Emerging Market Bonds: A Strategic Opportunity Amid Rising Yields

As of June 2025, emerging market bonds have seen a notable resurgence, attracting inflows of approximately $3.8 billion. This trend is largely fueled by a weakening U.S. dollar and improving economic conditions in countries such as Brazil and Mexico, where yields are exceeding 6%. Investors are increasingly drawn to these bonds as they offer higher returns compared to U.S. Treasuries, which are currently under pressure due to rising interest rates and inflation concerns. However, while the potential for attractive yields is significant, investors must remain cautious of the inherent risks associated with political instability and currency fluctuations in emerging markets.

Key Factors Driving Investment

Weakening U.S. Dollar

The depreciation of the dollar has made emerging market assets more appealing to foreign investors, enhancing their purchasing power. As the dollar weakens, local currencies may gain strength relative to the dollar, resulting in potentially higher returns for investments denominated in those currencies.

Improving Economic Conditions

Countries like Brazil and Mexico are showing signs of economic recovery, which is positively impacting their bond markets. Brazil’s economic growth, spurred by increased commodity prices and structural reforms, has led to greater investor confidence. In Mexico, a stable political environment and reforms aimed at boosting foreign investment are fostering a positive outlook.

Yield Opportunities

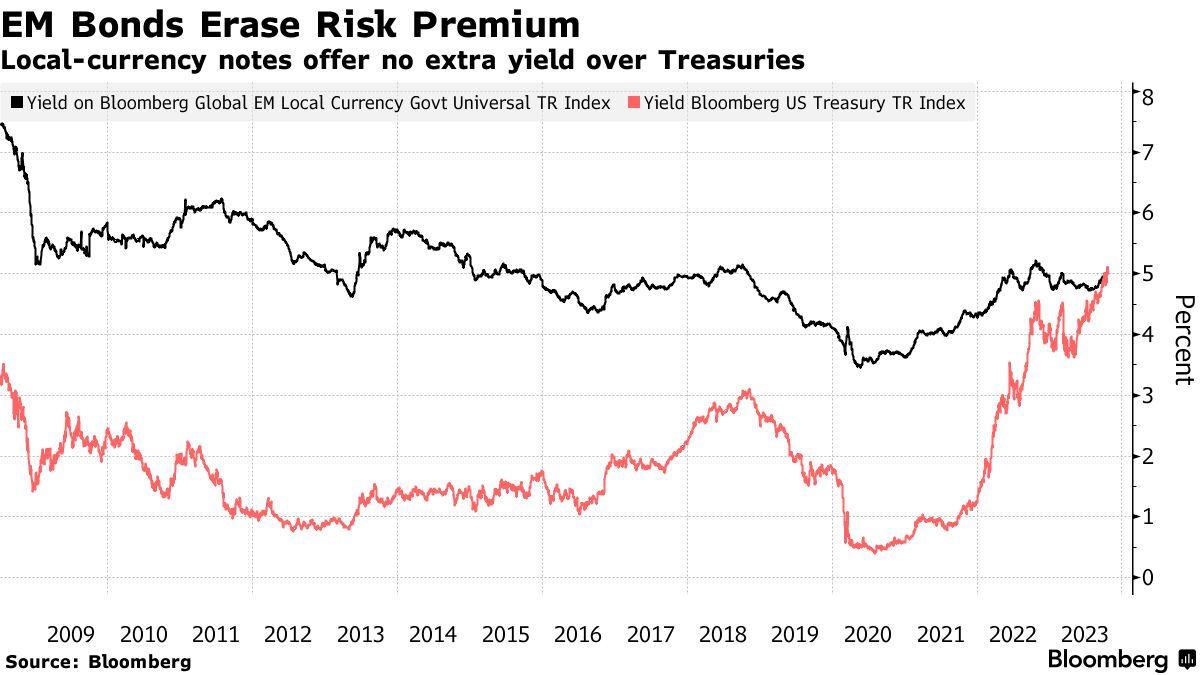

With yields above 6%, emerging market bonds present a lucrative alternative for yield-seeking investors. As central banks in many developed countries maintain low interest rates, the return on investments in emerging markets becomes increasingly attractive. This shift is particularly advantageous for those looking to hedge against inflation.

Risks to Consider

Political Instability

Many emerging markets are susceptible to political changes that can affect economic stability and investor confidence. For instance, elections, regime changes, or social unrest can lead to abrupt shifts in policy that could negatively impact bond performance. Investors should carefully monitor political developments in these regions to mitigate risks.

Currency Fluctuations

Exchange rate volatility can impact returns for foreign investors, particularly if local currencies depreciate against the dollar. For example, if an investor holds bonds in a country experiencing economic upheaval, currency depreciation could erode the anticipated returns when converted back to dollars.

Conclusion

Emerging market bonds offer a compelling investment opportunity in the current landscape, but investors should conduct thorough due diligence and consider diversifying their portfolios to mitigate risks. As the market evolves, staying informed about geopolitical developments and economic indicators will be crucial for making informed investment decisions.

In light of the current trends, investors seeking higher yields might want to consider allocating a portion of their portfolios to emerging market bonds, keeping an eye on the associated risks. As the world continues to recover from the economic repercussions of the pandemic, these investments could play a pivotal role in achieving diversified and profitable portfolios.

By strategically navigating the emerging bond market landscape, investors can position themselves to capitalize on growth opportunities while managing potential downsides.