The Rise of Municipal ETFs: A Strategic Shift in Fixed Income Investing

In an era marked by heightened market volatility and evolving investor preferences, municipal exchange-traded funds (ETFs) have emerged as a compelling option for fixed income investors. As they gain traction, especially among financial advisors and retail investors alike, municipal ETFs are reshaping investment strategies, offering unique benefits such as tax efficiency and improved liquidity. This article delves into the factors driving their popularity, industry insights, and the implications for fixed income portfolios.

Key Drivers of Popularity

1. Tax Efficiency

One of the foremost advantages of municipal ETFs is their tax efficiency. Unlike traditional taxable bonds, municipal bonds typically offer income that is exempt from federal taxes and, in some cases, state and local taxes as well. This feature makes them particularly attractive in a rising interest rate environment, where maximizing after-tax returns becomes paramount. Investors can enjoy yields that, when adjusted for tax implications, rival those of taxable counterparts.

According to Vanguard, the tax-exempt nature of municipal income allows investors to potentially enhance their overall returns, particularly for those in higher tax brackets. The firm highlights municipal ETFs as an effective way to access this asset class while benefiting from the structural efficiencies of ETFs over mutual funds.

2. Liquidity and Accessibility

Municipal ETFs provide significant liquidity compared to individual municipal bonds, which can often be illiquid and challenging to trade. Investors can buy and sell shares of municipal ETFs throughout the trading day, ensuring they can react swiftly to market conditions.

This liquidity is particularly crucial for tactical investors who may wish to adjust their portfolios based on changing economic indicators or interest rates. The ease of access to these funds—typically available on major exchanges like the New York Stock Exchange—makes them an appealing choice for both seasoned investors and those new to the municipal bond market.

3. Evolving Investor Base

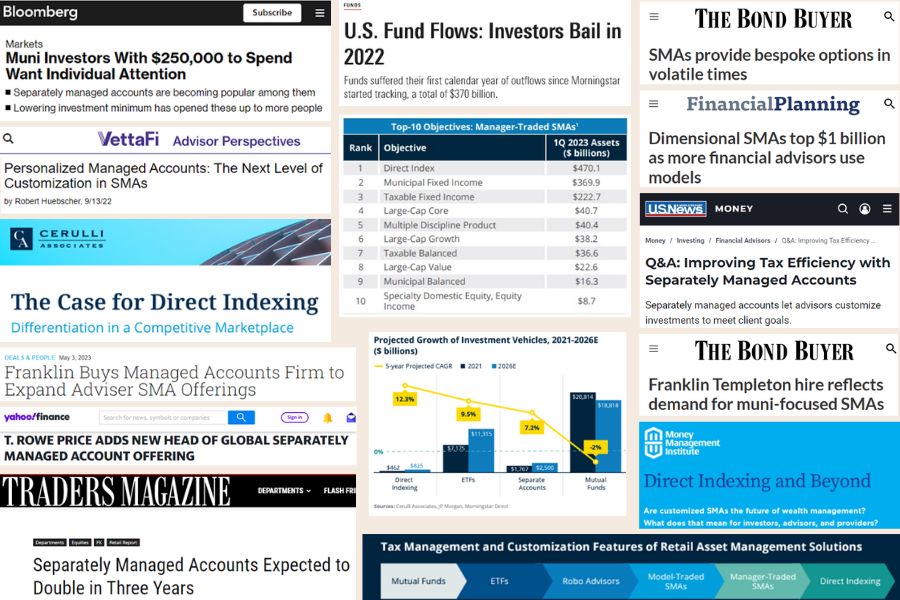

The demographic of municipal bond investors has shifted significantly in recent years. Historically dominated by buy-and-hold retail investors, the market has seen an influx of financial advisors using municipal ETFs as part of more strategic asset allocation.

As noted by Justin Schwartz, a leader at Vanguard, “Municipals have become a more dominant part of model portfolios.” This shift can be attributed to the growing recognition of the tactical opportunities available within municipal ETFs, including tax-loss harvesting strategies, which allow investors to optimize their tax positions during volatile market conditions.

Industry Insights

The rise of municipal ETFs reflects a broader trend of democratizing access to the bond market. As investment platforms evolve and become more accessible, a wider range of investors can now participate in these markets through low-cost and diversified options.

Schwartz emphasizes that “the ETF structure provides a greater level of tax efficiency for the end investor, allows for intraday trading, and provides consistent exposure.” This flexibility supports the growing appetite for tax-efficient investing amid rising interest rates and economic uncertainties.

Moreover, industry experts point out that the design of municipal ETFs—including their focus on healthy yield maximization, tax efficiency, and good liquidity—plays a crucial role in their growing acceptance. Vanguard's strategic approach to product design and benchmark selection underscores the importance of creating competitive municipal ETF offerings that resonate with a diverse investor base.

Market Performance and Trends

As of mid-2025, the growth of municipal ETFs aligns with broader trends in the ETF market. Data from Vanguard indicates that ETF assets rose 8.79% in the first quarter of 2025, reaching $8.87 trillion, with fixed income ETFs garnering significant inflows. The heightened interest in tax-exempt income, coupled with the need for liquidity in uncertain times, has positioned municipal ETFs as a formidable asset class.

Case Study: Vanguard’s Municipal ETFs

Vanguard's suite of municipal ETFs exemplifies the strategic shift in fixed income investing. The Vanguard Intermediate-Term Tax-Exempt Bond ETF (VTEB) and the Vanguard California Tax-Exempt Bond ETF (VCAL) have gained popularity for their robust performance and tax efficiency.

The VTEB offers exposure to a diversified portfolio of municipal bonds, while the VCAL focuses specifically on California municipal bonds. Both funds leverage Vanguard's experienced management and competitive fee structures, appealing to cost-conscious investors.

Conclusion

The increasing popularity of municipal ETFs signifies a strategic shift in fixed income investing. As more investors recognize the advantages these products offer—such as tax efficiency, liquidity, and broader access—municipal ETFs are likely to play an increasingly vital role in diversified investment portfolios.

Investors should consider their specific financial goals, risk tolerance, and tax situations when integrating these instruments into their strategies. As the market continues to evolve, municipal ETFs stand out as a compelling choice for those seeking a tax-efficient and liquid investment vehicle in an unpredictable economic landscape.

For more insights on municipal ETFs and the strategies to effectively incorporate them into your portfolio, visit Vanguard’s municipal ETF insights.