Leveraged and Inverse ETFs: Navigating the Risks and Rewards

As investors increasingly seek ways to enhance their portfolios, leveraged and inverse exchange-traded funds (ETFs) have surged in popularity. These financial instruments promise the allure of amplified returns, yet they come with complexities that can significantly alter an investor's risk profile. Understanding these dynamics is essential for anyone considering these high-octane investment vehicles.

Understanding Leveraged and Inverse ETFs

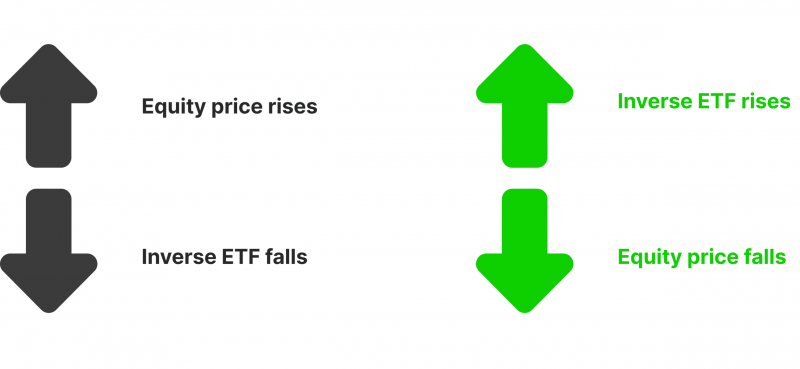

Leveraged and inverse ETFs are crafted specifically to either magnify the returns of an underlying index or to provide a counter-position against it. Leveraged ETFs, such as the ProShares Ultra S&P500 (SSO) or Direxion Daily Technology Bull 3X Shares (TECL), aim to deliver returns that are typically two or three times the daily performance of the index they track. Conversely, inverse ETFs, like the ProShares Short S&P500 (SH), are designed to yield the opposite performance of the tracked index, functioning as a hedge against potential market downturns.

Key Features

-

Daily Reset Mechanism: A critical feature of these ETFs is their daily reset mechanism. This means they are engineered to achieve their performance objectives on a day-to-day basis. Over longer periods, this can result in significant performance discrepancies due to the effects of compounding.

-

Volatility and Risk: Leverage undeniably increases volatility. For investors holding these ETFs beyond a single trading day, the risks can escalate dramatically, particularly in volatile market conditions. Notably, the longer the holding period, the greater the potential for both gains and losses.

Performance Considerations

The appeal of leveraged and inverse ETFs lies in their potential for high returns, particularly in favorable market conditions. For instance, in a bullish market, a leveraged ETF may substantially outperform traditional index funds. However, this potential comes with the caveat that prolonged exposure to these products can lead to significant losses. According to research from Morningstar, the performance of these ETFs can diverge considerably from that of the underlying index over time due to the mathematical compounding of returns.

An illustrative example can be seen during periods of high volatility. Let's consider a hypothetical case where the underlying index fluctuates daily. If an investor holds a 2X leveraged ETF, the daily compounding can lead to a situation where, despite the index returning to its original value after several days, the leveraged ETF's value may be significantly different due to the compounding effects on its gains and losses.

Risk Management and Investment Strategy

Investors must approach leveraged and inverse ETFs with a robust risk management strategy. One recommended practice is to limit exposure to these products to short-term trading scenarios. Those who plan to hold positions for more than a day should strongly consider whether they fully understand the implications of leverage and compounding.

Furthermore, it is essential for investors to conduct thorough research and analysis before diving into these products. The Financial Industry Regulatory Authority (FINRA) provides guidelines that investors should review, emphasizing the importance of understanding the complexities involved with leveraged and inverse ETFs.

Conclusion

Leveraged and inverse ETFs are powerful tools for experienced investors looking to capitalize on short-term market moves. However, they are not suited for every investor, particularly those with a long-term investment horizon. The potential for high returns comes hand-in-hand with substantial risks, and a clear understanding of the underlying mechanisms is vital to successfully navigating these products.

As the market continues to evolve, investors must remain vigilant and informed. Utilizing resources such as ETF.com and CETERA can provide valuable insights into the dynamics of these funds, helping investors make more informed decisions.

By combining careful analysis with a clear investment strategy, investors can potentially reap the rewards of leveraged and inverse ETFs while managing the associated risks effectively.