The Rise of Thematic ETFs: Capitalizing on Innovation in 2025

In 2025, thematic exchange-traded funds (ETFs) have emerged as a popular investment vehicle, particularly those targeting innovative sectors such as artificial intelligence (AI), renewable energy, and biotechnology. Noteworthy examples include the Global X Robotics & AI ETF (BOTZ), which has recorded a remarkable year-to-date return of 30%, and the Invesco Solar ETF (TAN), achieving an impressive 28% return. This surge in performance has propelled these funds to collectively surpass $10 billion in assets under management.

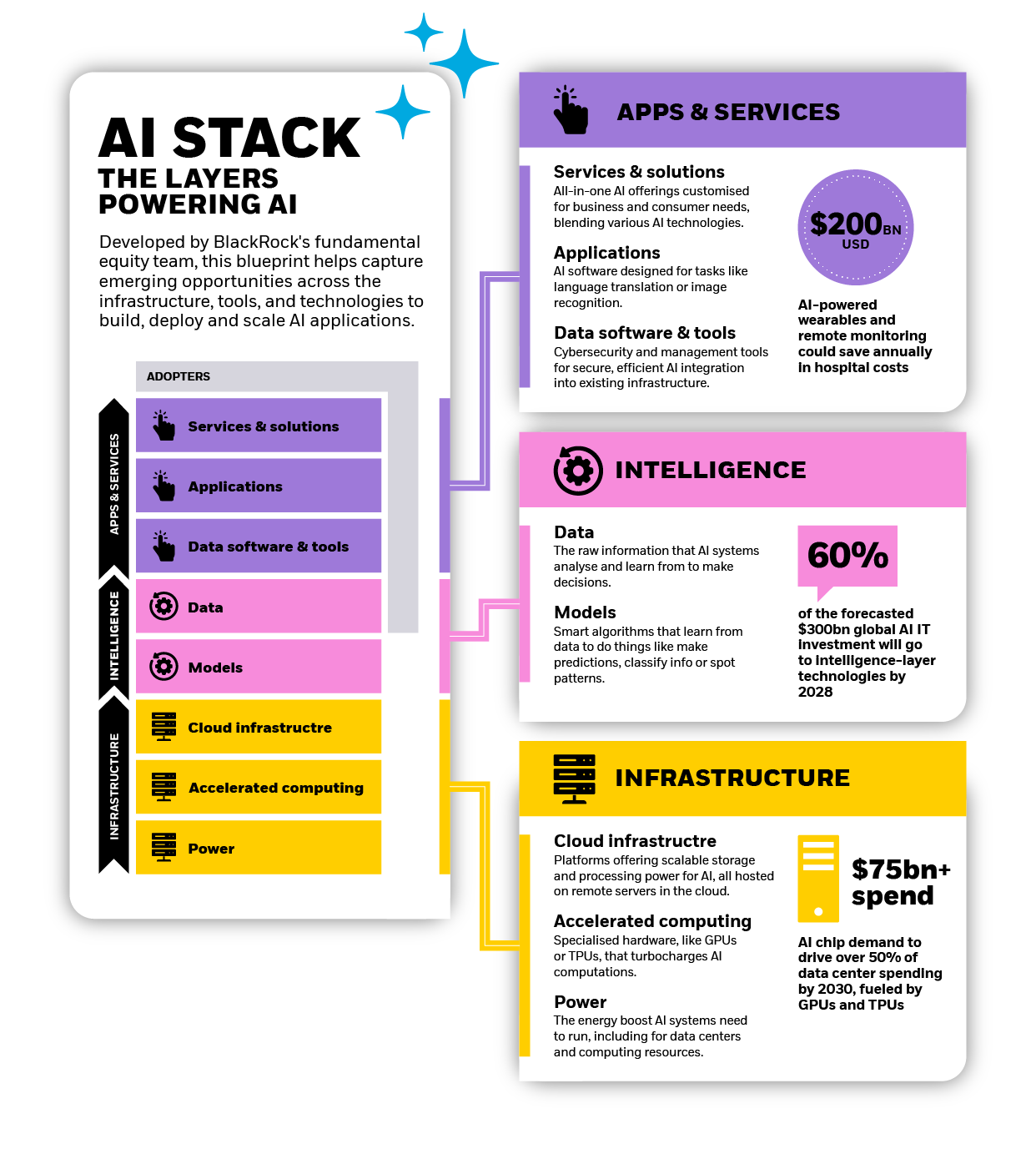

Investors are increasingly drawn to thematic ETFs due to their potential for high growth in sectors expected to drive future economic expansion. Thematic investing allows for the alignment of portfolios with trends that reflect global challenges and technological advancements. For instance, the demand for renewable energy sources is a direct response to climate change, while AI is transforming numerous industries by enhancing operational efficiencies and enabling data-driven decision-making.

Thematic ETFs and Growth Potential

As traditional investment strategies evolve, these thematic funds offer a way to capitalize on emerging trends while diversifying portfolios. Thematic ETFs typically focus on a specific theme or trend, providing investors with concentrated exposure to sectors poised for growth. For example, the biotechnology sector is seeing rapid advancements in drug development and personalized medicine, driven by innovations that cater to aging populations and chronic diseases.

According to Morningstar's latest research, the popularity of thematic ETFs is expected to continue growing. “Investors are eager to tap into the growth potential of sectors that are not only innovative but also essential for a sustainable future,” said a Morningstar analyst. This sentiment is echoed across the financial community as more investors seek to align their investments with their values.

Navigating Risks with Thematic Investments

However, it is essential for investors to remain aware of the inherent risks associated with concentrated investments in specific sectors, which can lead to increased volatility. Thematic ETFs, while offering high potential returns, can also be subject to market whims and sector-specific downturns. For instance, the ARK Innovation ETF (ARKK), which heavily invests in disruptive technologies, experienced a significant 40% drawdown in late 2024, highlighting the risks associated with such concentrated strategies.

Investors are advised to conduct thorough research and consider their risk tolerance before diving into thematic ETFs. Diversifying across various themes or sectors can help mitigate potential losses during periods of volatility.

The Future of Thematic ETFs

As the market landscape continues to shift, thematic ETFs represent a compelling opportunity for investors looking to align their portfolios with innovative and sustainable growth trajectories. The ongoing evolution of technology and an increasing focus on sustainability are likely to drive further investment into these funds.

As we move through 2025, the potential of thematic ETFs to deliver returns that outpace traditional indices suggests that they may play an increasingly prominent role in investment strategies. According to Bloomberg, the total assets in thematic ETFs are projected to continue growing as retail and institutional investors alike recognize the value of exposure to innovation.

Conclusion

In conclusion, the rise of thematic ETFs in 2025 marks a significant shift in investment strategies, with a focus on sectors such as AI, renewable energy, and biotechnology. While these funds present exciting opportunities for growth, it is crucial for investors to remain vigilant about the risks associated with concentrated investments. As the demand for innovative solutions to global challenges continues to increase, thematic ETFs are likely to become a cornerstone of modern investment portfolios.

For ongoing updates and analysis on thematic ETFs, reputable sources such as ETF.com and Morningstar provide valuable insights into performance and market trends.