The Silent Surge: Platinum's Unexpected Outperformance in Commodity Markets

As of July 2025, platinum has emerged as a surprising outperformer in the commodity markets, defying expectations and outpacing other precious metals. This article delves into the factors contributing to this trend and what it means for investors.

Market Dynamics Driving Platinum's Performance

Platinum prices have seen a significant increase, attributed to several key factors:

-

Automotive Demand: The resurgence in automotive production, particularly in the electric vehicle (EV) sector, has spurred demand for platinum, which is used in catalytic converters. With stricter emissions regulations globally, manufacturers are increasingly turning to platinum as a cleaner alternative. According to the World Platinum Investment Council, automotive demand is projected to account for approximately 40% of platinum consumption in 2025, significantly bolstered by the push for greener technologies.

-

Jewelry Sector Recovery: Following a downturn during the pandemic, the jewelry market is rebounding, with platinum jewelry gaining popularity due to its durability and prestige. Market reports indicate that global platinum jewelry demand surged by 25% year-on-year in early 2025, highlighting a resurgent consumer appetite for luxury items.

-

Investment Interest: Investors are increasingly viewing platinum as a hedge against inflation and currency fluctuations, leading to a rise in speculative buying. Platinum’s price rally has attracted institutional investors looking for diversification, as evidenced by a 30% increase in platinum-backed exchange-traded funds (ETFs) since the start of the year.

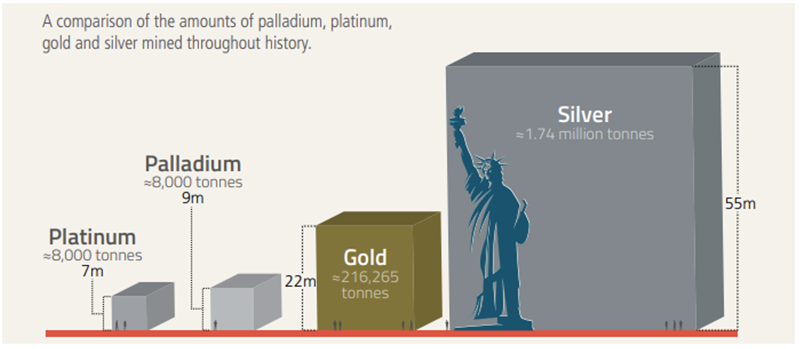

Comparative Analysis with Other Commodities

In contrast to gold and silver, which have faced headwinds due to rising interest rates and a stronger dollar, platinum's unique demand drivers have allowed it to carve out a niche. According to the latest analyses from Lipper Alpha, platinum has outperformed gold by approximately 15% year-to-date, showcasing its resilience in a volatile market.

This performance is further underscored by the fact that gold has struggled to maintain its value amid a stronger dollar and rising interest rates, with its price hovering around $1,850 per ounce. In contrast, platinum prices have surged to around $1,200 per ounce, making it a compelling alternative for investors seeking stability.

Future Outlook

Looking ahead, analysts predict that platinum will continue to benefit from its dual role as both an industrial metal and an investment asset. The ongoing transition to greener technologies and the potential for increased automotive production will likely sustain demand.

Notably, the International Energy Agency (IEA) has forecasted that demand for platinum in catalytic converters alone could increase by 20% globally by 2030 as more countries implement stringent emissions regulations. This trend is further supported by the automotive industry's shift towards hydrogen fuel cells, which also utilize platinum in their technology.

Investors are advised to consider platinum as a strategic addition to their portfolios, particularly as global economic conditions evolve. The Wall Street Journal suggests that investors should monitor developments in the automotive sector closely, as shifts in consumer preferences and technological advancements could significantly influence platinum prices.

Conclusion

Platinum's unexpected rise in 2025 highlights the importance of understanding market dynamics and consumer trends. As the commodity landscape shifts, staying informed about these developments will be crucial for investors seeking to capitalize on emerging opportunities. With strong demand in the automotive and jewelry sectors, alongside increasing investor interest, platinum presents a unique investment narrative amidst a complex commodity market.

For further insights and updates on commodities and market trends, resources such as Bloomberg Markets and Kitco provide comprehensive data and analysis.

Keywords

Platinum, commodities, investment, automotive, jewelry, market trends