Analyzing the 2025 Altcoin Rally: Momentum, Market Cap, and Investment Strategies

The cryptocurrency market in 2025 is witnessing a remarkable resurgence in altcoin performance, signaling a renewed phase of investor optimism beyond Bitcoin's dominance. With the Altcoin Season Index climbing to 27—up from a low of 15 earlier this year—27 out of the top 100 cryptocurrencies have outperformed Bitcoin over the last 90 days. This surge reflects growing capital inflows, technological developments, and regulatory progress that collectively underpin a vibrant altcoin market.

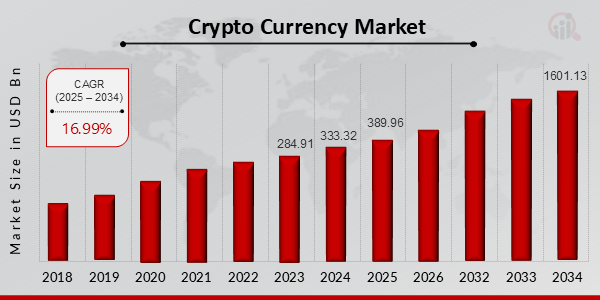

Market Capitalization and Growth Trajectory

As of mid-2025, the total cryptocurrency market capitalization has expanded to approximately $3.46 trillion, representing a robust year-to-date growth of 54.03%. This acceleration is driven not only by Bitcoin reaching new all-time highs—recently surpassing $112,000—but also by a broadening ecosystem of altcoins charting significant gains across diverse sectors such as decentralized finance (DeFi), non-fungible tokens (NFTs), and sustainability-focused blockchain projects.

This strong market expansion signals increasing investor confidence and maturation in the cryptocurrency landscape, with altcoins capturing a larger share of total trading volume and institutional interest.

Key Drivers Fueling Altcoin Momentum

Technological Innovation and Network Upgrades

Platforms like Ethereum (ETH) remain at the forefront, benefiting from ongoing network upgrades aimed at enhancing scalability and lowering transaction fees. The implementation of Ethereum’s Layer 2 solutions and improvements in smart contract efficiency have catalyzed developer activity and expanded use cases, reinforcing Ethereum’s dominant role in DeFi and NFTs.

Similarly, high-throughput blockchains like Solana (SOL) continue to attract developers and investors with their ability to process thousands of transactions per second at minimal cost, underpinning a shift toward more scalable decentralized applications.

Institutional Adoption and Regulatory Clarity

The landscape for altcoins is evolving with increased regulatory clarity in key jurisdictions, notably the United States. Recent SEC guidelines have facilitated the approval of cryptocurrency exchange-traded funds (ETFs) linked to altcoins such as Solana and XRP, opening avenues for institutional capital inflows that were historically concentrated in Bitcoin and Ethereum.

The passage of regulatory frameworks like the GENIUS Act for stablecoins and the anticipated CLARITY Act to define crypto market structure have alleviated some investor uncertainty, supporting broader adoption.

Emerging Market Sentiment and Speculative Interest

The bullish sentiment in altcoins is also fueled by speculative momentum, with emerging tokens gaining traction due to innovative use cases and community engagement. Cryptocurrencies such as Bonk (BONK), Hyperliquid (HYPE), and Bittensor (TAO) have attracted attention for their unique value propositions and rapid growth potential, reflecting a market appetite for diversification beyond established projects.

Notable Altcoins to Watch in 2025

| Cryptocurrency | Market Cap Focus | Key Features | 2025 Performance |

|---|---|---|---|

| Ethereum (ETH) | Large-cap | Smart contracts, DeFi, NFTs, Layer 2 scalability | Benefiting from network upgrades reducing costs and increasing throughput |

| Cardano (ADA) | Large-cap | Security-focused smart contracts, institutional partnerships | Price up over 2,700% since 2017, growing institutional interest |

| Solana (SOL) | Large-cap | High throughput, low fees, developer ecosystem | Major ETF approval and growing adoption in DeFi |

| Bonk (BONK) | Emerging token | Meme token with community-driven initiatives | Notable speculative rally |

| Hyperliquid (HYPE) | Emerging token | Innovative DeFi derivatives platform | Rising trading volumes and investor interest |

| Bittensor (TAO) | Emerging token | Decentralized machine learning network | Garnering attention for unique use cases |

Strategic Investment Considerations and Risk Management

While the altcoin rally offers attractive growth opportunities, investors must navigate the inherent volatility and risk profile of these assets with disciplined strategies:

-

Due Diligence: Thorough evaluation of project fundamentals, including governance structures, developer activity, and community engagement, is critical. Understanding the underlying technology and real-world applicability helps mitigate risks of speculative bubbles.

-

Portfolio Diversification: Allocating investments across a spectrum of altcoins, including both established platforms and promising emerging tokens, helps balance risk and return. Given smaller-cap altcoins’ susceptibility to price swings, diversification is a prudent risk management technique.

-

Regulatory Monitoring: Staying abreast of regulatory developments and potential policy shifts can provide early signals of market impact. Legislative outcomes, such as SEC rulings and international regulatory frameworks, remain significant market drivers.

-

Momentum Indicators: Utilizing technical metrics like 7-day price performance and 24-hour trading volume can aid in identifying altcoins with strong market momentum. These indicators help investors spot assets that may be poised for short- to medium-term appreciation.

-

Risk Tolerance Alignment: Given the speculative nature of many altcoins, investors should calibrate exposure based on individual risk tolerance, avoiding over-concentration in highly volatile tokens or meme coins.

Conclusion

The 2025 altcoin rally marks a critical phase in the evolution of the cryptocurrency ecosystem, characterized by expanding market capitalization, increasing institutional participation, and accelerating technological innovation. Ethereum, Cardano, and Solana continue to lead the charge, while emerging tokens offer avenues for diversification and speculative gains.

However, investors must approach this dynamic landscape with rigorous analysis and risk-conscious strategies. By blending fundamental research with momentum insights and regulatory awareness, investors can position their portfolios to capitalize on altcoin growth while safeguarding against volatility.

As the cryptocurrency market matures, the altcoin sector's trajectory will remain a bellwether for broader digital asset adoption and innovation.

References

- Forbes Advisor, Top 10 Cryptocurrencies to Watch

- Economic Times, Cryptocurrency Market Updates

- CoinGecko, Global Cryptocurrency Charts

Disclosure: Cryptocurrency investments are subject to market risks and volatility. This article is for informational purposes only and should not be construed as investment advice. Investors should consult with financial professionals before making investment decisions.