Copper’s Strategic Role in the 2025 Commodity Landscape: Geopolitical, Technological, and Trade Perspectives

Copper has taken center stage in global commodity markets in 2025, reflecting its pivotal role in the accelerating energy transition and the evolving geopolitical environment. As nations race to meet ambitious climate targets and industries shift towards electrification and renewable infrastructure, copper demand is soaring. At the same time, supply disruptions, trade frictions, and innovation in mining practices add layers of complexity to market dynamics. This comprehensive analysis elucidates copper's strategic position, providing investors with crucial insights into price trends, supply-demand fundamentals, trade policies, and technological advances shaping its outlook.

Copper prices have reached multi-year highs amid tightening supply and surging demand

Source: Banco Carregosa

Market Fundamentals: Balancing Demand Surge and Supply Constraints

Copper’s indispensable electrical conductivity and recyclability underpin its fundamental role in the global energy and technology shift. The following factors define the current supply-demand landscape:

Robust Demand Drivers

- Electric Vehicles (EVs): An electrified transportation revolution is underway. According to industry estimates, an average EV contains approximately three to four times more copper than a conventional internal combustion engine vehicle, underscoring the metal’s importance.

- Renewable Energy Expansion: Solar photovoltaic panels, wind turbines, and grid modernization projects require extensive copper wiring and components. The International Energy Agency (IEA) projects renewable energy capacity to double by 2030, implying a sustained copper demand trajectory.

- Infrastructure Electrification: Aging grids worldwide are undergoing modernization to handle distributed energy resources and smart grid technologies, further intensifying copper consumption.

Supply-Side Challenges

- Mining Disruptions: Chile and Peru, accounting for over 40% of global copper output, face recurrent labor strikes, environmental permitting delays, and regulatory tightening. These disruptions constrain mine production volumes.

- Geographical Concentration Risks: The concentration of copper reserves and mining operations in politically sensitive regions elevates supply risk premiums.

- Inventory Tightness: Global copper inventories remain near historic lows on exchanges like the London Metal Exchange (LME), amplifying price volatility due to speculative positioning and physical demand pressures.

Innovations in mining technology aim to enhance copper production efficiency

Source: Mining.com

Geopolitical and Trade Influences on Copper Markets

Copper’s strategic importance has prompted governments and global actors to adopt policies that affect its trade flows and pricing.

Trade Policy Impacts

- Tariffs and Export Controls: Key copper-producing nations have implemented export restrictions and tariffs to safeguard domestic supply and capture greater value from resource flows, influencing global market liquidity.

- Trade Negotiations: Ongoing tariff discussions between major economies such as the US, China, and the EU affect copper import costs and supply chain reliability, with knock-on effects on industrial planning and pricing.

- Strategic Stockpiling: Recognizing copper’s criticality, some governments have increased strategic reserves to buffer against supply shocks and geopolitical uncertainties, further tightening available market supply.

Geopolitical Tensions

Heightened geopolitical frictions and resource nationalism in South America and Africa inject uncertainty into copper supply planning. Investors must monitor political stability and policy shifts in these regions closely, as they materially influence copper availability and price direction.

Technological and Environmental Considerations Shaping Copper Supply

Mining Innovations

The copper mining industry is pursuing automation, digitalization, and sustainable practices to improve productivity and environmental stewardship.

- Automation and AI: Autonomous haul trucks, real-time monitoring systems, and AI-driven exploration reduce operational costs and improve safety.

- Sustainable Mining: Water recycling, waste reduction, and cleaner energy use are being integrated to mitigate mining’s environmental footprint, facilitating regulatory approvals and social license to operate.

Circular Economy and Recycling

Although recycling contributes a growing share of copper supply, it currently cannot fully meet the brisk rise in demand. Enhanced collection and processing technologies improve secondary copper availability but primary mining remains indispensable to satisfy net demand growth.

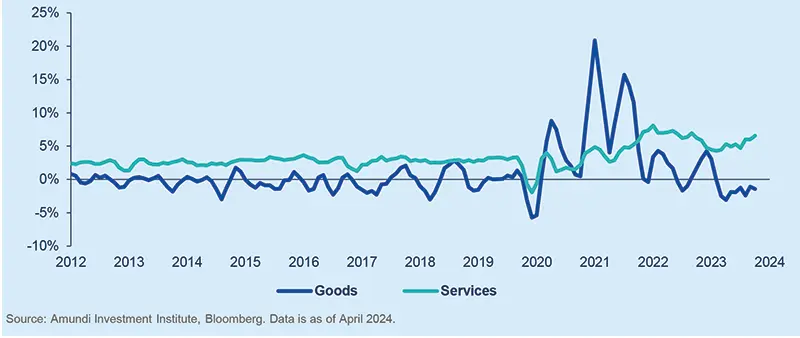

Copper price trends illustrate volatility amid supply-demand imbalances and geopolitical risk

Source: Amundi Research

Investment Implications: Navigating Opportunity and Risk

Copper’s unique market characteristics create compelling yet complex investment opportunities.

- Diversification and Thematic Exposure: Copper offers investors direct exposure to the green transition theme, complementing traditional commodity and equity allocations focused on technology, energy, and infrastructure sectors.

- Volatility Management: Market participants should anticipate price swings driven by geopolitical events, labor disruptions, and speculative flows. Employing hedging instruments such as futures, options, or copper-linked ETFs can help manage risk.

- Long-Term Outlook: Structural demand increases driven by decarbonization policies support a bullish medium- to long-term outlook. However, near-term price action may remain choppy due to supply chain uncertainties and macroeconomic developments.

Conclusion

In 2025, copper’s strategic significance transcends traditional commodity roles, embedding itself at the heart of global energy transition, technological innovation, and geopolitical strategy. Its indispensable role in electrification and renewable infrastructure, combined with tightening supply amid geopolitical tensions and trade policy shifts, renders copper a critical asset for investors and policymakers alike. Equipped with comprehensive market intelligence and robust risk management frameworks, investors can effectively navigate copper’s evolving landscape and capitalize on its pivotal position in the 21st-century commodity complex.

References

By integrating geopolitical awareness, technological innovation, and market fundamentals, investors can better position themselves in the dynamic copper market of 2025.