Emerging Market Bonds: A Resurgence in Investor Interest

In recent weeks, emerging market (EM) bonds have captured the attention of global investors, marking a significant turnaround after a prolonged period of underperformance. As of June 13, 2025, EM bond funds recorded inflows totaling $3.8 billion, the highest weekly amount in over a decade. This trend signals a renewed confidence in the asset class, driven by a combination of factors including a weaker U.S. dollar and improving economic fundamentals in various EM regions.

Factors Driving the Resurgence

-

Weaker Dollar: A depreciating dollar enhances the attractiveness of EM bonds, as it reduces the cost of servicing dollar-denominated debt for many countries. This dynamic has been particularly beneficial for nations with strong export sectors, where a weaker dollar boosts competitive advantage in global markets. According to a recent report by Reuters, the dollar index has shown a marked decline, which is inversely correlated with rising investor interest in EM assets.

-

Improving Economic Conditions: Many emerging economies are showing signs of recovery, with GDP growth rates rebounding from the pandemic-induced slump. Countries like Brazil and Mexico are experiencing robust economic activity, which supports their bond markets. For instance, Brazil's central bank recently reported an uptick in manufacturing and services, reinforcing the overall positive sentiment surrounding Brazilian bonds.

-

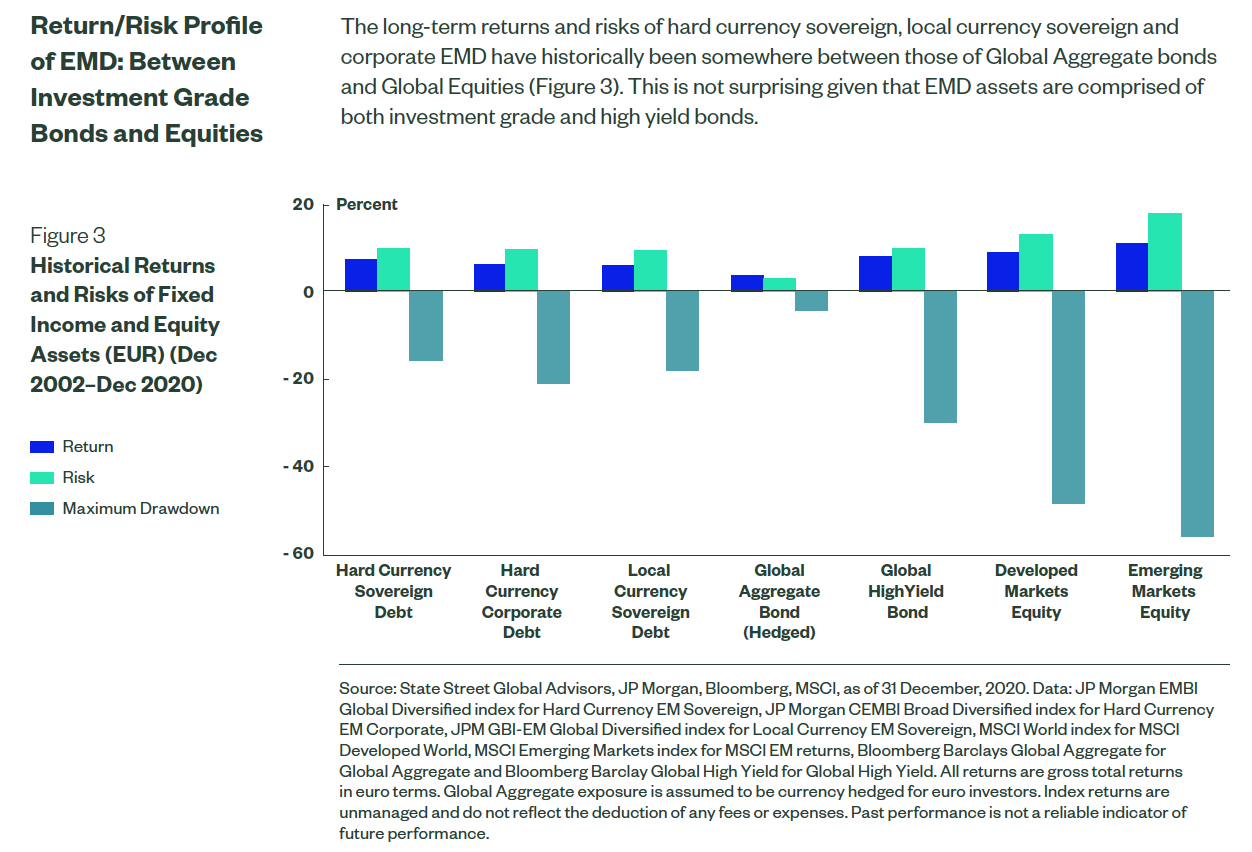

Yield Advantage: EM bonds continue to offer higher yields compared to developed market counterparts. For instance, while the yield on the 10-year U.S. Treasury stands at approximately 4.418%, many EM bonds are yielding above 6%. This yield differential makes EM bonds an attractive option for yield-seeking investors. The allure of higher returns is further amplified by the relatively low correlation of EM bonds with U.S. Treasury rates, providing a buffer against volatility.

Implications for Fixed Income Portfolios

The resurgence of EM bonds presents both opportunities and risks for investors. While the potential for higher returns is enticing, it is essential to remain cognizant of the inherent risks, such as political instability and currency fluctuations. A diversified approach that includes EM bonds can enhance overall portfolio performance, but careful selection and risk management are crucial.

According to Michel Vernier, Head of Fixed Income Strategy at Barclays, “Investors should view EM bonds as a complementary asset class that can enhance yield and diversification within a fixed income portfolio.” He further notes that the tactical allocation towards EM bonds could benefit investors in the current economic climate, given their performance potential in relation to developed market securities.

Emerging market bonds can also serve as a hedge against inflation. With many central banks across the globe, including the U.S. Federal Reserve, adopting a more hawkish stance, the inflationary pressures could lead to a reassessment of traditional fixed income assets. Emerging market bonds are often viewed as a viable alternative that could withstand inflationary environments better than their developed market counterparts.

Current Market Dynamics

As the landscape continues to evolve, investors are encouraged to monitor developments closely and consider adjusting their fixed income allocations accordingly. The current environment suggests that now may be an opportune time to explore emerging market bonds as part of a broader investment strategy.

One significant factor underpinning this market resurgence is the recent trend of foreign investment inflows into Asian bonds, which recorded its largest influx in nearly a decade. According to another Reuters report, Asian countries like Indonesia and Thailand have seen substantial increases in foreign participation, buoyed by their improving credit ratings and economic recovery trajectories.

Risks to Consider

Despite the promising outlook, potential investors must remain aware of the risks associated with EM bonds. Political instability, such as changes in government or regulatory environments, can significantly impact bond performance. Moreover, currency volatility can lead to adverse returns for investors holding dollar-denominated EM bonds, particularly in countries experiencing economic upheaval or social unrest.

Additionally, as highlighted by experts, the ongoing geopolitical tensions, particularly in regions like the Middle East and Eastern Europe, could also pose systemic risks to emerging markets. Investors must evaluate their risk appetite and consider employing strategies such as hedging or diversifying across different regions to mitigate these risks.

Conclusion

The recent inflows into emerging market bonds reflect a significant shift in investor sentiment, driven by favorable economic conditions and attractive yield differentials. As global markets navigate ongoing volatility, EM bonds could play a pivotal role in enhancing fixed income portfolios. Investors are advised to conduct thorough due diligence and consider the broader macroeconomic landscape as they position themselves in this recovering asset class.

By taking a strategic approach and keeping abreast of market trends, investors can capitalize on the resurgence of emerging market bonds while effectively managing the associated risks. The evolving dynamics of the global financial landscape will likely continue to shape investment strategies in the months ahead.