Momentum Indicators in Forex Trading: Strategies for Success

In the fast-paced world of forex trading, the ability to discern the strength and direction of market movements can separate profitable traders from the rest. One of the most effective ways to achieve this is through the use of momentum indicators. These tools not only help identify market trends but also assist traders in pinpointing optimal entry and exit points, thereby enhancing their trading strategies. This article delves into the significance of momentum indicators in forex trading, exploring their applications and practical strategies to maximize profit potential.

Understanding Momentum Indicators

At its core, momentum trading involves buying and selling currency pairs based on the strength of recent price movements. Momentum indicators measure the rate at which currency prices change over a specified period, providing insight into whether a currency pair is trending upwards or downwards. Notable momentum indicators include the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and the Momentum Oscillator.

These indicators function by comparing current price levels with those from prior periods, allowing traders to gauge market sentiment effectively. For instance, a momentum indicator will generally consist of a single line plotted above and below a centerline, often set at 100, which indicates whether the market is in an uptrend or downtrend.

How to Use Momentum Indicators

-

Identifying Trends: Momentum indicators can signal the presence of an uptrend or downtrend. For example, when the momentum indicator crosses above the 100-line, it suggests an upward trend, prompting traders to consider buying positions. Conversely, crossing below the 100-line indicates a potential downtrend, signaling traders to sell.

-

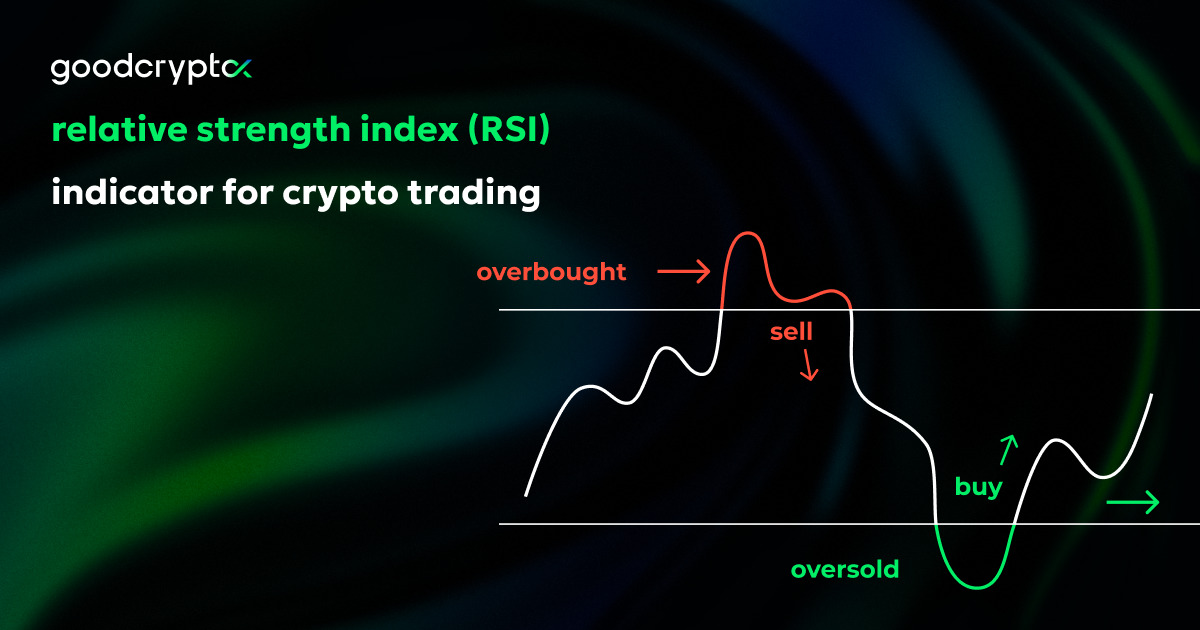

Entry and Exit Points: Momentum indicators can help traders determine not only when to enter a trade but also when to exit. A common strategy involves watching the RSI; if it indicates that a currency pair is overbought, it may be time to sell. Conversely, if the RSI shows that a pair is oversold, traders may consider it a buying opportunity.

-

Combining Indicators: To refine trading strategies, traders often combine momentum indicators with other technical analysis tools, such as Bollinger Bands or moving averages. This combination can give a more comprehensive view of market conditions and improve decision-making.

Practical Strategies

-

Trend Following: This strategy involves using momentum indicators to identify and follow prevailing trends. Traders enter trades in the direction of the trend and implement stop-loss orders to manage risk effectively.

-

Reversal Trading: Traders should look for divergences between price movements and momentum indicators. For example, if the price is making new highs while the momentum indicator fails to do so, it may signal a potential reversal, indicating that it's time to exit or short the trade.

-

Risk Management: Implementing sound risk management strategies is crucial. This includes setting stop-loss orders and calculating position sizes based on account equity to minimize potential losses.

Advanced Insights into Momentum Indicators

For a deeper understanding, momentum indicators can be analyzed through several lenses:

Volume and Volatility

Volume plays a significant role in the effectiveness of momentum indicators. A high trading volume typically leads to more reliable signals, as it reflects strong market interest. When analyzing currency pairs, traders should pay attention to the volume associated with price movements, as high liquidity can lead to more accurate momentum readings.

Volatility also influences momentum indicators. In highly volatile markets, price movements tend to be more pronounced, enhancing the effectiveness of momentum signals. Traders should, therefore, consider both volume and volatility when developing their strategies.

Conclusion

Momentum indicators are invaluable tools in the forex trader's toolkit. By understanding how to effectively utilize these indicators, traders can enhance their ability to identify trends, optimize entry and exit points, and ultimately improve trading performance. As with any trading strategy, continuous learning and adaptation are key to success in the dynamic forex market.

References

For further reading and deeper insights into momentum indicators, visit Blueberry Markets.

Incorporating momentum indicators into your trading strategy can lead to more informed decisions and increased profitability, but it's essential to remain vigilant and adapt to the ever-changing market conditions.