The Cryptocurrency Landscape: Risks and Future Prospects

As the digital currency ecosystem continues to thrive, its total market capitalization has soared to $1.7 trillion, marking a significant milestone in the evolution of cryptocurrencies over the past seven years. This burgeoning asset class, once relegated to niche discussions among tech enthusiasts, is now a focal point for investors ranging from retail to institutional levels. However, as enthusiasm grows, so do the complexities and risks associated with this volatile market, prompting a closer examination of its future trajectory.

Market Growth and Volatility

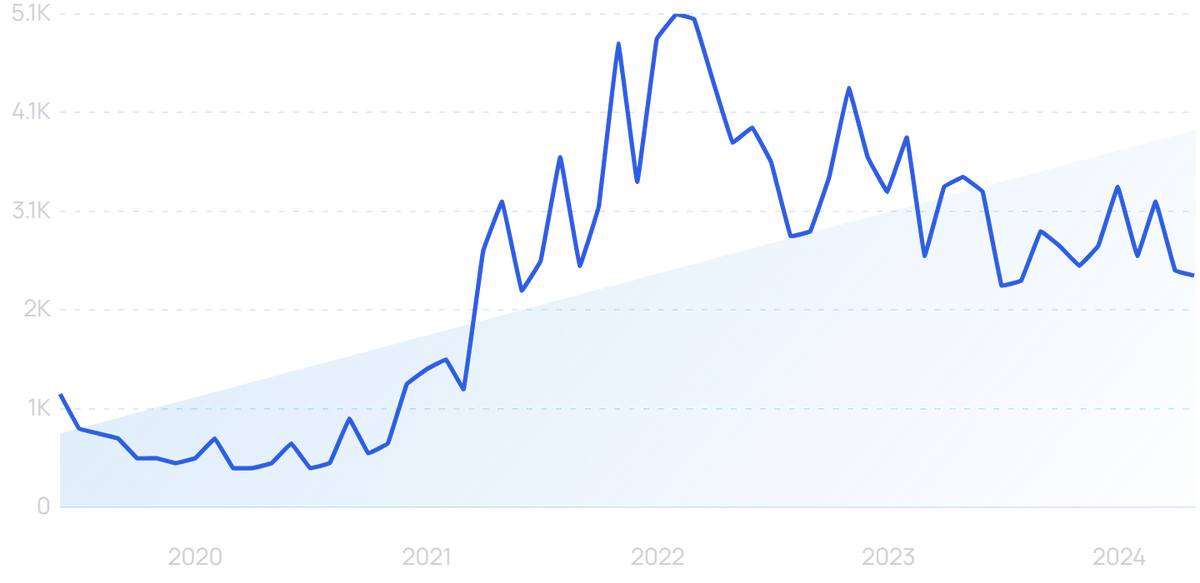

The cryptocurrency market has experienced extraordinary growth, drawing interest not only from individual traders but also from major institutions. According to recent data, Bitcoin is trading around $105,000, a significant increase from earlier figures, with altcoins also reflecting similar bullish trends. However, this rapid expansion comes with substantial volatility; price swings of 10% or more within a single day are not uncommon.

Investors are often faced with the challenge of navigating an environment fraught with regulatory uncertainties, market manipulation, and cybersecurity threats. The recent $11 million hack of the BitoPro exchange highlights the security vulnerabilities that continue to plague the industry. Such incidents reinforce the necessity for due diligence and caution when engaging in cryptocurrency transactions.

Risks Involved

Cryptocurrency-related scams and fraudulent schemes have become increasingly prevalent, creating another layer of risk for investors. For instance, two women in Guelph recently fell victim to scams totaling $50,000, lured by false promises of high returns on investments. Authorities highlight that recovery of losses in such cases is often nearly impossible, underscoring the need for vigilance and skepticism when approached with investment opportunities in this space.

Moreover, regulatory scrutiny remains an ongoing concern. Many governments are still on the fence regarding the classification and regulation of cryptocurrencies, which can create additional uncertainty for investors. The lack of clear regulatory frameworks leaves the market susceptible to sudden changes in policy, which can directly impact the value and legitimacy of digital assets.

Future Outlook

Despite the inherent risks, the outlook for cryptocurrencies appears increasingly favorable, driven by advancements in technology and a growing acceptance among institutional investors. The market is witnessing significant innovations, particularly in the areas of decentralized finance (DeFi) and non-fungible tokens (NFTs). As the underlying technology continues to mature, it is expected that cryptocurrencies will become more integrated into traditional financial systems.

Regulatory bodies are gradually establishing clearer guidelines, which could help stabilize the market. Recently, there has been a noticeable shift in sentiment among regulators, with the U.S. Securities and Exchange Commission (SEC) taking steps to embrace certain aspects of the cryptocurrency world, such as the approval of Bitcoin exchange-traded funds (ETFs). This evolution suggests a path toward greater legitimacy for cryptocurrencies and increased investor confidence.

The Role of Institutional Investment

The trend of institutional investment in cryptocurrencies is indicative of a larger acceptance of digital currencies as a viable asset class. Major firms like BlackRock and Fidelity have begun offering crypto-related services, which not only lends credibility but also opens the door to broader participation from traditional investors. The entry of institutional players has historically resulted in increased stability, as these entities often employ rigorous risk management strategies and compliance practices.

Conclusion

In conclusion, while the cryptocurrency landscape presents substantial risks, it also offers a plethora of opportunities for savvy investors. The key to navigating this volatile market lies in remaining informed and adaptable. Investors are encouraged to approach cryptocurrencies with a balanced perspective, weighing the potential for high returns against the risks associated with this nascent asset class.

As the market continues to evolve, stakeholders must stay engaged with regulatory developments and technological innovations that will shape the future of cryptocurrencies. The ongoing dialogue between regulators and industry leaders will play a crucial role in determining the trajectory of digital currencies, paving the way for a more stable and mature market.

For those willing to undertake the necessary due diligence, the cryptocurrency market remains a dynamic space ripe for exploration. The future will likely see an increasing convergence between traditional finance and digital assets, promising both challenges and formidable growth potential.

References

- Morningstar: The Cryptocurrency Landscape

- CoinDesk: BitoPro Confirms $11M Hack

- Investopedia: The New Age of Cryptocurrency