Chicago Man Loses $10K to Cryptocurrency Scam Impersonating Elon Musk

A Chicago-area man has reported losing $10,000 to a cryptocurrency scam where a fraudster impersonated billionaire tech mogul Elon Musk. This alarming incident underscores the rising tide of scams in the cryptocurrency space, where opportunistic criminals continue to exploit both individual investors and the allure of digital currencies.

Richard Lyons, the victim of this scheme, believed he was making a legitimate investment after being approached by someone claiming to represent Musk in an exclusive cryptocurrency opportunity. “I thought it was a once-in-a-lifetime chance,” said Lyons, who later discovered he had been duped after several months of attempts to retrieve his funds.

The Federal Bureau of Investigation (FBI) has highlighted the alarming trend of cryptocurrency scams, noting that in 2024 alone, victims lost nearly $9 billion to fraudsters, with $6 billion attributed specifically to individuals tricked into sending cryptocurrencies to scammers. This year, impersonation scams, particularly those involving high-profile celebrities, have surged, with many perpetrators utilizing sophisticated methods such as deepfake technology and AI-generated imagery to enhance their credibility.

The FBI encourages victims to report fraud cases quickly, as the likelihood of recovery diminishes over time. “Being proactive and reporting scams as soon as possible can make a significant difference,” an FBI spokesperson stated. Private blockchain companies like Lionsgate Network have also emerged as resources to help track stolen funds through the cryptocurrency trail.

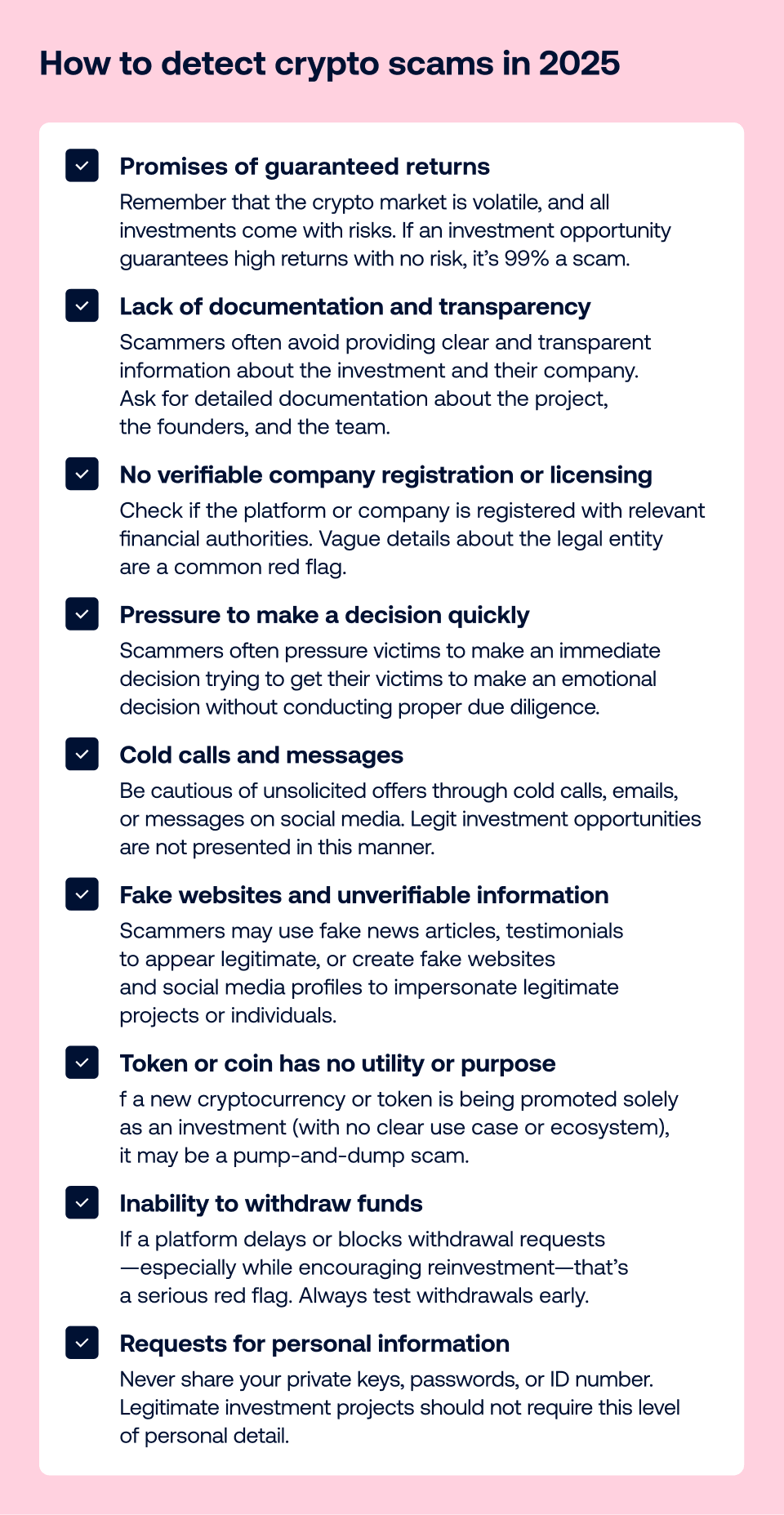

As cryptocurrency continues to gain traction among investors, the potential for scams remains high. The anonymity and lack of regulation surrounding cryptocurrencies create a fertile ground for fraud. “Scammers are becoming more sophisticated, using tactics that blur the line between reality and deception,” said a representative from Lionsgate Network. “It’s essential for investors to remain vigilant and conduct thorough due diligence before committing funds.”

Lyons's case exemplifies a growing need for enhanced investor education surrounding cryptocurrency investments. Financial experts advocate for critical thinking and skepticism, especially regarding unsolicited offers that promise unrealistic returns. “Investors must understand that if something sounds too good to be true, it likely is,” advised cybersecurity analyst Brian McCaffrey.

The overall landscape of cryptocurrency remains fluid, with both risks and opportunities on the horizon. As regulators grapple with the implications of this burgeoning market, scammers are poised to adapt, making it imperative for potential investors to exercise caution and seek guidance from trusted financial advisors.

As the cryptocurrency market evolves, ongoing vigilance from both individuals and regulatory bodies will be crucial in mitigating the risks posed by fraudsters. As highlighted by Lyons's experience, taking proactive steps to verify information and report suspicious activity is vital for preserving the integrity of this emerging financial landscape.

For those interested in cryptocurrency investments, it is essential to stay informed and educated about potential red flags. Engaging with reputable sources and platforms can provide a clearer understanding of the risks involved and how to navigate them effectively.

In conclusion, as the allure of cryptocurrencies grows, so does the urgency for investor education and protective measures against fraud. The case of Richard Lyons serves as a stark reminder that while the digital currency revolution offers significant potential, it also attracts those looking to exploit the unwary.

For further information on cryptocurrency scams and protective measures, the FBI and various financial advisories provide resources and guidance.

For more on this topic, visit the ABC7 Chicago article.