Navigating the ETF Landscape: Opportunities in China's Market Rebound

The past few years have been fraught with challenges for Chinese equities, marked by slow growth and heightened regulatory scrutiny. However, 2024 brought a significant shift as sweeping stimulus measures and signs of economic recovery ignited a market rebound. As of July 2025, Chinese equities remain below their historic averages, presenting a unique opportunity for investors looking to capitalize on the resurgence through Exchange-Traded Funds (ETFs).

Market Context

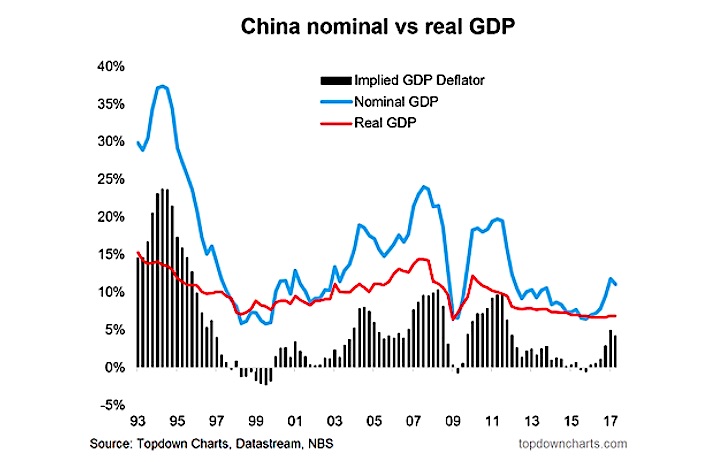

The Chinese government has rolled out various fiscal and monetary policies since late 2024 aimed at revitalizing its economy. These measures include cuts to interest rates, increased infrastructure spending, and incentives for technology and renewable energy sectors. According to data from the National Bureau of Statistics of China, the economy showed signs of stabilization with a GDP growth rate projected to reach 5.5% in 2025, up from 3.2% in 2023.

This rejuvenated economic landscape has led to a notable increase in investor confidence, especially among foreign investors. The Shanghai Composite Index, which rose by over 20% in the first half of 2025, reflects this newfound optimism. As stated by Wei Chen, an analyst at Huatai Securities, “The market is beginning to show a strong recovery as stimulus measures take effect, and sectors like technology and consumer goods are well-positioned for growth.”

Investment Opportunities

For investors seeking exposure to the burgeoning Chinese market, several ETFs provide targeted access to key sectors. Notable examples include:

1. Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR)

This ETF tracks the performance of the largest and most liquid A-shares listed on the Shanghai and Shenzhen stock exchanges. With a focus on the CSI 300 Index, ASHR is an ideal choice for investors aiming to capture the growth of major Chinese companies.

2. Invesco Golden Dragon China ETF (PGJ)

Unlike traditional ETFs, PGJ targets U.S.-listed companies that derive a significant portion of their revenue from China. This fund includes major players in various sectors, providing a unique angle on the Chinese market without direct exposure to local equities.

3. KraneShares CSI China Internet ETF (KWEB)

Focusing on the rapidly growing internet sector, KWEB encompasses leading Chinese internet companies involved in e-commerce, social media, and fintech. With the digital economy expanding, this ETF positions investors to benefit from the increasing consumption of digital services in China.

4. Global X MSCI China Financials ETF (CHIX)

As the nation’s financial sector rebounds, investing in CHIX allows exposure to banks and financial services companies, which are poised to benefit from increased economic activity and improved consumer confidence.

Risk Considerations

Despite the potential for substantial gains, investors must remain mindful of the risks associated with investing in Chinese equities through ETFs. Regulatory changes, ongoing geopolitical tensions, and market volatility can significantly influence performance. For instance, the recent crackdown on certain tech companies raised concerns among investors, emphasizing the importance of thorough due diligence.

According to a report from Morningstar, “Investors should look closely at each ETF's holdings, expense ratios, and historical performance to ensure they align with their investment goals.” Additionally, diversification across different sectors and asset classes remains a prudent strategy to mitigate risks.

Expert Insights

Financial experts are optimistic about China's growth trajectory, but caution against overexposure. “Investing in ETFs that focus on China's growth sectors can be rewarding, but it is crucial to balance these investments with more stable options in your portfolio,” advises Jessica Huang, a senior investment strategist at Fidelity Investments.

Conclusion

The current landscape of Chinese equities presents a compelling opportunity for investors aiming to diversify their portfolios through ETFs. With government stimulus measures propelling sectors like technology and renewable energy, investors can strategically position themselves to capitalize on China's next-generation growth engines. As always, careful consideration of market conditions, individual risk tolerance, and thorough analysis of fund performance are essential in navigating this dynamic environment.

By harnessing the potential within the Chinese market, investors can unlock new avenues for growth while remaining vigilant about the inherent risks involved. As the market evolves, staying informed and adapting investment strategies will be crucial for long-term success.

For further insights and resources on ETF investments, consider visiting UOB Asset Management or exploring tools available on platforms like Morningstar.