Institutional Adoption and Regulatory Advances Propel Bitcoin Beyond $118,000: Market Implications and Strategic Insights

Bitcoin (BTC) has recently shattered the $118,000 barrier, a milestone that underscores a transformative phase in the cryptocurrency market. This surge, representing more than a 60% increase since April 2025, is propelled by robust institutional inflows, favorable regulatory developments, and enhanced market liquidity. The evolving landscape redefines Bitcoin’s role from a speculative asset to a strategic reserve instrument amid global macroeconomic uncertainties.

Bitcoin continues to command attention as it breaches new price levels, buoyed by institutional demand and regulatory clarity.

Source: Decrypt

Institutional Momentum: A Strategic Shift Toward Bitcoin

Malta-based Samara Asset Group recently disclosed the acquisition of 525 BTC, valued at approximately $57.3 million, which constitutes 28% of the company's market capitalization. This strategic pivot signifies a growing trend among asset managers to embrace Bitcoin as a reserve asset that hedges against traditional market volatility and inflationary pressures. Such moves exemplify institutional acknowledgment of Bitcoin’s maturation as a store of value.

Furthermore, retail investors — colloquially dubbed the "Bitcoin shrimp, crab, and fish" community — have intensified accumulation, reportedly surpassing Bitcoin mining output at a pace of nearly 19,300 BTC per month. This collective behavior tightens the supply dynamics and underpins upward price momentum, reflecting a broadening base of long-term holders.

Institutional adoption is reshaping Bitcoin’s market structure.

Source: ET Markets

Regulatory Progress: A Catalyst for Market Legitimacy

Two recent legislative milestones have reinforced the institutional narrative around Bitcoin and the broader crypto ecosystem:

-

US Senate Stablecoin Bill: Passed in July 2025, this legislation establishes comprehensive guardrails and consumer protections for stablecoins — digital assets pegged primarily to the U.S. dollar. The bill, officially known as the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins), positions the U.S. crypto market for increased legitimacy and investor confidence.

-

Hong Kong Stablecoin Licensing Regime: Effective August 1, 2025, Hong Kong’s regulatory framework aims to solidify its status as a global crypto hub. By providing a formal licensing process for stablecoin issuers, Hong Kong offers a legal foundation that mitigates volatility concerns while encouraging institutional participation in the Asia-Pacific region.

These regulations are pivotal in paving the way for accelerated approvals of cryptocurrency exchange-traded funds (ETFs), which in turn facilitate broader market access and liquidity.

Regulatory clarity in the US and Hong Kong is accelerating crypto market integration.

Source: Reuters

ETF Expansion: Mainstreaming Cryptocurrency Investment

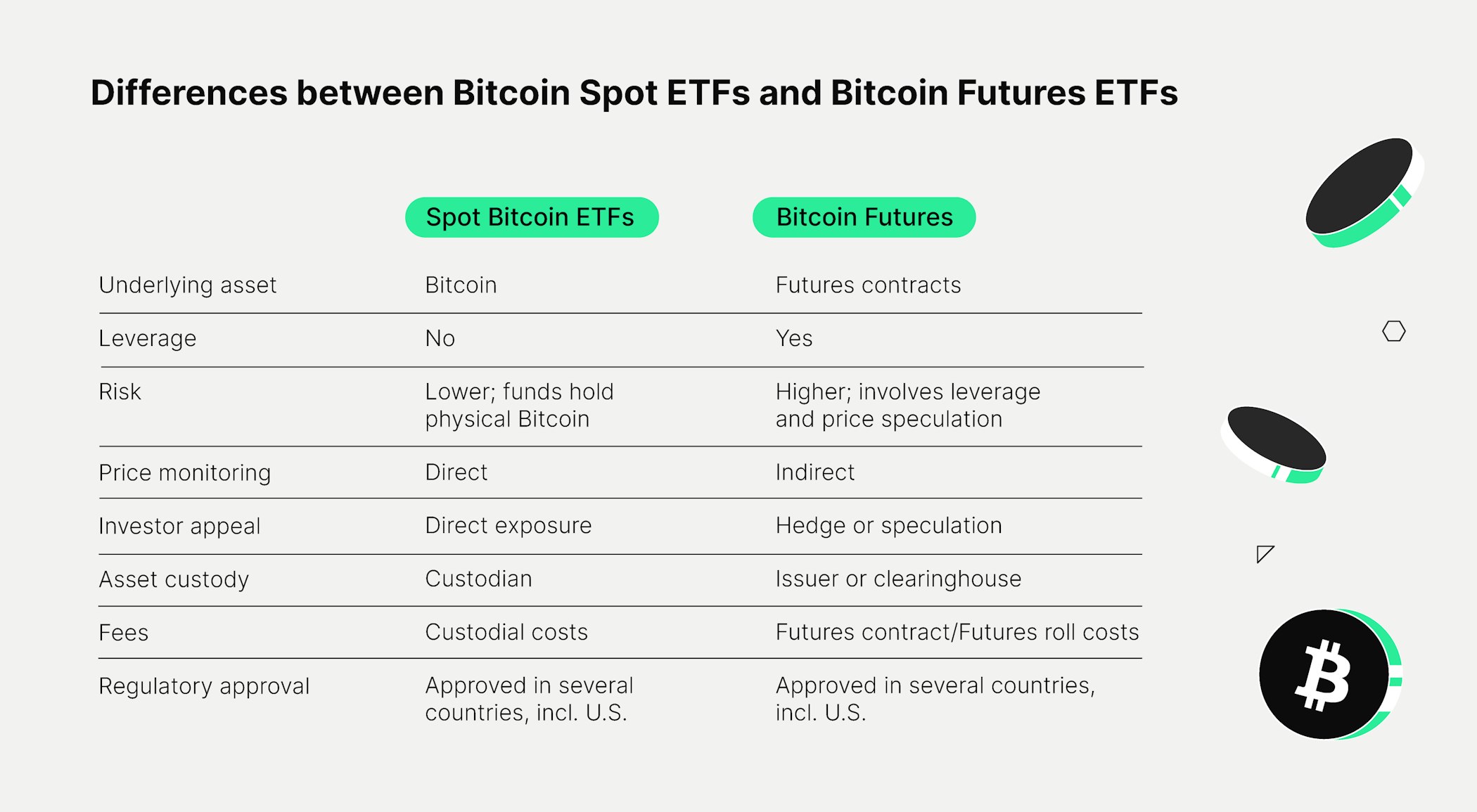

The recent debut of the first Solana ETF on Chicago’s Cboe BZX exchange signals the crypto market’s shift from niche to mainstream. Following Bitcoin and Ethereum ETFs, Solana’s fund offers retail and institutional investors diversified exposure to promising altcoins with solid fundamentals.

Financial analysts anticipate a surge in ETF filings covering a wide range of digital assets, including Ripple and Cardano, driven by regulatory guidance that demands transparent disclosures and conflict-of-interest management. This ETF expansion is expected to enhance market liquidity and reduce entry barriers for traditional investors.

Crypto ETFs are gaining traction as accessible investment products.

Source: Bitpanda Academy

Market Liquidity: Stablecoin Growth Underpins Price Momentum

The stablecoin market has witnessed robust growth, with the market caps of major players USDC and USDT increasing by over $1.3 billion and $1.4 billion respectively in July 2025. This influx injects fresh liquidity into crypto exchanges, enabling smoother price discovery and higher trading volumes.

Stablecoins function as vital liquidity corridors, facilitating fast capital deployment and reducing slippage. Their expansion not only fuels Bitcoin’s rally but also provides the backbone for DeFi applications and cross-border settlements, further integrating digital assets into global financial systems.

Market Structure and Strategic Outlook: Navigating a Bullish Phase

Bitcoin’s current price trajectory reflects a structural market shift, supported by both technical indicators and fundamental drivers. However, investors must remain vigilant given the asset’s inherent volatility and evolving regulatory landscape.

Key Strategic Considerations:

-

Portfolio Diversification: While Bitcoin remains the flagship "digital gold," exposure to altcoins with strong technological foundations, such as Solana and Cardano, through ETFs or direct holdings can enhance resilience and capture growth in emerging sectors.

-

Regulatory Vigilance: Ongoing developments in stablecoin legislation and ETF approvals will significantly influence market access and investor sentiment. Staying informed on such changes is critical for risk mitigation.

-

Risk Management: Given rapid price swings, disciplined position sizing, stop-loss orders, and hedging remain essential components of a prudent investment strategy.

-

Technological Innovation: Advances in Layer 2 scaling solutions and blockchain data streaming platforms (e.g., The Graph’s integration with TRON) improve transaction efficiency and developer ecosystems, potentially catalyzing wider adoption and utility.

Conclusion

Bitcoin’s breakthrough beyond $118,000 is emblematic of a maturing cryptocurrency market characterized by institutional adoption, regulatory clarity, and enhanced liquidity. These factors collectively are reshaping Bitcoin’s role into that of a strategic reserve asset within diversified portfolios amid uncertain macroeconomic conditions.

Investors equipped with a comprehensive understanding of the evolving regulatory environment and market structure, alongside disciplined risk management tactics, are well-positioned to capitalize on this transformative phase of digital asset investing.

References

- Crypto Traders Eye $130K Bitcoin as Majors Price-Action Shows Market Structure Shift – CoinDesk

- Crypto Investors Look Ahead to Policy Wins, Propelling Bitcoin to Record High – Economic Times

- Bitcoin Tops $118,000 for the First Time – AJC

- US Senate Passes Stablecoin Bill in Milestone for Crypto Industry – Gadgets360

- Solana’s First ETF Goes Live as Crypto Analysts Predict Surge of New Altcoin Funds – Fortune

By integrating institutional momentum, regulatory progress, and liquidity dynamics, Bitcoin’s ascent beyond historic price levels exemplifies a pivotal stage in cryptocurrency’s integration into mainstream finance.