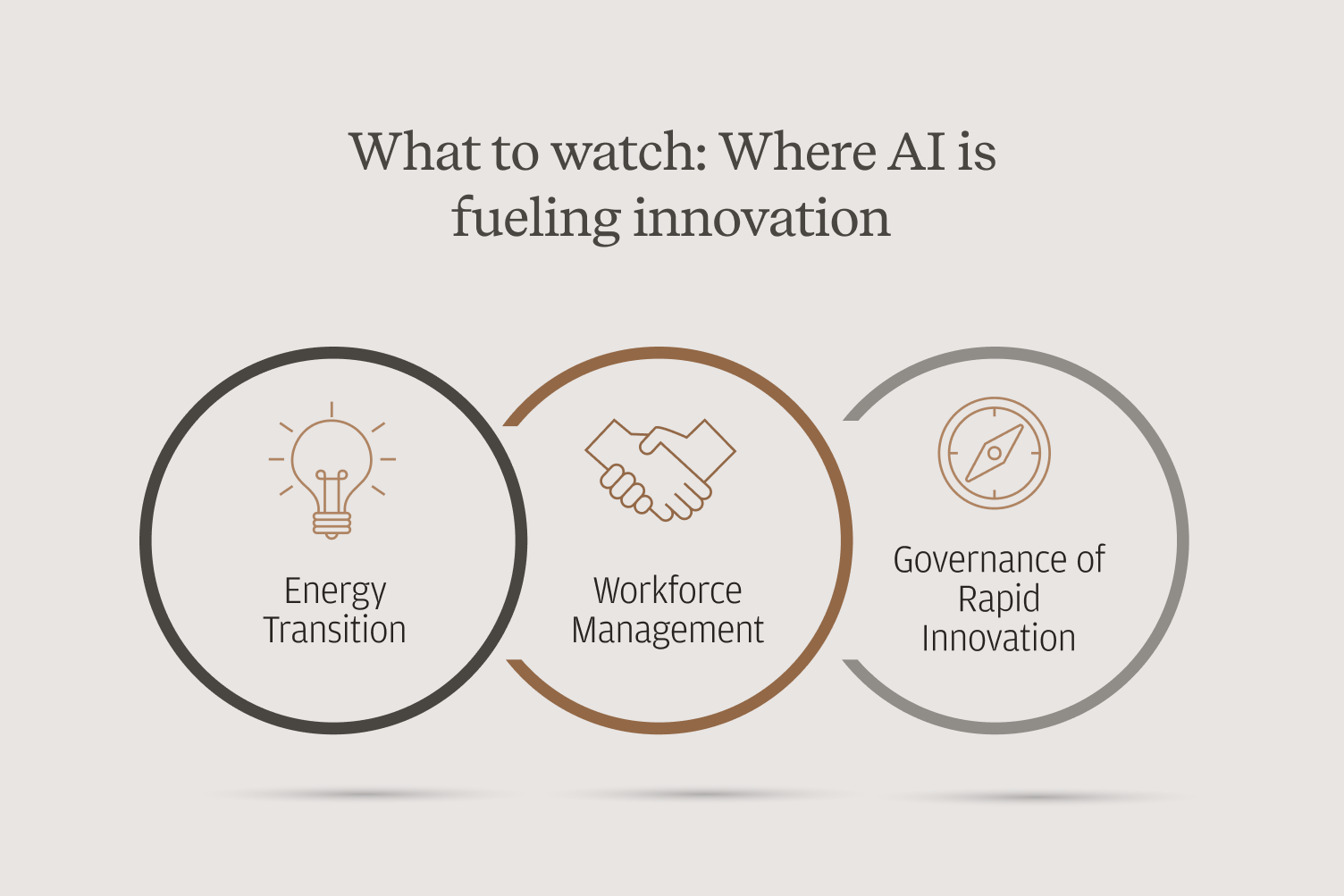

Thematic ETFs: A Deep Dive into High-Growth Sectors

As global markets evolve, investors are increasingly drawn to thematic exchange-traded funds (ETFs) that capitalize on high-growth sectors such as artificial intelligence (AI) and renewable energy. These funds provide a unique opportunity for investors to gain exposure to innovative trends without the complexity of individual stock selection. As of July 2025, thematic ETFs like the Global X Robotics & AI ETF (BOTZ) and Invesco Solar ETF (TAN) have showcased exceptional performance, with year-to-date returns of 30% and 28%, respectively.

Market Dynamics

The thematic ETF landscape is indicative of a broader shift in investment strategies. Traditional asset classes are often deemed insufficient in capturing the growth potential of emerging technologies and sustainable practices. Thematic ETFs allow investors to align their portfolios with trends that promise substantial upside potential, particularly in sectors such as AI and renewable energy.

According to a recent report by Morningstar, the thematic ETF market has seen a surge in assets, reflecting a growing appetite for targeted investment strategies. These funds typically focus on specific industries or themes, which not only reduces the need for intricate research but also leverages the overarching consumer and technological trends that are reshaping the economy.

Performance Analysis

The performance of thematic ETFs has outpaced broader market indices. For instance, the iShares Core MSCI World UCITS ETF rose 2.65% in June 2025, outstripping the average fund in the global large-cap category, which gained only 2.18%. This performance highlights a burgeoning investor confidence in funds that target innovative sectors.

The increase in returns can be attributed to several factors including heightened consumer demand for advanced technologies, government support for renewable initiatives, and a general shift towards sustainability. Thematic ETFs also tend to exhibit a higher risk-return profile, making them appealing to investors looking to maximize their returns in a competitive landscape.

Investment Strategies

Investors considering thematic ETFs should adopt a comprehensive approach to maximize their benefits:

-

Diversification: By integrating thematic ETFs into a broader investment portfolio, investors can achieve exposure to various sectors, effectively mitigating overall portfolio risks.

-

Long-term Holding: Given the promising growth trajectories of sectors like AI and renewable energy, a long-term investment horizon can yield substantial returns. The rapid pace of technological advancement and regulatory support for green initiatives will likely sustain momentum in these sectors.

-

Active Monitoring: While thematic ETFs simplify investment decisions, investors should remain vigilant about market trends and sector performance. Regularly adjusting one’s portfolio in response to market dynamics is essential for capitalizing on emerging opportunities.

Noteworthy Thematic ETFs

-

Global X Robotics & AI ETF (BOTZ): This fund focuses on companies that are involved in the development and production of robotics and AI technologies, positioning itself well in an industry projected to grow significantly in the coming years.

-

Invesco Solar ETF (TAN): With the increasing push for renewable energy solutions, TAN provides exposure to companies in the solar energy sector, driven by the global shift towards sustainable energy sources.

Conclusion

Thematic ETFs represent a compelling investment opportunity for those looking to align their portfolios with future growth sectors. As technology and sustainability continue to drive market dynamics, these funds provide a strategic vehicle for investors to gain exposure to high-growth industries. Investors are encouraged to assess their risk tolerance and investment objectives when considering thematic ETFs as part of their wider investment strategy.

In the evolving landscape of financial markets, thematic ETFs stand out as an innovative and lucrative option for discerning investors. With the right strategies, these funds can enhance portfolio performance and provide significant long-term gains.