The Strategic Shift Towards Bond ETFs: Navigating Interest Rate Risks

In a financial landscape marked by rising interest rates and persistent inflation, investors are shifting their strategies towards bond exchange-traded funds (ETFs) as a solution for enhanced liquidity, transparency, and cost efficiency. With global economic conditions evolving, the unique features of bond ETFs are increasingly seen as vital tools for portfolio management.

The Appeal of Bond ETFs

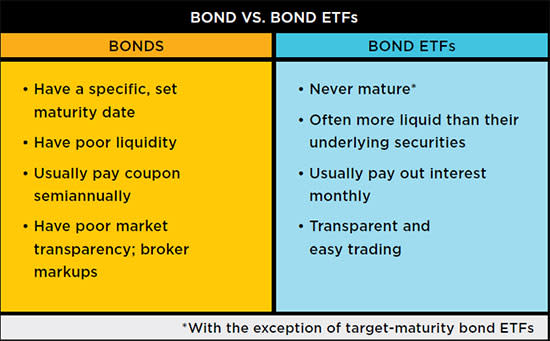

Bond ETFs have emerged as a formidable alternative to traditional bond investing, offering several compelling advantages:

-

Liquidity: Unlike individual bonds, which often require substantial capital and can be challenging to trade, bond ETFs allow investors to buy or sell shares throughout the trading day. This flexibility is essential in a volatile market where swift decision-making can enhance returns.

-

Transparency: Investors benefit from the ability to track the performance of bond ETFs and their underlying assets in real time. This level of transparency facilitates more informed decision-making compared to traditional bond investments that may not provide immediate performance metrics.

-

Lower Costs: Generally, bond ETFs have lower expense ratios compared to actively managed bond funds. This cost efficiency is particularly attractive in an environment where maximizing returns is paramount.

Current Market Trends

A notable trend in the market is the increasing appetite for bond ETFs as investors seek to mitigate risks associated with rising interest rates. According to recent data, the SPDR® Blackstone High Income ETF (HYBL) and the SPDR® Bridgewater® All Weather® ETF (ALLW) have seen significant inflows, as they provide diversified exposure to fixed income. The latter is particularly appealing given its strategic allocation across various asset classes, which aims to reduce overall portfolio risk.

The bond ETF market has experienced robust growth, with assets under management reaching new heights. As of mid-2025, bond ETFs have seen a year-to-date increase of approximately 30%, reflecting a broader trend of investors seeking secure but liquid investment options amid economic uncertainty.

Expert Insights

Financial experts emphasize the strategic advantages of integrating bond ETFs into diversified investment portfolios. “In a rising rate environment, the ability to adjust exposure quickly through ETFs can be a game changer for investors,” says Mark Zandi, chief economist at Moody’s Analytics. “The liquidity and lower costs associated with bond ETFs make them a compelling option for both retail and institutional investors alike."

Moreover, the attractiveness of bond ETFs is underscored by their ability to adapt to inflationary pressures. With inflation rates hovering above 4%, traditional fixed-income securities have struggled to provide real returns, making bond ETFs a preferred choice for those looking to preserve capital while seeking reasonable returns.

Conclusion

As the financial landscape continues to evolve with unpredictable interest rate movements and inflationary concerns, bond ETFs are poised to play an increasingly vital role in portfolio construction. Their unique traits—liquidity, transparency, and cost efficiency—offer a robust framework for investors navigating today’s complex market conditions.

By leveraging these investment vehicles, investors can enhance their resilience against economic volatility while positioning themselves for potential growth. The strategic shift towards bond ETFs not only reflects changing investor attitudes but also highlights an essential evolution in modern portfolio management.

Keywords

Bond ETFs, Interest Rates, Inflation, Liquidity, Transparency

References

Additional Insights

In summary, the bond ETF market's growth is indicative of a broader shift in investment practices as investors adapt to a rapidly changing economic environment. The flexibility and advantages offered by bond ETFs make them not just a practical choice but a strategic necessity for the forward-thinking investor. As the bond market continues to adjust to new realities, those who embrace these innovative financial products may find themselves better equipped to achieve their investment goals.