Navigating the Semiconductor Surge: Market Implications and Investment Strategies

As of June 11, 2025, the semiconductor sector stands at the forefront of market attention, boasting a significant uptick driven by burgeoning demand and rapid technological advancements. Stocks in this industry have demonstrated remarkable resilience, positioning themselves favorably amidst broader market fluctuations. The recent surge, characterized by increased valuations and strategic innovations, indicates a transformative period for semiconductor companies and presents a wealth of investment opportunities.

Market Dynamics

The rise in semiconductor stocks can be attributed to a confluence of factors that are reshaping the landscape of this critical industry:

1. Technological Advancements

The demand for semiconductors is increasingly fueled by innovations in areas such as artificial intelligence (AI), Internet of Things (IoT), and 5G technologies. These technological advancements necessitate the development of more sophisticated chips capable of handling complex computations and facilitating high-speed data transfer. According to a report from MarketsandMarkets, the global semiconductor market is projected to reach $1 trillion by 2030, primarily driven by the proliferation of electronic devices and the expansion of connected technologies.

2. Supply Chain Recovery

Following the disruptions caused by the COVID-19 pandemic, the semiconductor supply chain is gradually recovering. Improved logistics and manufacturing efficiency are enabling companies to ramp up production to meet the escalating demand. For instance, major players such as TSMC and Samsung have announced substantial investments in their manufacturing capabilities, aiming to enhance their output and reduce lead times. The increase in capacity is expected to alleviate some of the shortages that have plagued the industry in recent years.

3. Geopolitical Factors

Ongoing geopolitical tensions, particularly related to U.S.-China trade discussions, have created a heightened sense of urgency within the semiconductor sector. Investors are cautiously optimistic about potential breakthroughs in these negotiations that could favorably impact supply chains and trade relations. The Semiconductor Industry Association (SIA) has noted that favorable trade policies could lead to increased exports and higher revenues for U.S.-based semiconductor manufacturers.

Investment Strategies

As the semiconductor sector continues to flourish, investors seeking to capitalize on this trend should consider the following strategies:

Diversification

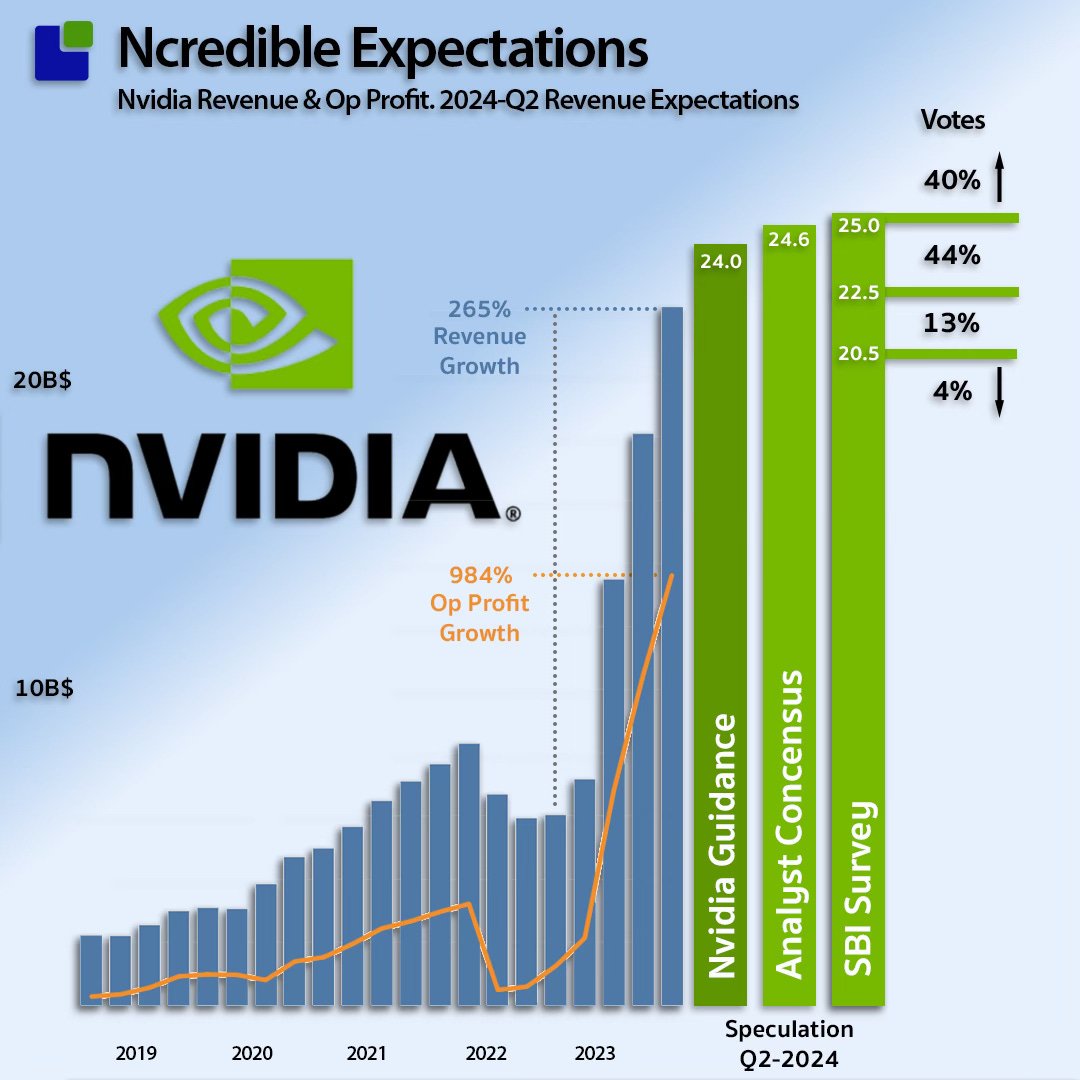

Building a diversified portfolio that spans both established players and emerging companies within the semiconductor space can effectively mitigate risks. For instance, NVIDIA Corporation (NVDA) has been a standout performer, largely due to its leadership in AI and gaming technologies. However, investing in smaller firms specializing in niche markets, such as Quantum Computing or Edge Computing, could provide valuable growth opportunities.

Focus on Innovation

Investors should prioritize companies at the forefront of innovation, particularly those involved in AI and machine learning applications. Firms like Advanced Micro Devices (AMD) and Qualcomm are heavily investing in research and development to stay competitive in an ever-evolving technological landscape. According to Gartner, spending on AI is expected to reach $500 billion by 2025, underscoring the immense potential for semiconductor companies that support this growth.

Monitor Global Trends

Keeping abreast of geopolitical developments and trade policies is critical, as these factors can significantly influence the semiconductor supply chain. For example, recent discussions surrounding semiconductor subsidies in both the U.S. and Europe indicate a strategic shift towards bolstering domestic manufacturing capabilities. Tracking policy changes can help investors anticipate market movements and adjust their portfolios accordingly.

Conclusion

The semiconductor sector presents an alluring investment opportunity as it continues to thrive amid a recovering global economy. With the ongoing advancements in technology and a recovering supply chain, investors are positioned to benefit from this upward trend. By understanding the market dynamics at play and employing strategic investment approaches, investors can navigate the complexities of this sector and harness its potential for growth.

For further insights and up-to-date market information, resources such as CNBC, Bloomberg, and the SIA can provide valuable data and analysis to inform investment decisions.

As we anticipate the future of this dynamic industry, one thing remains clear: the semiconductor sector's trajectory will be pivotal for both technological advancement and investment growth in the coming years. By maintaining a diversified and informed approach, investors can capitalize on the myriad opportunities this sector presents.