Japan's Bond Market Turmoil: Implications for Global Fixed Income Investors

As Japan grapples with a sharp rise in bond yields, the effects are reverberating throughout global financial markets. The 10-year Japanese Government Bond (JGB) yield has recently surged significantly, igniting a selloff in bond markets worldwide and increasing volatility across sovereign debt instruments. For investors who have long relied on the historically low yields of Japanese bonds as a stabilizing force within their portfolios, this shift poses considerable challenges and necessitates a reassessment of current investment strategies.

Rising Yields and Market Reactions

The current spike in JGB yields can be attributed to a myriad of factors, including persistent inflationary pressures and a notable shift in the Bank of Japan's (BoJ) monetary policy. After years of maintaining a low interest environment to stimulate economic growth, the BoJ’s recent pivot towards tightening has caught many investors off guard. According to market data, the JGB yield has soared as high as 0.5% in recent weeks, a significant increase compared to its historical lows of around 0.1%.

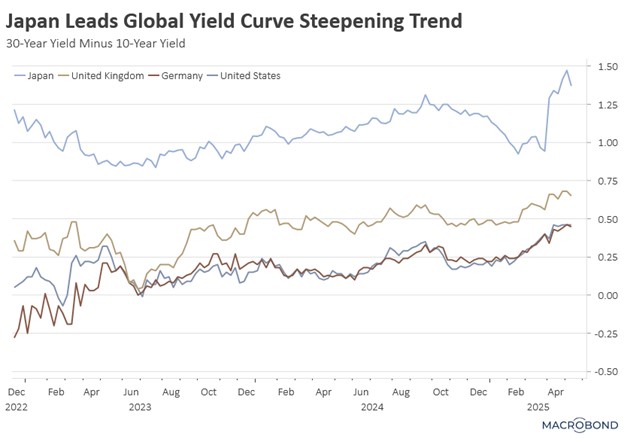

This yield jump has not occurred in isolation; it is reflective of a broader global trend, where rising inflation and anticipated monetary tightening are prompting investors to reassess their risk profiles across asset classes. Notably, the U.S. 10-year Treasury yield currently sits at 4.418%, illustrating a growing divergence between Japanese and U.S. yields that could alter capital flows and investment strategies moving forward.

Global Spillover Effects

The repercussions of these rising yields are already manifesting in increased volatility across other sovereign debt markets, particularly in Europe and the U.S. As investors exhibit heightened caution, there is a noticeable flight to quality—a strategy where capital is redirected toward perceived safer assets. This behavior has resulted in a spike in demand for U.S. Treasuries, as many seek refuge from the uncertainty that has overtaken the Japanese bond market.

The selloff has also led to a corresponding decline in bond prices globally. According to Bloomberg, the volatility stemming from Japan's bond market has fueled a broader risk-off sentiment, with the S&P 500’s bond index recently recording a decline of approximately 3% within a matter of weeks. Such market dynamics underscore the interconnectedness of global financial markets; what occurs in Japan can swiftly impact capital flows and investor sentiment elsewhere.

Strategic Considerations for Investors

For fixed income investors, the evolving landscape necessitates a thorough re-evaluation of investment strategies. With the likelihood of further increases in bond yields, it may be prudent for investors to explore alternative investments that could offer higher yields while maintaining acceptable risk levels.

Emerging market debt (EMD) presents a viable alternative, as certain countries are currently offering attractive yields compared to developed markets. Additionally, corporate bonds, particularly those rated investment grade, may provide a buffer against rising interest rates and the volatility permeating the global bond markets. Investors should consider increasing their allocation to these asset classes while maintaining diversification to mitigate risks associated with rate hikes.

Diversification could also involve strategic positioning within the fixed income space. For instance, focusing on shorter-duration bonds may help reduce sensitivity to rising rates, thereby alleviating some of the pain associated with falling bond prices.

Conclusion

The turmoil currently engulfing Japan's bond market serves as an important reminder of the intricate web connecting global financial systems. As yields rise and volatility escalates, fixed income investors must remain vigilant and adaptable, ready to navigate this rapidly evolving landscape. The interdependence of markets means that developments in Japan will continue to have significant implications for investors worldwide, underscoring the necessity for informed and proactive strategies in the face of uncertainty.

Keywords

Japan, bond yields, global markets, fixed income, volatility, U.S. Treasury, investment strategies

References

- Bloomberg. (2025). Japan's Bond Chaos Heralds More Volatility Across Global Markets. Retrieved from Bloomberg