Market Reactions to Geopolitical Tensions: The Impact of Israel's Strike on Iran

On June 12, 2025, Israel's military strike against Iran sent shockwaves through global financial markets, triggering immediate sell-offs and heightened volatility. The S&P 500 index dipped 1.3%, reflecting mounting investor anxiety as geopolitical tensions escalated. This incident is a poignant reminder of the historical patterns of market behavior during geopolitical crises, where uncertainty leads to significant market recalibrations.

Immediate Market Impact

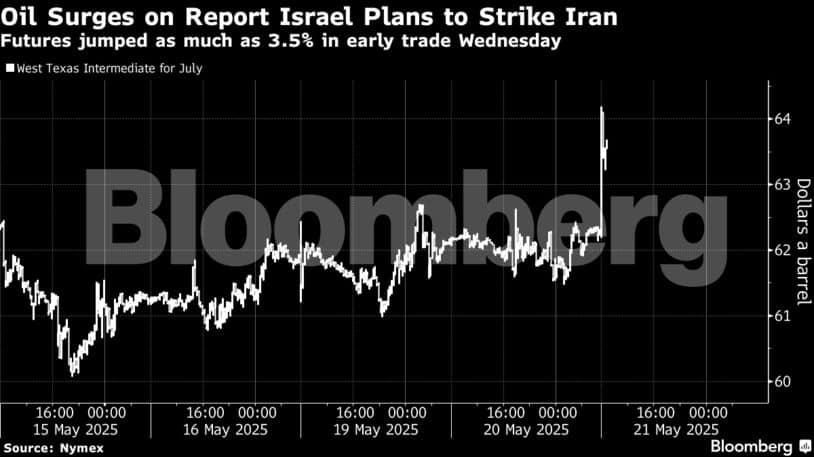

The ramifications of the strike were felt across various sectors. While the broader stock market suffered, energy stocks capitalized on fears of potential disruptions in oil supply. Oil prices surged over 5%, climbing to $74.31 per barrel, as investors anticipated possible constraints on production and distribution from the region, which is a pivotal hub for oil exports. Such dynamics underscore the interconnectedness of geopolitical events and oil market fluctuations.

As the violence unfolded, investors fled to safe-haven assets, leading to a notable increase in gold prices, a traditional refuge during times of uncertainty. This shift in market sentiment illustrates how geopolitical tensions can pivot investor focus towards assets perceived as more stable and secure.

Historical Context

The reaction of the markets to geopolitical crises is well documented. Historical analysis shows that similar events have often led to increased volatility and investor caution. For instance, the 2003 invasion of Iraq prompted a significant downturn in U.S. equities, while gold prices surged concurrently. The current situation echoes these past patterns, suggesting a predictable response from market participants facing the unpredictability of military conflicts.

According to a report from Business Insider, “Israel's strike on Iran spurred an immediate risk-off move across markets as stocks tumbled and gold surged” (Business Insider).

Sectorial Shifts and Investor Strategies

In the wake of the strike, investors are reassessing their portfolios. Defensive sectors, such as utilities and consumer staples, are likely to attract more interest as investors look for stability. The heightened volatility also leads analysts and investment strategists to recommend diversification as a crucial strategy to mitigate risks associated with geopolitical events.

Analysts suggest that military actions can lead to increased military spending, particularly in defense stocks, which are often perceived as safer during turbulent times. This shift could bolster the performance of companies engaged in defense manufacturing and contracting, such as Lockheed Martin, which saw an uptick in its stock price amid heightened tensions.

Looking Ahead: Potential Long-Term Implications

Market analysts remain vigilant as the situation continues to evolve. The potential for escalated conflict raises concerns about long-term disruption to oil supply chains, which could further influence global markets. The historical context provides a framework for understanding how ongoing military actions might affect market dynamics moving forward.

Investors are advised to monitor developments closely, as further escalation could lead to additional sell-offs in broader equities while simultaneously boosting energy prices and safe-haven assets like gold.

Conclusion

The military strike by Israel on Iran has ushered in a new wave of uncertainty across global markets, highlighting the intricate relationship between geopolitical events and market dynamics. As stock indices react to these developments, investors should remain cautious and consider strategies to protect their portfolios.

The current landscape underscores the importance of maintaining an adaptable investment approach that accounts for geopolitical risks. By diversifying and focusing on defensive sectors, investors can navigate these turbulent times with greater resilience.

The current episode serves as a reminder of the need for vigilance and strategic planning in the face of evolving geopolitical landscapes that can swiftly alter financial market trajectories.