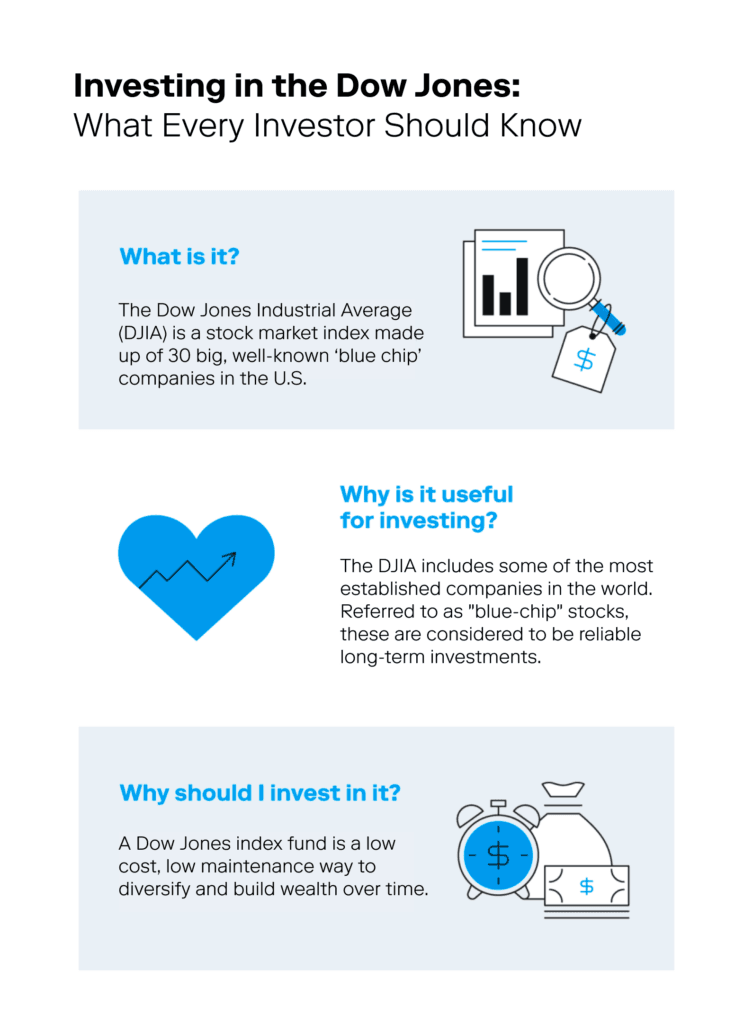

Overview of the Dow Jones Industrial Average

As of June 8, 2025, the DJIA is positioned to challenge previous highs, reflecting broader market trends that intertwine economic data and geopolitical events. The index's recent performance highlights a remarkable recovery trajectory, with the DJIA standing prominently as a cornerstone of American investment sentiment.

Key Market Drivers

1. Economic Indicators

Robust economic indicators are supporting the DJIA's upward movement. Recent reports show a steady recovery in consumer spending and employment figures that have exceeded market expectations. In particular, the latest employment data indicates a continuing trend of job growth, which bolsters investor confidence. According to the Bureau of Labor Statistics, the unemployment rate has dipped to 3.5%, a significant indicator that the labor market remains strong and is contributing to consumer spending power.

2. Geopolitical Factors

Geopolitical tensions, especially concerning U.S.-China trade negotiations and the ongoing feud between influential figures like Elon Musk and former President Donald Trump, have introduced volatility into the stock market. Recent discussions between the two nations suggest a potential thaw in relations, which could alleviate trade tensions that have previously weighed on market sentiment. However, investors are advised to monitor these developments closely, as fluctuations in sentiment can lead to pronounced market shifts.

3. Sector Performance

Technology and consumer discretionary sectors are leading the charge in the DJIA's ascent. Companies such as Apple Inc. (AAPL) and Tesla Inc. (TSLA) are driving substantial gains, reflecting investor enthusiasm in the face of technological advancements and innovative services. The anticipated launch of Tesla's robotaxi service is particularly noteworthy; analysts suggest that this could reshape market expectations regarding electric vehicle adoption and autonomous driving technology.

Global Market Context

The DJIA's performance is part of a larger narrative, with global indices reflecting a similarly bullish sentiment. The PSI 20 in Portugal recently rose to 7,454 points, indicating a robust recovery in European markets. This resurgence can be attributed to increased foreign direct investment and positive corporate earnings reports. Similarly, Turkey's BIST 100 index has shown positive movement, currently at 9,487 points, gaining 0.12% as of June 5, 2025. Such indicators suggest a broader trend of recovery across various regions, highlighting investor optimism as economies emerge from recent challenges.

Investment Strategies

In light of the evolving market conditions, investors should consider diversifying their portfolios to include sectors anticipated to benefit from ongoing economic recovery. Here are several actionable strategies:

- Sector Rotation: Focus on sectors showing strong earnings growth, such as technology and consumer services. The performance of these sectors can significantly influence overall market sentiment.

- Geopolitical Awareness: Stay informed about geopolitical developments that could impact market dynamics, particularly in U.S.-China relations. This awareness can guide investment decisions and risk management strategies.

- Inflation Monitoring: Keep an eye on inflation trends and central bank policies. Recent inflation readings have shown fluctuations, with the Consumer Price Index (CPI) reflecting varied consumer sentiment and spending habits. Understanding these trends will be essential for navigating potential market fluctuations.

Conclusion

As the DJIA and global markets continue to evolve, investors must remain vigilant and adaptable. The interplay of economic indicators, geopolitical factors, and sector performance presents both challenges and opportunities. By leveraging insights from recent market trends and maintaining a proactive investment strategy, stakeholders can position themselves for success in this dynamic landscape.

In summary, the current market environment is characterized by resilience among global indices, a strong labor market, and promising technological advancements. As we move further into 2025, the path forward may be fraught with challenges; however, informed and strategic investment decisions can still yield significant returns.

References: