Forex Market Depth Analysis: Leveraging Order Book Insights for Enhanced Trading Strategies in July 2025

In the fast-paced and highly liquid foreign exchange (forex) market, understanding the subtle undercurrents beneath price movements is a critical competitive advantage. As of July 2025, the strategic use of market depth analysis—the real-time study of buy and sell order volumes across multiple price levels—is gaining traction among retail and institutional traders alike. This technique offers a granular view of liquidity, enabling more precise identification of potential support and resistance zones, order flow imbalances, and anticipatory signals for imminent price action.

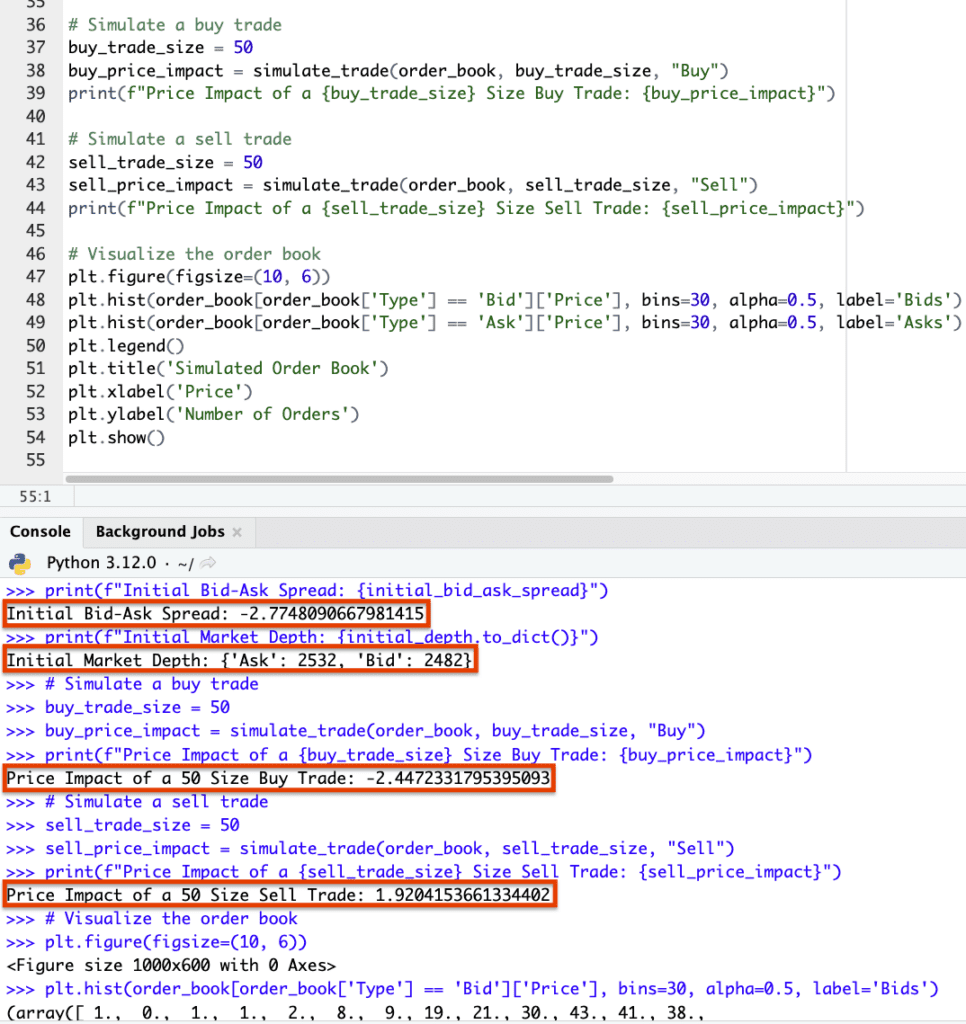

Advanced order book visualization tools display liquidity distribution across price levels, critical for real-time trading decisions.

Understanding Market Depth: Beyond the Price Chart

Market depth, often presented through Level II quotes or an order book, shows the aggregate number of buy (bid) and sell (ask) orders pending at various price points. Unlike traditional price charts that only reflect executed trades, market depth reveals latent supply and demand, allowing traders to anticipate potential price barriers and psychological levels where liquidity clusters.

Key insights gained from depth analysis include:

-

Liquidity Pools: Concentrations of orders at specific prices hint at strong support or resistance zones. For instance, a sizable buy order cluster below the current market price may act as a floor, while heavy sell orders above can cap upside movement.

-

Order Flow Imbalances: Disparities between bid and ask volumes can signal directional bias. A persistent excess of buy orders may foreshadow upward momentum, whereas dominance of sell orders might indicate bearish pressure.

-

Stop-Loss Clusters and Breakout Zones: Certain price levels may contain numerous stop-loss orders. When triggered, these can induce rapid price cascades, often exploited by sophisticated traders to predict volatility surges.

This depth of insight elevates market depth analysis above basic volume or price-based technical indicators, offering a more nuanced reflection of market participant intentions.

Sophisticated Tools for Market Depth Analysis

Technological advancements have democratized access to high-fidelity order book data. Leading forex trading platforms now offer features such as:

-

Real-Time Bid/Ask Volume Visualizations: Dynamic displays of order sizes at each price level update continuously to reflect the evolving market.

-

Heatmaps: Color-coded representations indicate the concentration of orders, allowing quick identification of liquidity “hot spots.”

-

Historical Depth Data: Some platforms archive order book snapshots, enabling traders to recognize recurring patterns or liquidity shifts over time.

For example, popular platforms like TradingView integrate market depth modules alongside traditional technical charts, providing a comprehensive toolkit for strategy development. This integration allows traders to correlate order book data with technical signals—such as moving averages, RSI, or Fibonacci retracement levels—for a multi-layered analysis.

Scalpers leverage immediate liquidity information to time precise entry and exit points.

Strategic Applications Across Trading Styles

1. Scalping and Short-Term Trading

Scalpers, who capitalize on small price movements, find market depth invaluable for timing entries and exits. By observing the ebb and flow of order volumes, scalpers can predict where price might stall or accelerate. For example, a sudden increase in sell orders at a particular level might indicate an impending retracement, prompting a quick exit or a short position.

2. Swing Trading

Swing traders use market depth to validate traditional support and resistance zones. Large liquidity pools at these levels reinforce their significance, increasing confidence in trend reversal or breakout setups. Depth data also helps in avoiding false breakouts by highlighting whether price moves are supported by genuine order flow or mere price fluctuations.

3. Algorithmic and High-Frequency Trading

Algorithmic strategies increasingly incorporate order book information to optimize execution and minimize slippage. By analyzing depth data, algorithms can detect hidden liquidity pockets and adjust trade sizes or timing accordingly. This real-time responsiveness enhances profitability and reduces market impact.

Challenges and Risks in Market Depth Analysis

While the benefits of market depth analysis are compelling, traders must navigate inherent challenges:

-

Data Latency: Even minor delays in order book updates can cause misinterpretation, especially in fast-moving markets where liquidity shifts occur within milliseconds.

-

Market Manipulation: Large institutional players sometimes place spoof orders—large orders with no intention of execution—to create false impressions of supply or demand, misleading retail participants.

-

Volatility and External Shocks: Sudden geopolitical events or economic news releases can cause rapid order book changes, making static depth readings unreliable without contextual awareness.

Given these risks, experts recommend using market depth analysis as part of a broader framework that includes macroeconomic fundamentals, robust technical indicators, and stringent risk management protocols.

Expert Perspectives on Integrating Market Depth

John Peters, a senior market strategist at FXStreet, emphasizes:

"Market depth offers a window into the intentions of both retail and institutional players. However, it's not a crystal ball. Successful traders combine depth insights with broader market context and maintain discipline in execution."

Meanwhile, Sophia Nguyen, a quantitative analyst at a leading hedge fund, notes:

"Incorporating order book data into algorithmic models has improved our trade execution efficiency by reducing slippage by approximately 15% over the past year. But we remain cautious of overfitting strategies solely on depth signals due to their susceptibility to sudden market shifts."

Visualization of market depth integrated with price action illustrating liquidity clusters.

Conclusion: A New Frontier in Forex Trading

As the forex landscape evolves, market depth analysis emerges as a sophisticated and actionable tool to decode the complex dance of liquidity and price. By leveraging granular order book data, traders can sharpen their timing, enhance risk control, and gain deeper insights into market sentiment.

Nevertheless, mastery requires balancing depth analysis with awareness of its limitations, integrating it into a comprehensive trading plan. For investors aiming to navigate July 2025’s dynamic forex markets, adopting market depth insights may mark the difference between reactive speculation and strategic foresight.

References

- TradingView: Forex Market Depth Analysis and Trading Strategies

- FXStreet: Forex News and Real-Time Analysis

- FOREX.com: Market News and Analysis

Keywords: Forex, market depth, order book, liquidity, trading strategies, forex trading, order flow, risk management, technical analysis, algorithmic trading

Published: July 12, 2025