The Future of Oil: Navigating Demand Declines and Supply Surges

The global oil market is poised for a seismic shift as the International Energy Agency (IEA) projects that demand will plateau by 2030, largely influenced by the rapid ascent of electric vehicles (EVs). With oil demand growth anticipated to increase by merely 2.5 million barrels per day (bpd) between 2024 and 2030, the landscape of oil production and consumption is changing dramatically. By the end of the decade, the IEA forecasts that global oil demand will stabilize at approximately 105.5 million bpd.

Key Insights from the IEA Report:

-

Declining Demand: The rise in EV adoption is forecasted to displace around 5.4 million bpd of oil demand globally by the end of the 2020s. This trend is particularly evident in China, which is ramping up its efforts in transport electrification.

-

Supply Dynamics: The United States is projected to maintain its status as the world's leading oil producer, with production levels expected to exceed 20 million bpd. However, growth in U.S. oil production is slowing as companies reduce capital expenditures.

-

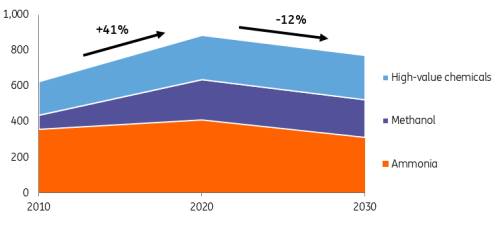

Petrochemical Sector Growth: Even as demand declines in traditional transport fuels, the petrochemicals industry is anticipated to be the main driver of future oil demand due to increasing urbanization and consumption of petroleum-derived products.

-

Refinery Challenges: Refineries designed for traditional fuels are expected to face closures as demand shifts. The IEA highlights that the refining sector may increasingly struggle with excess capacity as demand for refined products is set to peak in 2027.

Investment Implications

For investors, these trends signal a need for strategic diversification into alternative energy and petrochemical markets. As traditional oil investments face new headwinds, the IEA's insights suggest that crude prices may remain suppressed due to oversupply. Investors should reassess their portfolios to align with the evolving landscape of energy consumption.

A Closer Look at Electric Vehicles

As of 2025, the IEA estimates that EVs will account for 20% of all vehicle sales globally, translating to approximately 20 million EVs sold out of a total of 100 million vehicle sales. This shift not only represents a significant milestone for clean energy but also catalyzes a dramatic transformation within the oil sector.

The ongoing transition to electric vehicles is underscored by government incentives and a cultural shift towards sustainability. Countries worldwide are increasingly adopting policies favoring EV production and usage, further solidifying the trend towards electrification. For instance, in China, ambitious targets aim to electrify public transport and commercial vehicles significantly, leading to decreased reliance on fossil fuels.

The Petrochemical Sector's Role

Despite the declining demand for traditional oil, the petrochemical industry is projected to remain robust. The IEA forecasts that by 2030, the global production of polymers and synthetic fibers will require 18.4 million bpd of oil, accounting for more than one in every six barrels produced. This demand is fueled by urbanization trends in emerging economies and a growing appetite for diverse chemical products.

The petrochemical sector’s resilience amid declining transportation fuel demand presents investment opportunities for stakeholders looking to pivot towards growth areas. Companies that diversify their portfolios to include petrochemical operations may benefit from this sector's anticipated expansion.

Refining Challenges and Future Outlook

As the oil market grapples with these transformations, refineries built to cater to traditional fossil fuel demand may not adapt quickly enough. The IEA anticipates that global demand for refined products will peak in 2027 at 86.3 million bpd, only slightly higher than current levels. This forecast indicates a potential oversupply in the refining sector, leading to increased closures of less efficient plants, particularly in Europe and North America.

Looking ahead, the production capacity for crude oil is expected to increase by 5.1 million bpd to 114.7 million bpd by 2030, driven predominantly by the U.S. and Saudi Arabia. This expanding capacity, juxtaposed with stagnant demand, suggests that crude prices may remain low, pressuring producers to adapt or exit the market.

Conclusion

The oil market is entering a transformative period characterized by declining demand and shifting supply dynamics. Investors must remain vigilant and agile in navigating this complex landscape. Strategic diversification into alternative energy and the petrochemical sector will be crucial as the market adjusts to the realities set forth by the growth of electric vehicles and a global push for sustainability.

As the IEA concludes, “if OPEC+ crude oil supply is sustained at current rates, all else being equal, global oil supply would rise to 107.2 million bpd by 2030, suggesting prices would have to drop to prevent an untenable stock build.” For investors, understanding these shifts will be essential to capitalizing on future opportunities in a rapidly evolving market landscape.

For further insights and analysis on the evolving dynamics of the energy sector, stakeholders can refer to S&P Global and ICIS.