Analyzing the Impact of Rising U.S. Treasury Yields on Fixed Income Strategies

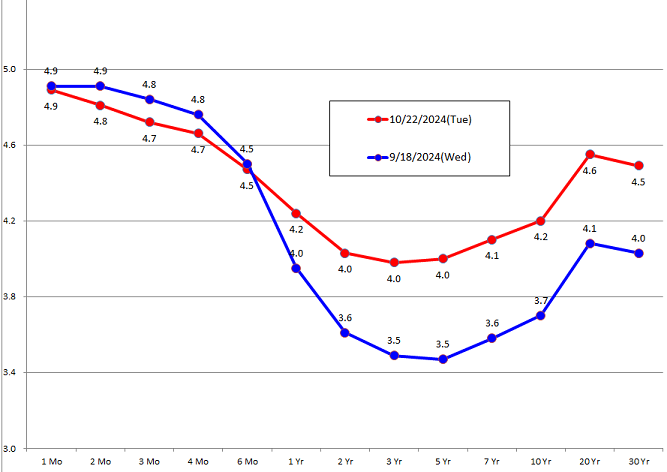

As of June 2025, the yield on the 10-year U.S. Treasury note has surged to 4.418%, while the 30-year Treasury bond yield stands at approximately 4.84%. This upward momentum reflects broader economic concerns, particularly the ballooning U.S. government debt, which now exceeds $36 trillion. Coupled with a 123% debt-to-GDP ratio, the implications for fixed income investors are profound and warrant strategic reevaluations.

Understanding the Yield Curve Dynamics

The current environment has resulted in a steepening yield curve, characterized by longer-term bond yields increasing at a faster pace compared to short-term yields. This phenomenon is crucial for market participants to grasp, as it can create opportunities for those willing to recalibrate their investment strategies. According to Chip Hughey, managing director for fixed income at Truist Advisory Services, recent auction results indicate a robust demand for long-term securities. "The 30-year auction just went very well," Hughey noted, emphasizing the resilience of demand from both domestic and foreign investors. This sentiment was echoed in a recent auction where roughly 65.2% of the bonds sold were purchased by foreign investors, marking the strongest demand since January.

Strategic Adjustments for Investors

In light of these developments, fixed income investors are advised to diversify their portfolios strategically. Emphasizing seven- to ten-year bonds may strike a beneficial balance between yield and interest rate sensitivity. This approach allows investors to lock in higher yields while simultaneously mitigating risks tied to U.S. government debt concerns. Furthermore, incorporating international investment-grade bonds and emerging market debt can enhance diversification and provide a bulwark against domestic volatility. As highlighted by a recent analysis from Edward Jones, these strategies can provide investors with a pathway to navigate the complexities of the current market.

Future Outlook

While the prospect of rising yields is likely to usher in an era of increased market volatility, experts continue to view the U.S. Treasury market as one of the most liquid and secure globally. Brian Therien, Senior Fixed Income Analyst at Edward Jones, reassured investors by stating, "The U.S. government is unlikely to default, and U.S. investment-grade government bonds offer higher yields than those from most other developed markets." This perspective is critical, as it underscores the inherent stability that U.S. Treasuries maintain despite the looming fiscal challenges.

The ongoing demand for U.S. Treasuries is a testament to their status as a safe haven. However, the bond market’s dynamics are shifting. Investors should prepare for potential increases in borrowing costs, as higher yields can lead to elevated rates for consumer loans and credit facilities. Furthermore, the implications of government fiscal policy must be carefully monitored, as decisions made at the federal level will continue to influence market conditions.

Managing Risks in a Volatile Environment

As fixed income investors navigate these challenges, it is essential to remain cognizant of the risks associated with rising interest rates. For instance, when interest rates increase, bond prices typically decrease, which can lead to capital losses for those who sell before maturity. Therefore, the importance of a well-balanced portfolio cannot be overstated.

Moreover, with inflationary pressures persisting, investors may need to adjust their bond allocation accordingly. The recent auction results reflect a market that is still receptive to U.S. Treasuries, but the overarching fiscal landscape suggests that caution is warranted, particularly for long-term bonds. According to Collin Martin, a fixed income strategist at Charles Schwab, “While bonds still look relatively attractive compared to stocks, we expect to focus and be ‘overweight’ on 5- and 10-year bonds, while being less focused and ‘underweight’ on longer-term bonds.”

Conclusion

In summary, as Treasury yields continue to rise, it is imperative for fixed income investors to remain agile and adaptive. By focusing on diversified bond portfolios and being cognizant of the risks associated with increasing interest rates, investors can position themselves strategically in this evolving landscape. The current climate presents both challenges and opportunities; staying informed and adjusting investment strategies accordingly will be crucial for success in the fixed income sector.

As the bond market evolves, stakeholders must keep a close eye on fiscal policies and their effects on yields and overall market stability. With a strategic approach, investors can not only weather potential volatility but also capitalize on the opportunities that arise from this shifting dynamic.

For those looking to deepen their understanding, consulting with financial advisors or leveraging research resources can provide additional insights into navigating the complexities of fixed income investments in the current environment.